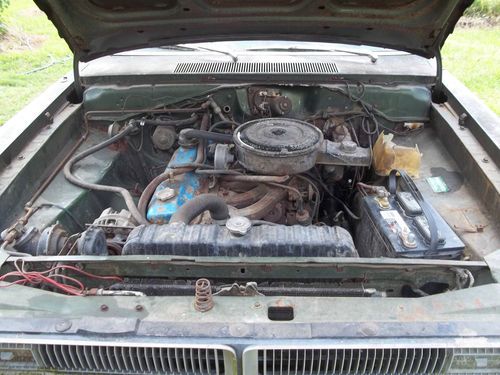

1970 Dodge Dart Swinger Factory Air Car Slant 6 Project Car !!!!!!!!!!!! on 2040-cars

Fort Payne, Alabama, United States

Vehicle Title:Clear

Make: Dodge

Drive Type: rear drive

Model: Dart

Mileage: 93,192

Trim: vinyl

Dodge Dart for Sale

2013 dodge dart 4dr sdn limited(US $22,999.00)

2013 dodge dart 4dr sdn limited(US $22,999.00) 2013 dodge dart 4dr sdn rallye power windows air conditioning tachometer(US $18,527.00)

2013 dodge dart 4dr sdn rallye power windows air conditioning tachometer(US $18,527.00) 1968 dodge dart 2 door hard top hemi clone built for super stock

1968 dodge dart 2 door hard top hemi clone built for super stock 2013 dodge dart 4dr sdn se(US $18,385.00)

2013 dodge dart 4dr sdn se(US $18,385.00) 2013 dodge dart 4dr sdn rallye air conditioning tachometer power windows(US $18,013.00)

2013 dodge dart 4dr sdn rallye air conditioning tachometer power windows(US $18,013.00) 65 afx custom dragster replica 4.56 pro gear 2 door sedan(US $44,999.00)

65 afx custom dragster replica 4.56 pro gear 2 door sedan(US $44,999.00)

Auto Services in Alabama

Wathas ★★★★★

Warren Tire & Auto Center ★★★★★

Southern Automotive Group Inc ★★★★★

Professional Collision Springhill ★★★★★

Professional Collision ★★★★★

Precision Tune Auto Care ★★★★★

Auto blog

6k-mile 2001 Dodge Viper hits Bring a Trailer

Tue, May 19 2020I'm an unapologetic fan of the second-generation Dodge Viper GTS to the point where I keep my eyes peeled for nice examples of the final years of its production. This Bring a Trailer listing landed in my inbox when it went live Tuesday morning, and from the limited photos and information provided, it seems like a reasonably clean driver, rather than a museum-quality piece. For somebody who wants to experience a Viper that hasn't been beat on too extensively, this 6k-mile 2001 GTS may be just what you're looking for. Apart from the iconic launch model in white-over-blue, these later-year coupes represent some of the most desirable examples of the earlier Viper. Unlike the first few model years, they were equipped with anti-lock brakes. They didn't do much to improve the Viper's ultimate stopping capabilities, but at least they allow for a little more control at the limits of adhesion. The later second-generation cars also benefited from suspension development that came out of Chrysler's factory racing program, and while a GTS isn't quite as track-ready as the hardcore ACR model, these later examples are certainly better suited to it than those from prior years. Their frames were also better-reinforced than those of earlier models. The listing notes that the car shows some interior wear, and the paint seems less than pristine in the (admittedly low-quality) exterior photos provided by the seller, but by all accounts, everything on the car is original and in well-maintained, running condition. It has lived in California and Arizona for its entire documented life, and the underside is nothing short of immaculate. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Dominic Toretto's 'Fast and Furious' Lego Dodge Charger lives its life a quarter mile at a time

Mon, Mar 30 2020Fan of the "Fast and Furious" franchise and Lego kits? You're in luck. The brick-builder announced that it is now taking pre-orders for a new kit dedicated to the 1970 Dodge Charger widebody driven by Dominic Toretto (Vin Diesel) in the car heist film series. The release of the latest installment in the "F&F" franchise may have been delayed until next year, but for better or worse, a lot of merchandising that was in the works to cross-promote the new film is still in the pipeline. The approximately 1,100-piece Technic-line kit can be posed both on four wheels and in a wheelie stance thanks to a flip-down prop stand (which itself looks a bit like a misplaced wheelie bar). The kit includes details such as a trunk-mounted dual-bottle nitrous kit, a detailed roll cage, and other nods to the long-running movie car. "With 1,077 pieces, this cool building set provides a fun challenge for kids who love toy model cars. Inspired by the original 1970s Dodge Charger R/T, this faithful replica is packed with realistic details," Lego's product page says. The kit features several moving parts, too, including the wheels, suspension, supercharger induction system and steering. It measures more than a foot long (15") and even comes with authentic California replica plates. Those who want a kit will be able to pre-order it from the Lego website, with shipments starting on April 27. Those who want to roll the dice on retail availability will be able to shop for it in local stores the same day, provided those stores are open, of course. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Building The Fate Of The Furious Cars | Autoblog

12 new cars that will never go out of style

Tue, Nov 23 2021Some cars never go out of style. It’s rare, but it happens. They get old. They get depreciated. But they never stop looking cool. Some might call them modern or instant classics. Within a few years theyÂ’re no longer the latest and greatest, no longer the flavor of the month, but they remain special. Eternally special. Timeless. These cars arenÂ’t necessarily going to be worth a fortune someday. However, some may not depreciate as rapidly or as far as other models. But thatÂ’s not what weÂ’re talking about here. These are the cars that enthusiasts will always find desirable from the curbside. TheyÂ’re the cars you end up shopping on eBay late at night 10 years later because you canÂ’t get them out of your head. TheyÂ’re the cars that will forever excite you when you spot a clean one in traffic or in a parking lot. There are plenty of recent examples over the past couple of decades that could count as instant design classics. But then we got to thinking, what 2021 models will be forever cool to stare at? Which new cars and trucks on sale today will we be shopping on eBay late at night in the 2030s? We kept supercars and other ultra-expensive cars off the list to keep things within the realm of attainability, and ended up with 12 total cars. Lexus LC WeÂ’re not applying a numerical ranking to any of the cars on this list, but if we were, the Lexus LC would be No. 1. There isnÂ’t another car design out there that can stir our emotions the way an LC can when itÂ’s just standing still. This car is a concept design come true in the most beautiful of ways, and itÂ’s a shoo-in winner for Concours events decades into the future. All of this heaping praise, and we havenÂ’t even gotten to the LC 500Â’s intoxicating 5.0-liter V8. It doesnÂ’t win drag races. It wonÂ’t be the fastest around the track against any similarly-priced competition. But none of that matters. ItÂ’s quite possibly the best car you can buy new, and that says it all when it comes to the LC. Chevrolet Corvette It might not be the stunner that the Lexus LC is, but the new C8 Corvette is and will always be a special vehicle. ItÂ’s the first mid-engine Corvette, which instantly cements it into an automotive hall of fame section of sorts. All of the performance stats and specs are there to back up its supercar-like looks, and it remains the best performance bargain on sale today.