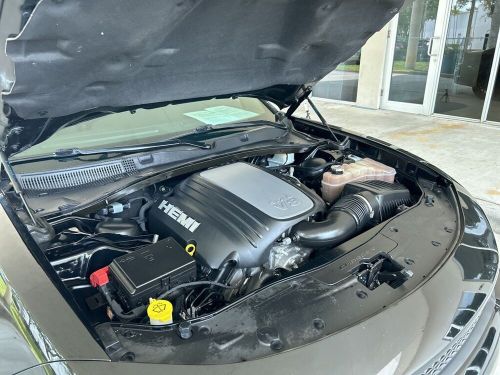

2021 Dodge Charger R/t on 2040-cars

Engine:HEMI 5.7L V8 Multi Displacement VVT

Fuel Type:Gasoline

Body Type:4D Sedan

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 2C3CDXCT2MH553223

Mileage: 48436

Make: Dodge

Trim: R/T

Features: --

Power Options: --

Exterior Color: Black

Interior Color: Black

Warranty: Unspecified

Model: Charger

Dodge Charger for Sale

2016 dodge charger awd 5.7l v8 hemi police(US $9,795.00)

2016 dodge charger awd 5.7l v8 hemi police(US $9,795.00) 2019 dodge charger scat pack(US $28,595.00)

2019 dodge charger scat pack(US $28,595.00) 2023 dodge charger r/t scat pack(US $47,997.00)

2023 dodge charger r/t scat pack(US $47,997.00) 2021 dodge charger r/t scat pack widebody(US $49,997.00)

2021 dodge charger r/t scat pack widebody(US $49,997.00) 2018 dodge charger awd 5.7l v8 hemi police(US $24,995.00)

2018 dodge charger awd 5.7l v8 hemi police(US $24,995.00) 2019 dodge charger sxt(US $22,845.00)

2019 dodge charger sxt(US $22,845.00)

Auto blog

FCA and Peugeot reportedly agree on merger

Wed, Oct 30 2019Citing a Wall Street Journal report, the Detroit Free Press says "Fiat Chrysler and PSA Groupe have agreed to merge." The Journal reported on talks between the two car companies only yesterday. It's said that Peugeot's board met yesterday to approve the deal, FCA's board met today, and an announcement could come as soon as tomorrow, Thursday. Both automakers have released statements, but neither company has released any information beyond admitting to ongoing talks. If the merger happens, the combined entity would become the world's fourth-largest carmaker with a $50 billion valuation, slotting in behind Toyota, the Volkswagen Group, and the Renault Nissan Mitsubishi alliance. Among the merger options possible, "an all-stock merger of equals" is the one analysts and Moody's seem to give the best grade. The reported merger would come about four months after FCA walked away from merger talks with Renault. FCA said the French government scuppered those talks over the role of Nissan in a reformed entity, but there were also brewing issues with French unions, and ongoing turmoil among Renault and Nissan leadership thanks to continuing fallout from ex-CEO Carlos Ghosn's arrest last year. FCA makes most of its revenue in the U.S. and rules Italy, while Peugeot is the second-best-selling automaker in Europe with its own brand in France and Opel in Germany. The two companies already have a partnership in Europe making vans, one that FCA CEO Mike Manley has spoken highly of. Among the list of obvious benefits in a potential merger, FCA would get access to Peugeot's small, modern platforms, $10.2 billion in cash, and electrified and hybrid architecture developments, the latter especially important to FCA as those are fields where it lags. Peugeot would get much easier access to the U.S. market, and the money-printing brands Jeep and Ram. A merged carmaker would have combined sales of nearly 9 million a year, based on 2018 results. By comparison, both Volkswagen and Toyota sell over 10 million cars a year, while the Renault-Nissan-Mitsubishi alliance almost 11 million. Peugeot CEO Carlos Tavares has proved he knows how to do turnarounds and mergers. After leaving a position as Carlos Ghosn's right-hand man in 2012, Tavares took over Peugeot in 2014, navigated a bailout from the French government and China's Dongfeng Motors in 2015, and turned PSA into a regional powerhouse.

Driving the Jeep J6, Shakedown Challenger and other Mopar concepts

Wed, Sep 11 2019Mopar has been a one-stop-shop for factory-backed performance modifications and accessories on FCA products for a long time now. You want a 707-horsepower engine for your old Plymouth Belvedere? Mopar has you covered with the Hellcrate. Maybe you want a lift and off-roading lights on that newly-bought Wrangler? Mopar can accommodate those wants (or needs, we don’t judge) as well. We get to see some of the companyÂ’s weirdest creations every now and then, but rarely do we get the opportunity to drive the FCA Mopar concepts. ThatÂ’s what made this past Woodward Dream Cruise so special: We got to rip some of MoparÂ’s finest and most recent creations up and down Woodward Avenue. Everything from a 1971 Challenger restomod to the brand-new Easter Jeep Safari J6 concept was in attendance, so letÂ’s get right to it. Mopar Woodward View 6 Photos 1967 Plymouth Hellvedere This car is near the pinnacle of what you can do with off-the-shelf Mopar purchases. It was only a humble 1967 Plymouth Belvedere before Mopar dropped the 707-horsepower supercharged V8 from the Hellcat into the engine bay. Sound ridiculous? Yeah, it is. Other parts of it are new as well, including the disc brakes. Good call. However, Mopar didnÂ’t remove the classic car charm from the entire driving experience. The steering, for example, is surely as slow and inaccurate as it was back in 1967. That doesnÂ’t help matters when youÂ’re trying to put 707 horsepower to the pavement with less-than-ideal rear rubber. Floor it in damn near any gear of the Tremec six-speed, and the front end rises straight up as the rear kicks sideways with the force of many mules. There are no electronics such as traction control or stability control to step in and wrangle the car into submission. But hey, who wants them, anyway? The question remains: Should you buy a Hellcrate engine for your classic? If money were no object, the easy answer is yes. Have at it so long as you love smoky burnouts and excessive amounts of horsepower. Just make sure you know how to deal with that much power before you stick your right foot in it.  Dodge Challenger Shakedown View 15 Photos 2016 Dodge Shakedown Challenger Concept WeÂ’re going downhill in horsepower with this restomod, but the drivability and ease of driving goes way up. Dodge showed this “Shakedown” concept at SEMA awhile back, and as with most concept cars, getting a chance behind the wheel is a special opportunity.

Stellantis not looking for further mergers, including with Renault

Mon, Feb 5 2024MILAN — Stellantis Chairman John Elkann on Monday denied the carmaker was hatching merger plans, responding to press speculation about a possible French-led tie-up with rival Renault. Elkann said that the Peugeot owner, the world's third largest carmaker by sales, was focused on the execution of its long-term business plan. "There is no plan under consideration regarding merger operations with other manufacturers," said Elkann, who also heads Exor, the Agnelli family holding company that is the largest single shareholder in Stellantis. After abandoning the Russian market, at the time its second largest after France, and reducing the scope of its global cooperation with Nissan, Renault has been seen as a potential M&A target. Speculation intensified after an electric vehicle market slowdown forced it last week to cancel IPO plans for its EV and software unit Ampere. Its market cap remains stubbornly low at little over 10 billion euros ($10.8 billion) despite a financial recovery over the past few years. Stellantis, the product of a 2021 merger between France's PSA and Fiat Chrysler and one of the most profitable groups in the industry, has a market cap of more than 85 billion euros when unlisted shares are factored in. It has a 14 brand portfolio also including Citroen, Jeep, Opel and Alfa Romeo. NEWSPAPER REPORT Italian daily Il Messaggero had said on Sunday that the French government, which is Renault's largest shareholder and also has a stake in Stellantis, was studying plans for a merger between the two groups. A spokeswoman for Renault said on Monday the group did not comment on rumors. France's Finance Ministry had declined to comment on Sunday. Stellantis has crossed swords with the Italian government, which has accused it of acting against the national interest on occasions. Industry Minister Adolfo Urso last week raised the prospect of the Italian government taking a stake in Stellantis to help to balance the French influence. Renault shares pared gains after Elkann's comments to stand 1.2% higher by 1220 GMT, having initially risen more than 4%. Stellantis CEO Carlos Tavares, a Portuguese-national, last week said in an interview with Bloomberg that the group was "ready for any kind of consolidation" and that its job was to make sure that it would be "one of the winners". Analysts, however, question the rationale of a Stellantis-Renault merger, which would also expand the group's excess capacity in Europe.