2011 Dodge Charger Rt Mopar 11 Special Edition Leather Seats Heated Seat 5.7l V8 on 2040-cars

Springfield, Virginia, United States

Vehicle Title:Clear

Engine:5.7L V8

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Make: Dodge

Warranty: Vehicle has an existing warranty

Model: Charger

Trim: R/T

Options: Leather Seats, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Side Airbags

Mileage: 19,431

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats, Ask For Carlos Umanzor 703)8661702

Sub Model: 2011 Dodge Charger R/T Mopar 11 Special Edition

Exterior Color: PITCH BLACK

Interior Color: BLACK INTERIOR

BodyStyle: Sedan

Number of Cylinders: V8

FuelType: Gasoline

Dodge Charger for Sale

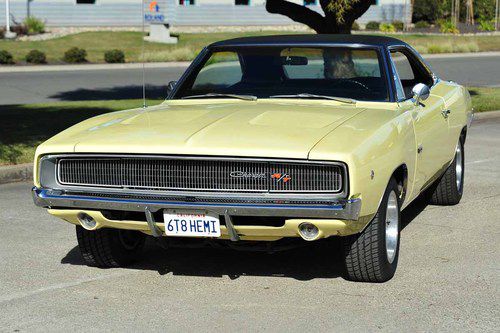

1969 dodge charger r/t(US $33,000.00)

1969 dodge charger r/t(US $33,000.00) Stock original 1968 dodge charger r/t 426ci/425hp dual quad hemi numbers match

Stock original 1968 dodge charger r/t 426ci/425hp dual quad hemi numbers match 1966~recently restored with a rebuilt 383 v8 4 bbl engine~orig bright red color!(US $28,500.00)

1966~recently restored with a rebuilt 383 v8 4 bbl engine~orig bright red color!(US $28,500.00) White sxt hemi 5.7l v8, 95k hwy miles, ex-fed govt,pw/pl,cruise(US $9,595.00)

White sxt hemi 5.7l v8, 95k hwy miles, ex-fed govt,pw/pl,cruise(US $9,595.00) 2006 grey auto sunroof nav heated leather hemi!!! great car! we finance!!!(US $15,498.00)

2006 grey auto sunroof nav heated leather hemi!!! great car! we finance!!!(US $15,498.00) 2010 dodge charger rt black leather unconnect sat radio chrome wheels auto(US $25,388.00)

2010 dodge charger rt black leather unconnect sat radio chrome wheels auto(US $25,388.00)

Auto Services in Virginia

Virginia Tire & Auto ★★★★★

Valley Collision Repair Inc ★★★★★

Valley Auto Repair ★★★★★

Union Auto Body Shop ★★★★★

Transmissions Inc. ★★★★★

Tony`s Used Auto Parts ★★★★★

Auto blog

MotorWeek remembers a better time for Mitsubishi performance

Fri, Feb 26 2016Dodge still knows how to create an capable performance car – look at the Hellcats, for example – but the same isn't true for Mitsubishi. With the Lancer Evo's demise, we don't expect driving enthusiasts to clamor for any of the Japanese automaker's other products. Things used to be different, though. As MotorWeek found in its new Retro Review, the 1991 Mitsubishi 3000GT VR4 and its sibling, the Dodge Stealth R/T Turbo, were impressive sports coupes in their day. Dodge and Mitsubishi packed a bevy of cutting-edge tech into the coupes. In these trims, both sported all-wheel drive, four-wheel steering, an adjustable suspension, active exhaust, and automatic climate control. The 3000GT VR4 upped the ante even more with active aero parts at the front and rear. Their 3.0-liter twin-turbo V6 was good for 300 horsepower and 307 pound-feet, which were good numbers at the time. This pair put all their gizmos to good use, too. MotorWeek compares the all-wheel-drive system's grip levels to a Porsche 911 Carrera 4. When was the last time you heard any favorable similarity between a Mitsubishi and a Porsche? The Stealth R/T Turbo and 3000GT VR4 came from a special time for Japanese sports coupes, when every brand had a halo model. Whether you were looking at Nissan 300ZX, Mazda RX-7, Toyota Supra, or even the Acura NSX, there was a lot to like on the market. MotorWeek's latest Retro Review offers a great reminder of that period.

NHTSA, IIHS, and 20 automakers to make auto braking standard by 2022

Thu, Mar 17 2016The National Highway Traffic Safety Administration, the Insurance Institute for Highway Safety and virtually every automaker in the US domestic market have announced a pact to make automatic emergency braking standard by 2022. Here's the full rundown of companies involved: BMW, Fiat Chrysler Automobiles, Ford, General Motors, Honda, Hyundai, Jaguar Land Rover, Kia, Mazda, Mercedes-Benz, Mitsubishi, Nissan, Subaru, Tesla, Toyota, Volkswagen, and Volvo (not to mention the brands that fall under each automaker's respective umbrella). Like we reported yesterday, AEB will be as ubiquitous in the future as traction and stability control are today. But the thing to note here is that this is not a governmental mandate. It's truly an agreement between automakers and the government, a fact that NHTSA claims will lead to widespread adoption three years sooner than a formal rule. That fact in itself should prevent up to 28,000 crashes and 12,000 injuries. The agreement will come into effect in two waves. For the majority of vehicles on the road – those with gross vehicle weights below 8,500 pounds – AEB will need to be standard equipment by September 1, 2022. Vehicles between 8,501 and 10,000 pounds will have an extra three years to offer AEB. "It's an exciting time for vehicle safety. By proactively making emergency braking systems standard equipment on their vehicles, these 20 automakers will help prevent thousands of crashes and save lives," said Secretary of Transportation Anthony Foxx said in an official statement. "It's a win for safety and a win for consumers." Read on for the official press release from NHTSA. Related Video: U.S. DOT and IIHS announce historic commitment of 20 automakers to make automatic emergency braking standard on new vehicles McLEAN, Va. – The U.S. Department of Transportation's National Highway Traffic Safety Administration and the Insurance Institute for Highway Safety announced today a historic commitment by 20 automakers representing more than 99 percent of the U.S. auto market to make automatic emergency braking a standard feature on virtually all new cars no later than NHTSA's 2022 reporting year, which begins Sept 1, 2022. Automakers making the commitment are Audi, BMW, FCA US LLC, Ford, General Motors, Honda, Hyundai, Jaguar Land Rover, Kia, Maserati, Mazda, Mercedes-Benz, Mitsubishi Motors, Nissan, Porsche, Subaru, Tesla Motors Inc., Toyota, Volkswagen and Volvo Car USA.

The mad genius of killing the Dodge Dart and Chrysler 200

Thu, Jan 28 2016Sergio Marchionne isn't crazy. At least not with respect to the recent announcement that Fiat Chrysler Automobiles will cease production of the Dodge Dart and Chrysler 200. Instead of crazy I'd call this CEO ruthlessly pragmatic, and perhaps short-sighted. The latest revisions to FCA's most recent five-year plan tell some truths about the company's finances. In other words, it can't afford to build mainstream sedans. With only 87,392 units sold in 2015, the Dart is an also-ran in the segment. The axe falls easily there - Chrysler hasn't had a compact-car hit since the second-generation Neon. The 200 isn't so cut and dried: Last year sales increased 52 percent, and the 177,889 total for 2015 is more than those for the Subaru Legacy and Kia Optima. But looking at the overall FCA picture the Chrysler 200 has to go, at least from a short-term perspective. The vehicles that make big money – Ram trucks; Jeep's Cherokee, Grand Cherokee, and Wrangler – can't be made fast enough. FCA can't afford to idle the 200's Sterling Heights, MI, assembly plant to cut back on inventory when other plants are running flat out. It seems crazy to throw away 265,000 sales, but FCA is leaving money on the table by not building more profitable vehicles. The Wirecutter's Senior Autos Editor (and former Autoblogger) John Neff agrees. "As bold as it looks from the outside, he's really making a safe bet that their money is better spent on designing better and building more crossovers and trucks. He's probably right about that." But according to Jessica Caldwell, Executive Director of Strategic Analytics at Edmunds, "FCA's strategy of eliminating the Dart and 200 might be short-sighted if gas prices were to rise and Americans, once again, flocked to small vehicles. FCA must have plans to expand the lineup of small SUVs and position them as small-car alternatives in terms of price and fuel efficiency for this strategy to make sense." FCA's latest announcement focuses mainly on the profitable brands and nameplates. There's hardly a mention of Chrysler, Dodge, or Fiat. And future planning is where the plot holes appear. This realignment cuts dead weight from the product portfolio, but FCA's latest announcement focuses mainly on the profitable brands and nameplates. There's hardly a mention of Chrysler, Dodge, or Fiat. So what's Sergio up to? David Sullivan of AutoPacific thinks Marchionne is still looking for another CEO to hug.