2012 Ram 4500 Chassis Cab Custom Cummins Turbo Diesel on 2040-cars

Peoria, Illinois, United States

Vehicle Title:Clear

Fuel Type:Diesel

For Sale By:Dealer

Transmission:Automatic

Make: Dodge

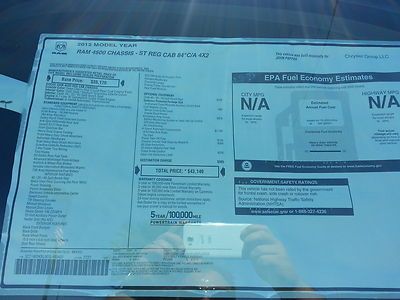

Warranty: Vehicle has an existing warranty

Model: Ram 4500

Mileage: 15

Options: CD Player

Sub Model: 2WD Reg Cab

Power Options: Power Locks

Exterior Color: Red

Interior Color: Black

Dodge Ram 4500 for Sale

Ram 4500 parts truck good engine, trans, frame, rear end and body parts(US $12,000.00)

Ram 4500 parts truck good engine, trans, frame, rear end and body parts(US $12,000.00) 2008 dodge ram 4500

2008 dodge ram 4500 4500 flatbed quadcab 6.7l turbo diesel dually a/c cd automatic transmission(US $25,900.00)

4500 flatbed quadcab 6.7l turbo diesel dually a/c cd automatic transmission(US $25,900.00) 2008 dodge ram 4500 4x4(US $28,500.00)

2008 dodge ram 4500 4x4(US $28,500.00) 2008 st/slt/laramie used turbo 6.7l i6 24v automatic rwd

2008 st/slt/laramie used turbo 6.7l i6 24v automatic rwd Ram 4500 extra heavy duty not 3500 cummins diesel 6 spd. low miles eng. warranty(US $28,498.00)

Ram 4500 extra heavy duty not 3500 cummins diesel 6 spd. low miles eng. warranty(US $28,498.00)

Auto Services in Illinois

Wheels of Chicago ★★★★★

Vern`s Auto Repair ★★★★★

Transmissions To Go ★★★★★

Transmatic Transmission Specialists ★★★★★

Total Auto Glass ★★★★★

Sunderland Automotive ★★★★★

Auto blog

NHTSA investigating Ram 1500 models for rear differential failure

Mon, 30 Jun 2014The National Highway Traffic Safety Administration is investigating Fiat Chrysler Automobiles and its Ram brand following a number of reports regarding the 2005 Dodge Ram 1500 pickup. According to 15 consumer complaints, the trucks' rear differential locked up while in other cases, the driveshaft separated at its connection to the diff.

Nearly half of the reports claim the truck was traveling at or above 50 miles per hour, while two consumers reported that the diff lockup/driveshaft separation sent their pickups into a spin. Most troubling, though, is that consumers reported little to no sound indicating there was a problem with their truck.

We reached out to Ram for additional information, such as how many vehicles may be affected or what equipment might be fitted that could cause the issue. Unfortunately, the company wasn't willing to elaborate on specifics.

6k-mile 2001 Dodge Viper hits Bring a Trailer

Tue, May 19 2020I'm an unapologetic fan of the second-generation Dodge Viper GTS to the point where I keep my eyes peeled for nice examples of the final years of its production. This Bring a Trailer listing landed in my inbox when it went live Tuesday morning, and from the limited photos and information provided, it seems like a reasonably clean driver, rather than a museum-quality piece. For somebody who wants to experience a Viper that hasn't been beat on too extensively, this 6k-mile 2001 GTS may be just what you're looking for. Apart from the iconic launch model in white-over-blue, these later-year coupes represent some of the most desirable examples of the earlier Viper. Unlike the first few model years, they were equipped with anti-lock brakes. They didn't do much to improve the Viper's ultimate stopping capabilities, but at least they allow for a little more control at the limits of adhesion. The later second-generation cars also benefited from suspension development that came out of Chrysler's factory racing program, and while a GTS isn't quite as track-ready as the hardcore ACR model, these later examples are certainly better suited to it than those from prior years. Their frames were also better-reinforced than those of earlier models. The listing notes that the car shows some interior wear, and the paint seems less than pristine in the (admittedly low-quality) exterior photos provided by the seller, but by all accounts, everything on the car is original and in well-maintained, running condition. It has lived in California and Arizona for its entire documented life, and the underside is nothing short of immaculate. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

2018 Dodge Durango Pursuit SUV is the tall arm of the law

Thu, May 10 2018Dodge is adding to its police car portfolio with the 2018 Durango Pursuit, a specially-prepped police version of the automaker's SUV. Available with an optional 360-horsepower Hemi engine, the Durango Pursuit comes with everything you'd expect in a truck built to protect and serve. We'll try to avoid too many Blues Brothers cop car references but, yes, this Dodge includes some serious "cop shocks" and that aforementioned "cop engine," among many other modifications. The Hemi engine produces 360 horsepower and 390 lb. ft. of torque, all of which is routed to an eight-speed automatic transmission and full-time AWD system. According to Dodge, this is the most popular powertrain fitted to the existing Charger Pursuit police car. The brakes have been strengthened and are capable of bringing the Durango Pursuit from 60-0 mph in 134 feet. The Durango Pursuit also adds a two-speed transfer case, which should prove handy when bad guys try to escape by venturing off road. "Unofficial testing results at the Michigan State Police 2018 model-year vehicle evaluation event created such a stir among law enforcement agencies that we simply had to find a way to build this vehicle," said Steve Beahm, Head of Passenger Car Brands, Dodge/SRT, FCA North America. Despite the apparent buzz around this police vehicle, Dodge has said the Durango Pursuit V-8 AWD will only be available "for a limited time." And as you've already guessed, you have to be in law enforcement to place an order for one — sorry to disappoint. Other notable features of the Durango Pursuit include 8.1 inches of ground clearance, a tow rating of 7,200 pounds, heavy-duty oil cooler and water pump, 220-amp alternator, a spare tire mounted beneath the rear of the truck to free interior space, a spotlight wiring prep package, along with trailer sway control. Dog lovers will be pleased that K-9 units have been taken into consideration, too. The Durango Pursuit is available with a tri-zone climate control package, to make certain badge-wearing four-legged constables remain comfortable while fighting crime. Related Video: Dodge SUV Police/Emergency police car