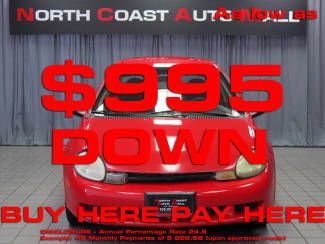

2005 Dodge Neon Srt-4 Sedan 4-door 2.4l on 2040-cars

Bluefield, West Virginia, United States

Body Type:Sedan

Vehicle Title:Clear

Engine:2.4L 2429CC 148Cu. In. l4 GAS DOHC Turbocharged

Fuel Type:GAS

Number of Cylinders: 4

Make: Dodge

Model: Neon

Trim: SRT-4 Sedan 4-Door

Options: Sunroof, CD Player

Drive Type: FWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 74,719

Power Options: Air Conditioning, Power Locks, Power Windows

Exterior Color: Red

Interior Color: Black

Number of Doors: 4

Dodge Neon for Sale

2001(01) dodge neon highline save big! must see! we finance!!!(US $6,995.00)

2001(01) dodge neon highline save big! must see! we finance!!!(US $6,995.00) 2001 dodge neon r/t sedan 4-door 2.0l - 5 speed

2001 dodge neon r/t sedan 4-door 2.0l - 5 speed 2004 dodge neon srt-4

2004 dodge neon srt-4 2005 dodge neon sxt auto cd power windows a/c aluminum wheels am/fm stereo

2005 dodge neon sxt auto cd power windows a/c aluminum wheels am/fm stereo 2005 dodge neon sxt --- no reserve --- great mpg 122k miles runs great!!!

2005 dodge neon sxt --- no reserve --- great mpg 122k miles runs great!!! 2002 dodge neon rare low miles 84166 k original no reserve runs great clean

2002 dodge neon rare low miles 84166 k original no reserve runs great clean

Auto Services in West Virginia

Western Maryland Collision Center ★★★★★

Thomas Subaru Hyundai ★★★★★

State Park Motors ★★★★★

Rusty`s Used Cars Inc ★★★★★

Ramey Motors, Inc. ★★★★★

Precision Collision ★★★★★

Auto blog

Chrysler recalling 280k Dodge Ram 1500 pickups over axle seizures

Fri, Dec 19 2014Following a June investigation by the National Highway Traffic Safety Administration, Fiat Chrysler Automobiles will be recalling 280,000 Dodge Ram pickups from model year 2005. The issue, NHTSA told The Detroit News, centered on a loose pinion nut, which could cause the rear axle to seize and, potentially, the driveshaft to detach. The affected vehicles were built between January of 2004 and August of 2005, while of the 280,000 trucks, only 257,000 were sold in the US market. According to The News, the recall will begin on February 13, and will see owners report to dealerships to have "a retention feature" added to the pinion nut.

Dodge Hellcats change their stripes for 2016

Mon, Jan 11 2016If you've been on the fence about ordering up a new Dodge with Hellcat power, this might just provide the extra incentive you were looking for. Starting this month, Dodge is offering a new stripe option, exclusive to its most powerful muscle cars. The SRT Hellcat stripes are now available to order on the top-of-the-line, 707-horsepower versions of both the Charger and Challenger. The dual full-length stripes run all the way up from the front lip, over the grille, up the hood, accentuating the NACA duct, along the roof, down the trunklid, across the rear spoiler, and down the rear bumper. They feature a carbon-fiber texture, and can be ordered with any of eleven colors for an extra $995. Along with the stripes, Dodge has also announced that it is extending the availability of the exclusive Plum Crazy color – which was originally scheduled to expire at the end of December – for another month. The throwback hue can be ordered on Charger and Challenger models ranging from the SXT through the R/T models all the way up to the SRT 392 and Hellcat. 2016 CHALLENGER AND CHARGER SRT HELLCAT MODELS EARN EXCLUSIVE STRIPES, DODGE EXTENDS PLUM CRAZY PAINT - All-new SRT Hellcat dual exterior stripe design adds even more Dodge attitude to 2016 Challenger and Charger SRT Hellcat models - SRT Hellcat-exclusive dual full-length carbon-fiber pattern stripes provide a customized-from-the-factory look - Dealers will start taking orders for Hellcat stripes in January 2016 - SRT Hellcat dual stripes have a U.S. Manufacturer's Suggested Retail Price of $995 - Dodge is answering enthusiast demand for Plum Crazy exterior paint with an additional one-month run of the legendary and limited-edition high-impact hue January 8, 2016 , Auburn Hills, Mich. - For more than a year, Dodge Challenger and Charger SRT Hellcat models — the fastest and most powerful muscle cars ever with 707 supercharged HEMI® horsepower each — have stormed roadways and drag strips with acceleration blasts to 60 mph in the low 3-second range, generated more than 61 million sensational YouTube video views around the globe, enabled an entirely new generation of Dodge enthusiasts and now for 2016 have been rewarded with their very own Dodge performance stripes.

Autoblog Podcast #414

Wed, Jan 21 2015Episode #414 of the Autoblog Podcast is here, and this week, Dan Roth, Steven Ewing, and Seyth Miersma discuss the new 2015 Shelby GT and go over the finer points of Elon Musk's recent speech during the Detroit Auto Show. Of course, the podcast starts with what's in the garage and finishes up with some of your questions, and for those of you who hung with us live on our UStream channel, thanks for taking the time. Check out the rundown with times for topics, and you can follow along down below with our Q&A. Thanks for listening! Autoblog Podcast #414 Topics 2015 Shelby GT Elon Musk speech in Detroit In The Autoblog Garage 2015 Lexus LX 570 2015 Dodge Charger Pursuit 2015 Toyota Prius C 2015 Lincoln Navigator Hosts: Dan Roth, Steven Ewing, Seyth Miersma Runtime: 01:17:58 Rundown Intro and Garage - 00:00 2015 Shelby GT – 32:41 Elon Musk – 41:33 Q&A - 54:48 Get The Podcast UStream – Listen live on Mondays at 10 PM Eastern at UStream iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Feedback Email – Podcast at Autoblog dot com Review the show in iTunes Podcasts Dodge Lexus Lincoln Toyota toyota prius c shelby lincoln navigator lexus lx