1989 Dodge Shadow Es Hatchback 2-door 2.2l on 2040-cars

Farwell, Michigan, United States

|

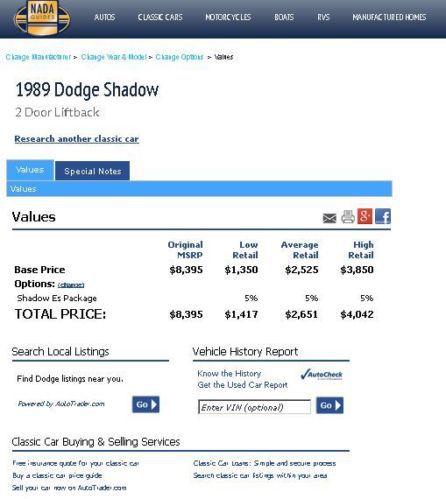

Car runs good, Current engine has just over 40,000 miles, replaced over a year ago. The windshield is cracked. New windshield wipers, coil, plugs, wires, and fuel lines. Nada Guides Value is between $1417 and $4042. I would estimate it at $3000, do to windshield and it could use a paint job. The seats and dash are in great shape. Radio, blower and gauges all work.

Will be sold with Full tank of Gas. If it isn't full at time of pick up, I will go with you to the station and pay to fill it. |

Dodge Shadow for Sale

1991 dodge shadow es convertible 2-door 2.5l(US $3,500.00)

1991 dodge shadow es convertible 2-door 2.5l(US $3,500.00) 1994 dodge shadow, no reserve

1994 dodge shadow, no reserve 1996 dodge viper gts coupe 2-door 8.0l, original, suvivor only 16,200 miles v10

1996 dodge viper gts coupe 2-door 8.0l, original, suvivor only 16,200 miles v10 96 rt/10 8.0 v10 rwd convertible rt manual low miles clean autocheck(US $34,900.00)

96 rt/10 8.0 v10 rwd convertible rt manual low miles clean autocheck(US $34,900.00) Custom built rare 1929 dodge da victoria street rod-cln title-custom paint-mint!

Custom built rare 1929 dodge da victoria street rod-cln title-custom paint-mint! 2013 black cloth v6 vvt lifetime powertrain warranty we finance 10k miles

2013 black cloth v6 vvt lifetime powertrain warranty we finance 10k miles

Auto Services in Michigan

Zielke Tires & Towing ★★★★★

Your Auto Service Inc ★★★★★

Victory Motors ★★★★★

Tireman Central Auto Center ★★★★★

Thomas Auto Collision ★★★★★

Tel-Ford Service ★★★★★

Auto blog

Fiat Chrysler dumped 40,000 unordered vehicles on dealers

Thu, Nov 14 2019In a move that echoes recent history, Fiat Chrysler has been making more cars and trucks than dealers in the U.S. are willing to accept, with Bloomberg reporting that at one point the automaker had built up a glut of around 40,000 unordered vehicles. Thatís led some dealers to accuse FCA of reviving the dreaded ¬ďsales bank¬Ē accounting practice of obscuring inventory to improve the balance sheet. The company reportedly began building up its inventory of unordered cars this summer despite an industrywide slowdown in sales and an eagerness by some dealers to thin their inventories because rising interest rates are making it more expensive to hold unsold cars. The inventory build-up also coincided with Fiat Chrysler¬ís efforts to find a merger partner, first with Renault, which fell through, then last month¬ís announcement that it will merge with France¬ís PSA Group. FCA denies any such scheme and tells Bloomberg the rising inventory is down to a new predictive analytics system designed to better square supply with demand from dealers that is helping the company save money and narrow the numbers of unsold vehicles. The company recently agreed to pay a $40 million civil penalty to the U.S. Securities and Exchange Commission to settle a complaint that it paid dealers to report fake sales figures over a span of five years. While no one is suggesting that FCA is in dire financial straits ¬ó the company saw higher than expected earnings in the third quarter and record profits in North America ¬ó the practice has strong historical precedent by Chrysler, which built up bloated inventories in the run-up to its two federal bailouts, in 1980 and 2009. It was also common at GM and Ford during the 2000s, when all three Detroit automakers struggled with excess manufacturing capacity and plummeting sales in the lead-up to the Great Recession. Back in 2012, CFO Magazine wrote about a report that explained automakers¬í rationale for the practice and how it works: Say fixed costs for a given factory are $100, and that the factory can make 50 cars. Consumers, however, demand only 10. Under absorption costing, if the company makes all 50 cars, its cost-per-car is $2. If it makes only up to demand, or 10 cars, the cost-per-car is $10. Although each car adds variable costs for steel and other parts, if those costs are low, the company still has an incentive to make more cars to keep the cost-per-car down.

Dodge Vipers selling for $480k in China

Wed, Apr 29 2015Want to get your hands on a new Dodge Viper? Be prepared to pay dearly. It starts at nearly $90k here in the US, but that's nothing compared to what you'd have to pay for one if you lived in, say, China. CarsNewsChina.com reports on one Viper available in Beijing for an eye-watering 298 million yuan Ė equivalent to about $480,000 at today's exchange rates and representing more than a 500-percent markup. Part of that premium comes down to the Chinese tax code that charges a reported 60 percent for anything with an engine displacing over four liters. And the Viper's, we needn't remind you, is more than twice that. It naturally costs some to import a car to China as well, but most of the rest is pure profit. The Beijing dealership reportedly gets the cars from dealers in California, has already sold three and plans to import several more. The dealer can also get you (or wealthy Chinese individuals) a Corvette Stingray for a comparatively cheap 1.73 million yuan (or $280k). Related Video:

121k Dodge Darts being investigated over braking problem

Mon, Jun 22 2015The National Highway Traffic Safety Administration is investigating the Dodge Dart due to reports of braking problems. Some 121,000 cars are possibly affected, all from the 2013 model year. According to The Detroit News, NHTSA received 18 complaints about the brake pedal becoming hard to depress on these cars, increasing stopping distance. Drivers reported hearing a "pop noise or an air hissing noise when applying the brake pedal, followed by a hard pedal feel and reduced brake effectiveness," NHTSA told the News. In a particularly terrifying incident, one driver says the Dart's braking system shut down while driving at 50 miles per hour. "I feared for my life. It is one of the scariest things I have ever dealt with," the complaint said, according to The Detroit News. A Fiat-Chrysler spokesperson said the automaker is "fully cooperating" with this investigation.