2018 Dodge Charger R/t Scat Pack on 2040-cars

Engine:SRT HEMI 6.4L V8 MDS

Fuel Type:Gasoline

Body Type:4D Sedan

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 2C3CDXGJ8JH289767

Mileage: 114962

Make: Dodge

Trim: R/T Scat Pack

Features: --

Power Options: --

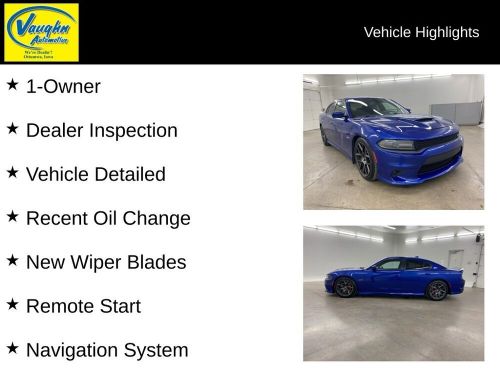

Exterior Color: Blue

Interior Color: Black

Warranty: Unspecified

Model: Charger

Dodge Charger for Sale

2018 dodge charger srt 392(US $45,855.00)

2018 dodge charger srt 392(US $45,855.00) 2018 dodge charger awd 5.7l v8 hemi police(US $16,795.00)

2018 dodge charger awd 5.7l v8 hemi police(US $16,795.00) 2015 dodge charger awd 5.7l v8 hemi police, partition and console(US $14,795.00)

2015 dodge charger awd 5.7l v8 hemi police, partition and console(US $14,795.00) 2020 dodge charger awd 5.7l v8 hemi police(US $18,995.00)

2020 dodge charger awd 5.7l v8 hemi police(US $18,995.00) 2019 dodge charger awd 5.7l v8 hemi police(US $17,995.00)

2019 dodge charger awd 5.7l v8 hemi police(US $17,995.00) 2018 dodge charger awd 5.7l v8 hemi police(US $28,795.00)

2018 dodge charger awd 5.7l v8 hemi police(US $28,795.00)

Auto blog

Custom 2014 Dodge Durango R/T proves SEMA can be subtle

Thu, 07 Nov 2013The annual SEMA Show in Las Vegas can often be a sensory overload of overwrought madness, with cars that don't even look drivable anymore. But every once in a while, a modestly modified show car graces our presence, like the customized Dodge Durango you see here, which, in addition to giving us our first glimpse at the aftermarket possibilities for the refreshed-for-2014 model, proves that a car doesn't have to be slammed, scooped, donked and Lambo-doored to have presence.

Sure, this Durango has custom hood inserts, dark 22-inch wheels and custom fender flares, but as far as external modifications go, that's it. Inside, Dodge has fitted new door sill guards, an ambient lighting kit, bright pedals, premium floor mats and - of course - Katzkin leather. The automaker has even added wireless internet connectivity as part of the excellent Uconnect infotainment system.

Performance upgrades are minimal on this Durango R/T, which comes packed with Chrysler's 5.7-liter Hemi V8. Larger brakes have been fitted, as have lowering springs (though it certainly doesn't look that much lower) and a custom exhaust.

Chrysler slows minivan production, hasn't built VW Routan this year

Wed, 13 Mar 2013Chrysler has slowed production of its Town and Country and Dodge Grand Caravan minivans this week, Automotive News reports. The Windsor, Ontario plant will cut its three shifts from eight hours each to four hours each in an effort "to align production with market demand," a Chrysler spokesperson told AN. Chrysler also builds the closely related Routan minivan for Volkswagen at its Ontario facility, but has not built a single example thus far in 2013.

Sales of Chrysler's minivans fell 15 percent for the first two months of 2013, and a large part of that has to do with the 26-percent drop of the Grand Caravan alone (the T&C was only down by one percent). According to Automotive News data, as of March 1, Chrysler had an unsold inventory of 24,713 Town and Country models and 18,547 Grand Caravans - a 69- and 43-day supply, respectively.

"No sense running full speed now, then have a lot of vehicles sitting around a few months down the line," Chrysler spokeswoman Jodi Tinson told AN. Full production is expected to resume again on March 18.

How Dodge is making sure dealers don't gouge Demon buyers

Tue, Jun 20 2017The Dodge Challenger SRT Demon is a ridiculous 840-horsepower, limited-production machine that we're sure many are eager to purchase. But, they're probably not excited at the prospect of the massive dealer markups that accompany rare, high-performance cars. Fortunately, Dodge is taking steps to make sure buyers aren't paying thousands of dollars extra to get a car early, and its main method is production priority. Dodge announced that cars purchased at or below the MSRP of $86,090 will be the first ones the company builds and delivers. If a dealer sells an allocated car for more than the sticker price, that car won't be built until the high-priority vehicles have been. Dodge will also ensure fair distribution of the 3,000 Demons it will build by limiting the number of orders a dealer can submit. Dealers will be allocated a certain number of cars, and the amount will be based on how many Challenger and Charger Hellcats the dealer has sold. This should also help prevent dealers from hoarding cars and slapping sky-high prices on them. Also, the fact that every Demon comes with a number plate with the buyers' name on it should help prevent dealers from buying cars for the lot to mark up. In addition to revealing these measures, Dodge announced that buyers will be able to submit an order for a Demon at an eligible dealer tomorrow, June 21. The only dealers eligible for Demon ordering are those that have sold more than one Hellcat in the past 12 months. Cars will begin production this summer, and deliveries will begin in the fall. Related Video: Featured Gallery 2018 Dodge Challenger SRT Demon: New York 2017 View 48 Photos Image Credit: Drew Phillips Dodge Car Buying Car Dealers Coupe Performance dodge demon