2007 Dodge Dakota St on 2040-cars

8000 Park Blvd., Pinellas Park, Florida, United States

Engine:3.7L V6 12V MPFI SOHC

Transmission:Automatic

VIN (Vehicle Identification Number): 1D7HW28K77S242646

Stock Num: 7S242646

Make: Dodge

Model: Dakota ST

Year: 2007

Exterior Color: White

Interior Color: Gray

Options: Drive Type: 4WD

Number of Doors: 4 Doors

Mileage: 110184

Safety-inspected. Room for 6! Plenty of interior storage and cupholders. 5-star driver and side-impact safety ratings! Powered by a 210-hp 3.7-liter V6 engine with a 4-speed automatic and 4wd. Nimble handling. a capable midsize truck that does most things well - Edmunds. It's the truck you've been looking for!

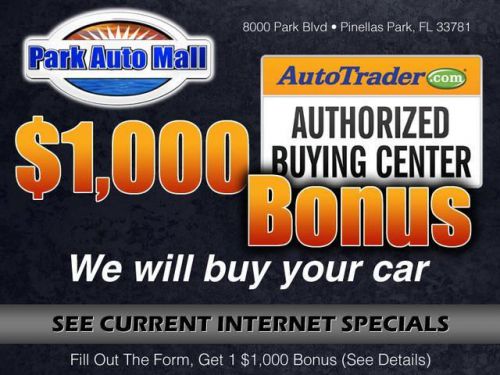

Call now to check availability. Park Auto Mall, winner of FIADA's 2013 Quality Dealer Award and the COC's 2014 Medium-Sized Business of the Year Award, has the largest selection of pre-owned vehicles in the Tampa Bay area! Located in Pinellas Park, FL, since 2000.

Friendly customer consultants will help you buy a car without pressure or hassle. Finance managers will give you the credit you deserve. We provide a full range of automotive services in our 15 service bays. We buy cars - bring it in today!

Price and payments do not include tag, tax, title, license, administrative cost, finance charges or 599 dollar Dealer Prep Fee.

Where Dreams Come True!

Dodge Dakota for Sale

2003 dodge dakota slt(US $8,995.00)

2003 dodge dakota slt(US $8,995.00) 2003 dodge dakota base(US $7,495.00)

2003 dodge dakota base(US $7,495.00) 2001 dodge dakota quad cab(US $9,495.00)

2001 dodge dakota quad cab(US $9,495.00) 2007 dodge dakota st(US $14,888.00)

2007 dodge dakota st(US $14,888.00) 2005 dodge dakota slt

2005 dodge dakota slt 2005 dodge dakota st

2005 dodge dakota st

Auto Services in Florida

Zych`s Certified Auto Svc ★★★★★

Yachty Rentals, Inc. ★★★★★

www.orlando.nflcarsworldwide.com ★★★★★

Westbrook Paint And Body ★★★★★

Westbrook Paint & Body ★★★★★

Ulmerton Road Automotive ★★★★★

Auto blog

The Fate of the Furious music video shows how much Demons love donuts

Fri, Mar 3 2017The new Dodge Demon is leaking into everything related to The Fate of the Furious in the lead-up to both the car and the film's debut in just over a month. The latest teaser involves Demons doing donuts and burnouts in the Get Off music video, with copious amounts of both tire smoke and hip hop to accompany the tire-shredding shenanigans. It also gives us a look at some of the film's other cars. Get Off is a song by Travis Scott, Quavo, and Lil Uzi that's featured on The Fate of the Furious soundtrack, which is out now. The teaser for the music video features a pack of Dodge Challengers - both Demon and non-Demon spec - along with a line of non-SRT related products. From what we can see, the movie will have a Scion FR-S/Toyota 86, a highly modified C2 generation Chevrolet Corvette, and a Mercedes-AMG GT S. In typical over-the-top fashion, the final shot shows a submarine bursting through ice in pursuit of several cars, including a Subaru WRX. We can't see much else as the full music video hasn't been released, but expect a few more teasers once it does. The Fate of the Furious debuts Friday, April 14, just days after the Dodge Demon's debut at the New York Auto Show. Related Video: News Source: Jetlag on Twitter TV/Movies Chevrolet Dodge Toyota music music video dodge hellcat the fate of the furious

Dodge Durango Shaker concept: A 392 V8 in front of six Viper seats

Tue, Nov 1 2016When done right, a parts-bin special can be a beautiful thing. This Dodge Durango Shaker concept for the 2016 SEMA show is one such vehicle, and it's easily our favorite Mopar debuting in Vegas. The key, of course, is pulling from the right bins. Take a tour and you'll see Charger, Challenger, and Viper pieces grafted onto this slick crossover. The featured special part is the big, 6.4-liter 392 Hemi V8 that's been dropped under the hood; it's sourced from the SRT Challenger and Charger where it makes 485 horsepower and 475 pound-feet of torque. With that in place, the fabricators cut a big hole in that hood for the Challenger's awesome optional shaker scoop. It wasn't an easy installation; it required a custom spacer for the intake to make sure everything lined up with the hole properly. View 17 Photos Apparently there were some Viper seats lying around, so six of them were stuck into this Durango. Makes sense. It does lose a bit of people-carrying capability as a result, since only two seats fit in each row, and the seats don't fold for extra cargo room. A Dodge spokesperson attested to the fact that all three rows are usable, if not totally comfortable. But then stock third-row seats aren't always that comfortable anyway. Seriously, though, Viper seats. We don't care how comfortable or usable the result is. Although you might not give it a second thought, even the fuel filler needed some special attention. This piece was also lifted from a Dodge Challenger, and it was taken along with the surrounding sheet metal. Because of the different orientation of the filler cover on the Challenger, the builders decided the easiest way to get it to fit was to chop the fuel filler section out and weld it onto the Durango. The designers also put a little blue Stig on the cover. And those are just the cool parts that were hard to install. This Durango features plenty of other slick details, like the custom bumpers, fender flares, and side skirts. Everything is painted B5 Blue with matte black and carbon accents all around. Up front, the bumper hides a pair of fog lights stolen from a Challenger Hellcat – and yes, they're the ones with intakes in the middle. The grille is also a custom piece, losing the standard crosshair design for better airflow. The fender flares cover up some seriously wide, 305-section tires at all four corners, which are hauled down by Hellcat brakes. The rear bumper bumper contains a stylish center-exit exhaust with dual tips.

2015 Dodge Challenger crash test results slip from last year's model

Mon, Dec 22 2014The National Highway Traffic Safety Administration has released the results of its latest round of crash testing, announcing that the 2015 Dodge Challenger has netted a five-star overall crash rating. Of course, Chrysler won't want us to tell you this, but that NHTSA overall rating is not the whole story here. As The Car Connection so astutely points out, five-star rating aside, the refreshed 2015 Challenger actually performed worse than when it was tested back in 2013. The V6-powered SXT model tested by NHTSA in this latest round of testing was only able to record a four-star rating in its frontal crash test, while it nailed a five-star rating in the side-impact test. The 2013 Challenger managed a five-star rating in the frontal test. Of course, while this rating is a sign of overall good news for Challenger fans, the car, as TCC argues, has yet to be tested by the Insurance Institute for Highway Safety. It'll be interesting to see if these NHTSA ratings translate to an IIHS Top Safety Pick or Top Safety Pick Plus. Scroll down for the full press release from FCA. All-new 2015 Dodge Challenger Earns Five-Star Overall Safety Rating From U.S. National Highway Traffic Safety Administration 2015 Dodge Challenger coupe earns five stars overall, the highest possible score in NHTSA's safety rating program More than 70 safety and security features, including new for 2015 class-exclusive Forward Collision Warning, adaptive cruise control, Blind-spot Monitoring and Rear Cross Path detection All-new 2015 Dodge Challenger starts at $26,995 (excluding tax, destination and title) December 18, 2014 , Auburn Hills, Mich. - The all-new 2015 Dodge Challenger has earned a five-star overall safety rating from the U.S. National Highway Traffic Safety Administration (NHTSA). Five stars is the highest possible safety rating given by NHTSA. "The new Dodge Challenger coupe further demonstrates our commitment to broaden the proliferation of advanced safety technologies, such as driver-assist features," says Scott Kunselman, Senior Vice President-Vehicle Safety and Regulatory, FCA-North America. In its assessment of the new Challenger, NHTSA notes the availability of Forward Collision Warning (FCW), which features forward-facing sensors programmed to detect the potential for certain types of frontal collisions. If detected, the driver is alerted with visual and audible warnings. The 2015 Dodge Challenger is the only car in its segment with such capability.