2022 Dodge Durango Gt Plus on 2040-cars

Engine:3.6L V6 24V VVT

Fuel Type:Gasoline

Body Type:4D Sport Utility

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 1C4RDJDG0NC201170

Mileage: 20041

Make: Dodge

Trim: GT Plus

Features: --

Power Options: --

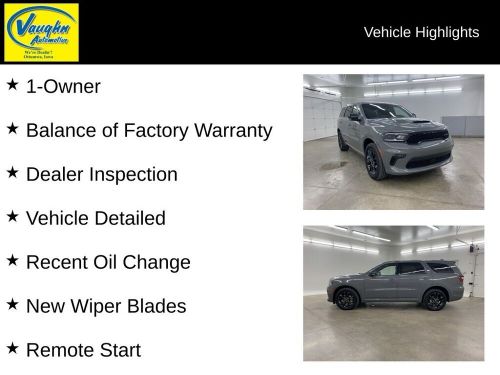

Exterior Color: Gray

Interior Color: Black

Warranty: Unspecified

Model: Durango

Dodge Durango for Sale

2024 dodge durango r/t(US $51,689.00)

2024 dodge durango r/t(US $51,689.00) 2022 dodge durango r/t(US $37,157.00)

2022 dodge durango r/t(US $37,157.00) 2019 dodge durango r/t awd(US $33,833.00)

2019 dodge durango r/t awd(US $33,833.00) 2023 dodge durango srt hellcat premium awd(US $85,300.00)

2023 dodge durango srt hellcat premium awd(US $85,300.00) 2022 dodge durango gt(US $1.00)

2022 dodge durango gt(US $1.00) 2023 dodge durango r/t(US $58,827.00)

2023 dodge durango r/t(US $58,827.00)

Auto blog

Stellantis ready to kill brands and fix U.S. problems, CEO Tavares says

Thu, Jul 25 2024Â MILAN — Stellantis is taking steps to fix weak margins and high inventory at its U.S. operations and will not hesitate to axe underperforming brands in its sprawling portfolio, its chief executive Carlos Tavares said on Thursday. The warning for lossmaking brands is a turnaround for Tavares, who has maintained since Stellantis was created in 2021 from the merger of Italian-American automaker Fiat Chrysler and France's PSA that all of its 14 brands including Maserati, Fiat, Peugeot and Jeep have a future. "If they don't make money, we'll shut them down," Carlos Tavares told reporters after the world's No. 4 automaker delivered worse-than-expected first-half results, sending its shares down as much as 10%. "We cannot afford to have brands that do not make money." The automaker now also considers China's Leapmotor as its 15th brand, after it agreed to a broad cooperation with the group. Stellantis does not release figures for individual brands, except for Maserati which reported an 82 million euro adjusted operating loss in the first half. Some analysts say Maserati could possibly be a target for a sale by Stellantis, while other brands such as Lancia or DS might be at risk of being scrapped given their marginal contribution to the group's overall sales. Stellantis' Milan-listed shares were down as much as 12.5% on Thursday, hitting their lowest since August 2023. That brings the loss for the year so far to 22%, making them the worst performer among the major European automakers. Few automotive brands have been killed off since General Motors ditched the unprofitable Saturn and Pontiac during a U.S. government-led bankruptcy in the global financial crisis in 2008. Tavares is under pressure to revive flagging margins and sales and cut inventory in the United States as Stellantis bets on the launch of 20 new models this year which it hopes will boost profitability. Recent poor results from global carmakers have heightened worries about a weakening outlook for sales across major markets such as the U.S., whilst they also juggle an expensive transition to electric vehicles and growing competition from cheaper Chinese rivals. Japan's Nissan Motor saw first-quarter profit almost completely wiped out on Thursday and slashed its annual outlook, as deep discounting in the United States shredded its margins. Tavares said he would be working through the summer with his U.S. team on how to improve performance and cut inventory.

Stellantis moves to set up its own lending unit

Sat, Sep 4 2021Stellantis is buying Houston-based auto lender First Investors Financial Services Group to set up its own finance arm in the U.S., a move that should support sales and eventually boost profit. The only major traditional automaker in the U.S. without its own finance company agreed to pay $285 million to a group of investors led by Gallatin Point Capital and Jacobs Asset Management, according to a statement. The transaction is expected to close by year-end. Stellantis was formed via the merger between Fiat Chrysler and PSA Group early this year. Carlos Tavares, the PSA boss who became the combined company’s chief executive officer, called the deal to acquire First Investors a milestone that will increase earnings and enhance customer loyalty. “Direct ownership of a finance company in the U.S. is a white-space opportunity which will allow Stellantis to provide our customers and dealers a complete range of financing options,” Tavares said Wednesday in the statement. Having an in-house finance company has helped rivals General Motors Co. and Ford Motor Co. pad profits, especially during the global semiconductor shortage that has limited production and crimped sales. GM bought subprime lender AmeriCredit Corp. in 2010 and renamed it GM Financial. The operation generated a $2.76 billion profit in the first half -- roughly a third of the companyÂ’s adjusted earnings before interest and taxes. Trouble for Santander? The First Investors acquisition could spell trouble for Chrysler Capital, the operation that Santander Consumer USA Holdings Inc. and Chrysler set up in 2013 before the U.S. automaker completed its merger with Fiat. In a statement, Santander Consumer said itÂ’s committed to supporting Stellantis through the term of their existing agreement and its transition. Santander Consumer will also have “ongoing conversations with Stellantis about long-term mutually beneficial opportunities beyond 2023,” the company said, adding that its consumer business remains strong and has “delivered solid results for our shareholders.” This, along with support from its parent company, will allow the lender to “pursue additional opportunities as they arise.” The lenderÂ’s U.S.-listed stock fell 1.5% in New York trading Wednesday after Bloomberg reported Stellantis was preparing to announce a new finance partner. Stellantis shares rose as much as 1.3% in Paris trading Thursday.

The last time Dodge recycled the Demon name, it was for a Miata fighter

Fri, Jan 20 2017We and the rest of the automotive world are eagerly awaiting the reveal of the Dodge Challenger Demon. And why wouldn't we be? It's going to be a Hellcat, but with less weight, bigger fenders, more performance, and more Vin Diesel. This isn't the first time we've been excited about a Demon from Dodge, though. Ten years ago, Dodge had another demonic car, but it was very different from the new one. The Demon of 2007 was a lithe little roadster that looked primed and ready to take on the Miata, as well as the now-departed Solstice and Sky twins. The Demon was just under an inch shorter than the MX-5 and the Solstice, and it packed a 172 horsepower 2.4-liter four-cylinder that fell right between the Miata's 170 and the Solstice's 177 outputs. Dodge's estimated the curb weight, which for a concept is largely theoretical, also slotted between the two cars at 2600 pounds. That was about 150 more than the Mazda, and about 200 less than the Pontiac. The pitch perfect specifications were presented in a crisp two-seat roadster wrapper. In many ways, it looked like a baby Viper, with a menacing crosshair grille, slanted headlights, and fat rear fenders. The Demon's line's were brutally simple and geometric, too. They didn't seem far removed from the first-generation Audi TT. The interior was also plain and simple. The key highlights were a horizontal aluminum accent that ran the width of the dash, echoed by an aluminum-covered center console. The instrument cluster was uncluttered, with just four gauges, and the only controls were some climate knobs, a double-DIN head unit, and a six-speed manual. It turns out that the 2007 Demon didn't drive very well, though. You see, we actually drove this concept back in the day, and like many concepts, it still had a long way to go to be production ready. The gearbox would grind, the ride quality was terrible. However, the interior was roomy, and the engine sounded suitably grumbly, if a bit coarse. At the time, we said Dodge should absolutely build the little roadster. In retrospect, the company probably made the right decision not to invest in the Demon. The small rear drive sports car segment was, and still is, an extremely niche market. It would have been a big investment for little return, something FCA today is trying to avoid. This is all before taking into account the fact that the recession was just around the corner. In the end, we can't be too sad though.