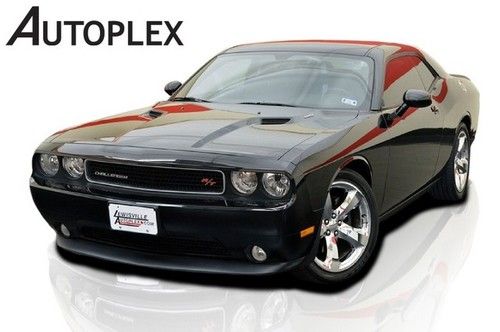

2009 Challenger R/t 5.7 Hemi Navigation Remote Start 20-inch Chrome 1-owner! on 2040-cars

Dallas, Texas, United States

Vehicle Title:Clear

Engine:5.7L 345Cu. In. V8 GAS OHV Naturally Aspirated

Fuel Type:GAS

For Sale By:Dealer

Transmission:Automatic

Make: Dodge

Cab Type (For Trucks Only): Other

Model: Challenger

Warranty: Vehicle has an existing warranty

Trim: R/T Coupe 2-Door

Drive Type: RWD

Mileage: 45,594

Disability Equipped: No

Sub Model: HEMI R/T Nav

Doors: 2

Exterior Color: Black

Drive Train: Rear Wheel Drive

Interior Color: Black

Number of Doors: 2

Number of Cylinders: 8

Inspection: Vehicle has been inspected

Dodge Challenger for Sale

Challenger rt hemi v8! leather 20s push start paddle shift heated seats!(US $31,991.00)

Challenger rt hemi v8! leather 20s push start paddle shift heated seats!(US $31,991.00) 2010 dodge challenger srt8 coupe 2-door 6.1l

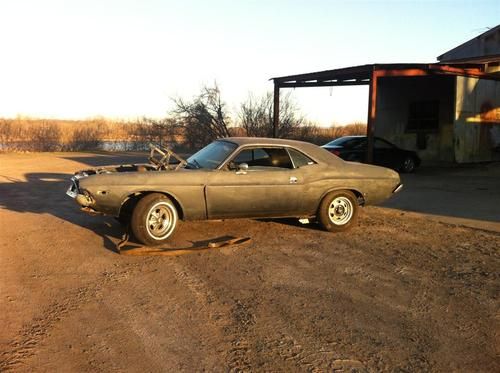

2010 dodge challenger srt8 coupe 2-door 6.1l 1974 dodge challenger

1974 dodge challenger New 2012 challenger srt 8 yellow jacket

New 2012 challenger srt 8 yellow jacket Srt8 392 new coupe 6.4l brand new yellow jacket automaic trans warranty

Srt8 392 new coupe 6.4l brand new yellow jacket automaic trans warranty 2010 dodge challenger srt8 coupe 2-door 6.1l

2010 dodge challenger srt8 coupe 2-door 6.1l

Auto Services in Texas

Yescas Brothers Auto Sales ★★★★★

Whitney Motor Cars ★★★★★

Two-Day Auto Painting & Body Shop ★★★★★

Transmission Masters ★★★★★

Top Cash for Cars & Trucks : Running or Not ★★★★★

Tommy`s Auto Service ★★★★★

Auto blog

Follow along for the 2018 Dodge Challenger SRT Demon live reveal

Wed, Apr 12 2017Updates: Live Demon premiere in Times Square and a viewing party on Woodward Ave. here in Detroit. The first Hellcat sold for about $800k at a Barrett-Jackson auction. New Pennzoil video with the last Dodge Viper premiering tomorrow. "Making the suits nervous is how we know we're on the right track." No love for accountants. "A modern day version of the Ramchargers." "The harder car companies work to take the driver out of the equation, the harder we work to keep them in." "We want to impress the NHRA more than the PTA." "It would have been easy to take a Hellcat and make it a bit faster." SRT says tuners have it all wrong. This is the way to build a performance drag car. Every Demon comes with a leather-bound manual that shows how to properly set up the car for tracks. 2.3 seconds to 60 mph 9.65 second 1/4 mile 840 horsepower This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Original Post: The 2018 Dodge Challenger SRT Demon is coming tonight, and we'll be bringing you live coverage and updates from New York. There have been months of teasers, trailers, and hints, but some of the big questions have yet to be answered. Dodge is showing the reveal live on the Demon's promo site, ifyouknowyouknow.com. Watch the stream and follow along here for the latest Demon info. The hype started back in January with the first video, "Cage." At the time, all we knew was that the Demon was going to be a hopped-up version of the already juiced up Dodge Challenger SRT Hellcat. After that, we learned that the Demon would be significantly lighter thanks to optional - yes, optional - passenger and rear seats. In addition to the seats, the Demon comes with lightweight wheels wrapped in sticky 315/40R18 Nitto drag radials at all four corners. Dodge showed off the Demon's crate of goodies, but it was a few more weeks before we learned what was inside. The Demon comes with a jack, an electric impact wrench, torque wrench, and a tire pressure gauge. The kit will be used to swap skinny front tires for use on a drag strip. As cool as those 315 section tires look up front, they hurt far more than they help on a drag strip.

Ford Police Interceptors dominate Michigan State Police testing

Tue, Nov 1 2016Once again, Ford Motor Company builds the fastest police vehicles. The Blue Oval touted the news in an official release following Michigan State Police and Los Angeles County Sheriff's Department testing. Ford did very well. Except for one acceleration metric – zero to 10 miles per hour – the Blue Oval's Taurus and Explorer-based cop cars were the quickest, with particular praise coming for the EcoBoost-powered models, which bested Chevrolet and Dodge's V8-powered variants. Dearborn's products also posted the fastest average times around MSP's vehicle dynamics course. But it wasn't all positive for Ford. The only four-cylinder in the contest, the 2.0-liter, EcoBoost Ford SSP Sedan, had both the lowest top speed, 120 mph, and the slowest acceleration figures. It was also the slowest in track testing. Ford's products also failed to match the braking and top speeds of its rivals from Detroit and Auburn Hills – the rear-drive Charger Pursuit posted the best braking stats of the entire test, while the V8-powered Chevrolet Caprice hit the highest top speed, at 155 mph. Ford did score a top speed award, among SUVs, but at 132 mph, the naturally aspirated Police Interceptor Utility had to share its award with the equally fast, rear-drive Chevrolet Tahoe. The LA County Sheriff's timing isn't publicly available, but according to Ford, the EcoBoost-powered police cars put on a similarly impressive show for cops on the West Coast. We've assembled a spreadsheet on Google Docs that offers an easy to browse comparison of the different stats assembled by the Michigan State Police, and divided the vehicles between standard V6-powered sedans, high-performance sedans (EcoBoost and V8 models), and SUVs. You can check it out here. Related Video:

This Dodge Challenger was stolen, used in police chases and recovered all in the week before its SEMA debut

Wed, Nov 6 2019Most of the drama in a SEMA build is in getting the car ready in time for the big show. That was all Quintin Bros Auto and Performance was expecting when they built a supercharged Dodge Challenger Scat Pack with custom carbon fiber body parts, aftermarket wheels and upgraded brakes. But unfortunately, a bigger drama happened in the week leading up to the show. And it was the worst kind. As part owner Pete Quintin told us, the car was shipped out in a small trailer, and while the delivery driver was spending the Monday night a week before the show at a hotel, a thief showed up in a stolen pickup and made off with the trailer and the car. It wasn't an easy task, either, as the delivery driver had parked the trailer in with the truck blocking it. The thief used his own (well, not his own, but you know what we mean) truck to shove the trailer hitch out where he could access it, then hooked it up and took off. Several miles down the road, he parked, opened up the trailer and vanished in the Challenger. The following morning, the delivery driver discovered the theft, and Quintin Bros immediately informed the owner so that a police report could be filed and a search could begin. The trailer was found not too long after, thanks to someone who was following the story on social media. But obviously the car was missing. Folks on social media were also helpful in tracking the car, in addition to the help of the Las Vegas Police Department (LVPD). What followed was a week of chasing the car down. Twice the car was found in parking garages, Quintin said, and both discoveries resulted in police chases. The second chase was the most dramatic, with a police officer stopping after noticing the car. The thief was in it, and he bolted upon seeing the officer. He powered the Challenger right through the nose of the police car, damaging both. The chase culminated on the highway, where Quintin told us 14 cars were in pursuit, and the thief got up to 150 mph. Police ended up calling off the chase because of the danger. But the car was damaged enough that the thief eventually abandoned it at one last garage, where it was picked up on Thursday. Once the car was recovered, things gradually began looking up for the Quintin family. Pete Quintin said that as soon as LVPD found out the Challenger was meant to go to SEMA, the department got the car out of evidence impound as fast as it could so the shop could show off the beat-up car.