1969 Dodge Dart Gts Hardtop - True H-code 383, 4-speed, Very Nice ! on 2040-cars

Somerset, Kentucky, United States

Transmission:Manual

Body Type:Hardtop

Engine:383-335 HP

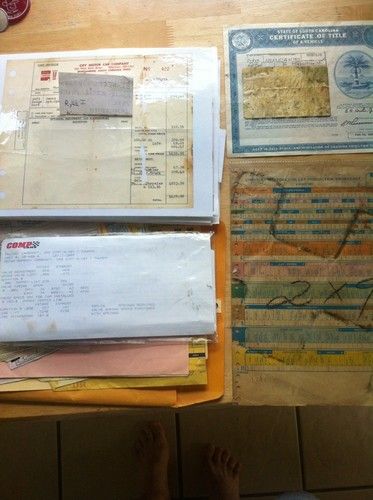

Vehicle Title:Clear

Fuel Type:GAS

Sub Model: GTS

Warranty: Vehicle does NOT have an existing warranty

Exterior Color: Yellow

Year: 1969

Interior Color: Black

Make: Dodge

Number of Cylinders: 8

Model: Dart

Trim: GTS

Drive Type: RWD

Dodge Dart for Sale

Auto Services in Kentucky

Transmission Exchange ★★★★★

Tire Discounters Inc ★★★★★

Stokes Auto Care ★★★★★

Sam`s Towing and Auto Repair ★★★★★

Rick`s Transmission & Auto Repair ★★★★★

Protech Automotive ★★★★★

Auto blog

2020 Dodge Challenger Drag Pak comes solely with supercharged power

Wed, Nov 6 2019The Dodge Challenger Drag Pak has returned for 2020, five years after the last one arrived, and two years after it began development. And while in many ways it looks like past Drag Paks, there are a number of tweaks that should make this the fastest and most capable factory drag car yet from Mopar. Unlike the last model, only a supercharged 354-cubic-inch (5.8-liter for the imperically challenged) V8 is available. Mopar says it's more powerful than its predecessor, though exact horsepower wasn't given. It did confirm that the previous car was capable of a stunning 1,200 horsepower. The engine is coupled solely to a three-speed automatic transmission with a manual shifter. 2020 Dodge Challenger Drag Pak View 17 Photos Supporting the massive engine are many chassis, suspension and driveline enhancements. The independent rear suspension and axles are gone in favor of a solid axle from Strange and a four-link suspension. The front remains stock except for double-adjustable Bilstein shocks. The engine is mounted to a subframe member that's beneficial both to weight distribution and center of gravity. The car gets high-performance brakes and custom Weld Racing wheels with "DRAGPAK" engraved on them. The interior features a welded-in roll cage certified for quarter-mile times as quick as 7.5 seconds. Helping keep the car planted without increasing drag too much are front and rear spoilers from the road-going Challenger, a new addition compared with the previous car. Every Drag Pak car also comes standard with a wheelie bar and parachute. Dodge will only build 50 of these cars, and they'll only be offered as race cars that aren't legal for the street. The cars will be eligible for competing in sportsman classes in NHRA and NMCA drag racing series. Pricing and availability hasn't been set yet, but will be revealed sometime next year.

FCA and UAW deal could mean huge production shakeups

Thu, Sep 17 2015The big labor contract between Fiat Chrysler Automobiles and the United Auto Workers is likely to lead to some very serious production shakeups across the company's North American manufacturing operations. That's according to a new report from Automotive News, which details the sweeping changes at no fewer than five production facilities in Michigan, Illinois, Ohio, Mexico, and Poland. So without further ado, here's what's going where, presented in easy to digest bullet form. Ram 1500 production would move from Warren, MI to Sterling Heights, MI Warren, MI would be retooled for unibody production and would handle the Jeep Grand Wagoneer and could potentially build Grand Cherokees to ease the strain on Detroit's Jefferson North factory Chrysler 200 production would move from Sterling Heights, MI to Toluca, Mexico Dodge Dart production would move from Belvidere, IL to Toluca, Mexic Fiat 500 production, which is currently handled by Toluca, would be concentrated in Poland, where the Euro-spec Cinquecento is built Jeep Cherokee production would move from Toledo, OH to Belvidere, IL to make room for Wrangler and Wrangler Pickup production Like we said, those are some big changes. But, as FCA CEO Sergio Marchionne said in an earlier interview with Automotive News, this kind of shakeup would make a lot of sense. In that August interview the exec said that automakers moved truck production to Mexico because they were "threatened" by the UAW. "The only thing [the UAW] want is to move the truck back. Which is right. If you move the truck back here, which is [the UAW's] domain, [and move] all the cars that we get killed on somewhere else, we could actually make sense of this bloody industry and actually increase the number of people employed in this country and really share wealth because we are making money," Marchionne told AN. News Source: Automotive News - sub. req.Image Credit: Bill Pugliano / Getty Images Plants/Manufacturing UAW/Unions Chrysler Dodge Fiat Jeep RAM Sergio Marchionne FCA toluca warren sterling heights

2016 Dodge Viper ACR priced from $117,895

Tue, May 12 2015Fancy getting your hands on the all-new Dodge Viper ACR? Prepare to shell out at least $117,895, not counting destination or gas-guzzler tax. Those two add $1,995 and $2,100, respectively, for an out-the-door price of $121,990. That's $32,900 more than a base 2015 Viper, or the equivalent of a Challenger with a few options. As we explained previously, the ACR model doesn't do much for outright power – the 8.4-liter V10 offers up only five more ponies than before – but it does add suspension and aerodynamic upgrades that make this particular Viper far more potent on the track. The order books are officially open for the ACR, so if you've got the coin, get in touch with your local dealer. Until then, head into Comments and let us know what you think of the ACR's pricing. Would you shell out $118,000 for the ultimate Viper? DODGE OPENS ORDER BANKS FOR NEW 2016 DODGE VIPER ACR The fastest street-legal Viper track car ever offers a tremendous value for performance May 12, 2015 , Auburn Hills, Mich. - Viper enthusiasts with the need for ultimate handling, performance and road course domination, as well as the ability to drive their Viper home from the track, can now place their orders for the fastest street-legal Viper track car ever. The Dodge brand has announced pricing and opened order banks for the recently introduced 2016 Dodge Viper ACR. Unveiled last week at the revamped Conner Avenue Assembly Plant in Detroit, the American Club Racer model of the iconic, hand-built American supercar will have a starting U.S. Manufacturer's Suggested Retail Price (MSRP) of $117,895 (excluding destination and gas guzzler tax). "Bringing our street-legal Dodge Viper ACR back is going to arm our track enthusiasts with the ultimate weapon to dominate road courses across the country," said Tim Kuniskis, President and CEO - Dodge and SRT Brands, FCA - North America. "This is without a doubt the best Viper ACR ever. The latest in aerodynamic, braking and tire technology will ensure its legendary performance reputation around the world." Originally introduced in 1999 and last available for the 2010 model year, the Viper ACR has a long-standing legacy as the ultimate street-legal track car for club racing. The new 2016 model honors that performance legacy with significant aerodynamic and suspension upgrades, new Carbon Ceramic brakes with six-piston calipers and high-performance tires specifically designed for ACR.

1972 dodge demon mopar plymouth dart duster 318 cuda drag race car a body

1972 dodge demon mopar plymouth dart duster 318 cuda drag race car a body 1966 dodge dart conv as is project

1966 dodge dart conv as is project 1972 dart swinger v-8. excellent frame, body and paint. new carpet + headliner.

1972 dart swinger v-8. excellent frame, body and paint. new carpet + headliner. 1972 dodge dart

1972 dodge dart 1971 dodge dart demon 340 h-code #s match

1971 dodge dart demon 340 h-code #s match 1964 dodge dart gt convertible

1964 dodge dart gt convertible