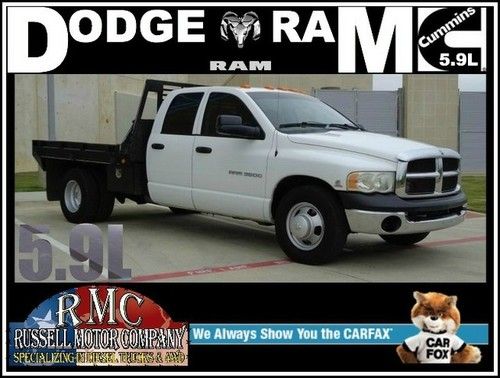

04 5.9l White Work Truck Dually Flat Bed Gooseneck Hitch Work Tool Box on 2040-cars

Mansfield, Texas, United States

Engine:8

Vehicle Title:Clear

Fuel Type:Diesel

For Sale By:Dealer

Transmission:Automatic

Make: Dodge

Cab Type (For Trucks Only): Crew Cab

Model: Ram 3500

Warranty: Vehicle does NOT have an existing warranty

Mileage: 171,000

Sub Model: SLT Quad Cab

Exterior Color: White

Disability Equipped: No

Interior Color: Gray

Doors: 4

Drive Train: Rear Wheel Drive

Dodge Ram 3500 for Sale

2004 dodge ram 3500 with 5.9 l cummins(US $14,999.00)

2004 dodge ram 3500 with 5.9 l cummins(US $14,999.00) 4x4 diesel, short bed, non dually. black on black, auto, all stock.(US $15,950.00)

4x4 diesel, short bed, non dually. black on black, auto, all stock.(US $15,950.00) 2000 ram 3500 5.9l l6 ohv 24v turbo diesel reg. cab long bed 4wd cummins engine

2000 ram 3500 5.9l l6 ohv 24v turbo diesel reg. cab long bed 4wd cummins engine 2004 dodge ram quad cab slt dually(US $21,000.00)

2004 dodge ram quad cab slt dually(US $21,000.00) 2010 brown laramie mega dually 6.7l i6 2x2 dvd sirius heated navigation sun roof(US $39,981.00)

2010 brown laramie mega dually 6.7l i6 2x2 dvd sirius heated navigation sun roof(US $39,981.00) 2006 dodge ram 3500 diesel 2wd dually slt lone star quad cab(US $25,980.00)

2006 dodge ram 3500 diesel 2wd dually slt lone star quad cab(US $25,980.00)

Auto Services in Texas

Wolfe Automotive ★★★★★

Williams Transmissions ★★★★★

White And Company ★★★★★

West End Transmissions ★★★★★

Wallisville Auto Repair ★★★★★

VW Of Temple ★★★★★

Auto blog

Stellantis earnings rise along with EV sales

Wed, Feb 22 2023AMSTERDAM — Automaker Stellantis on Wednesday reported its earnings grew in 2022 from a year earlier and said its push into electric vehicles led to a jump in sales even as it faces growing competition from an industrywide shift to more climate-friendly offerings. Stellantis, formed in 2021 from the merger of Fiat Chrysler and FranceÂ’s PSA Peugeot, said net revenue of 179.6 billion euros ($191 billion) was up 18% from 2021, citing strong pricing and its mix of vehicles. It reported net profit of 16.8 billion euros, up 26% from 2021. Stellantis plans to convert all of its European sales and half of its U.S. sales to battery-electric vehicles by 2030. It said the strategy led to a 41% increase in battery EV sales in 2022, to 288,000 vehicles, compared with the year earlier. The company has “demonstrated the effectiveness of our electrification strategy in Europe,” CEO Carlos Tavares said in a statement. “We now have the technology, the products, the raw materials and the full battery ecosystem to lead that same transformative journey in North America, starting with our first fully electric Ram vehicles from 2023 and Jeep from 2024.” The automaker is competing in an increasingly crowded field for a share of the electric vehicle market. Companies are scrambling to roll out environmentally friendly models as they look to hit goals of cutting climate-changing emissions, driven by government pressure. The transformation has gotten a boost from a U.S. law that is rolling out big subsidies for clean technology like EVs but has European governments calling out the harm that they say the funding poses to homegrown industry across the Atlantic. Stellantis' Jeep brand will start selling two fully electric SUVs in North America and another one in Europe over the next two years. It says its Ram brand will roll out an electric pickup truck this year, joining a rush of EV competitors looking to claim a piece of the full-size truck market. The company plans to bring 25 battery-electric models to the U.S. by 2030. As part of that push, it has said it would build two EV battery factories in North America. A $2.5 billion joint venture with Samsung will bring one of those facilities to Indiana, which is expected to employ up to 1,400 workers. The other factory will be in Windsor, Ontario, a collaboration with South KoreaÂ’s LG Energy Solution that aims to create about 2,500 jobs. The EV push comes amid a slowdown in U.S.

Auto Mergers and Acquisitions: Suicide or salvation?

Tue, Sep 8 2015We love the Moses figure. A savior riding in from stage right with the ideas, the smarts, and the scrappiness to put things right. Alan Mullaly. Carroll Shelby. Lee Iacocca. Andrew Carnegie. Steve Jobs. Elon Musk. Bart Simpson. Sergio Marchionne does not likely view himself with Moses-like optics, but the CEO of Fiat Chrysler Automobiles recently gave a remarkable, perhaps prophetic interview with Automotive News about his interest and the inevitability of merging with a potential automotive partner like General Motors. Marchionne has been overtly public about his notion that GM must merge with FCA. For a bit of context, GM sold 9.9 million vehicles in 2014, posting $2.8 billion in net income, while FCA sold 4.75 million units and earned $2.4 billion in net income, painting a very rosy FCA earnings-to-sales picture. But that's not the entire picture. Most people in the auto industry still remember the trainwreck that was the DaimlerChrysler "merger" written in what turned out to be sand in 1998. It proved to be a master class in how not to fuse two companies, two cultures, two continents, and two management teams. Oh, it worked for the two individuals at both helms pre-merger. They got silly rich. And the industry itself was in a misty romance at the time with mergers and acquisitions. BMW bought Rolls-Royce. Volkswagen Group bought Bentley, Bugatti, and Lamborghini, putting all three brands into their rightful place in both products and positioning. No marriages there, so no false pretense. Finally, Nissan and Renault got married in 1999. A successful marriage requires several rare elements in this atmosphere of gas fumes and power lust. But a successful marriage requires several rare elements in this atmosphere of gas fumes and power lust, the principle part being honesty. Daimler and Chrysler lied to each other. The heads of each unit, the product planners, and finance all presented their then-current and long-range forecasts to each other with less-than-forthright accuracy. Daimler was the far greater equal and no one from the Chrysler side enjoyed that. The cultures were entirely different, too, and little was done to bridge that gap. Which brings me back to the present overtures by Marchionne to GM. "There are varying degrees of hugs," Marchionne stated in the Automotive News piece. "I can hug you nicely, I can hug you tightly, I can hug you like a bear, I can really hug you." Seriously?

The Chrysler brand could be axed under Stellantis management

Sun, Jan 3 2021MILAN — While running NissanÂ’s North American operations from 2009 to 2011, Carlos Tavares had a reputation for closely watching costs with little tolerance for vehicles or ventures that didnÂ’t make money. Experts say that means Tavares, currently the head of PSA Group, is likely to follow that blueprint when he becomes leader of a merged PSA and Fiat Chrysler Automobiles. The low-performing Chrysler brand might get the axe as could slow-selling cars, SUVs or trucks that lack potential. Already the companies are talking about consolidating vehicle platforms — the underpinnings and powertrains — to save billions in engineering and manufacturing costs. That could mean job losses in Italy, Germany and Michigan as PSA Peugeot technology is integrated into North American and Italian vehicles. “You canÂ’t be cost efficient if you keep the entire scale of both companies,” said Karl Brauer, executive analyst for the iSeeCars.com auto website. “WeÂ’ve seen this show before, and weÂ’re going to see it again where they economize these platforms across continents, across multiple markets.” Shareholders of both companies are to meet Monday to vote on the merger to form the worldÂ’s fourth-largest automaker, to be called Stellantis. The deal received EU regulatory approval just before Christmas. Tavares, who for years has wanted to sell PSA vehicles in the U.S., wonÂ’t take full control of the merged companies until the end of January at the earliest. He likely will target Europe for consolidation first, because thatÂ’s where Fiat vehicles overlap extensively with PSAÂ’s, said IHS Markit Principal Auto Analyst Stephanie Brinley. Europe has been a money-loser for FCA, and factories in Italy are operating way below capacity — a concern for unions, given FiatÂ’s role as the largest private sector employer in the country. “We are at a crossroads,Â’Â’ said Michele De Palma of the FIOM CGIL metalworkersÂ’ union. “Either there is a relaunch, or there is a slow agonizing closure of industry, in particular the auto industry, in Italy.” ItalyÂ’s hopes lie with the luxury Maserati and sporty Alfa Romeo brands, but De Palma said investments are needed to bring hybrid and electric technology up to speed. FiatÂ’s Italian capacity stands at 1.5 million vehicles, but only a few hundred thousand are being produced each year. Most factories were on rolling short-term layoffs due to lack of demand, even before the pandemic.