2006 R/t* Only 46k* Custom* Celebrity Owned* Over $30k Invested* 05 07 08 09 10 on 2040-cars

Costa Mesa, California, United States

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Make: Dodge

Warranty: Vehicle does NOT have an existing warranty

Model: Charger

Mileage: 46,074

Options: CD Player

Sub Model: HEMI R/T

Safety Features: Driver Airbag

Exterior Color: White

Power Options: Air Conditioning

Interior Color: White

Number of Cylinders: 8

Dodge Charger for Sale

1973 dodge charger rallye 340 auto – number matching mopar

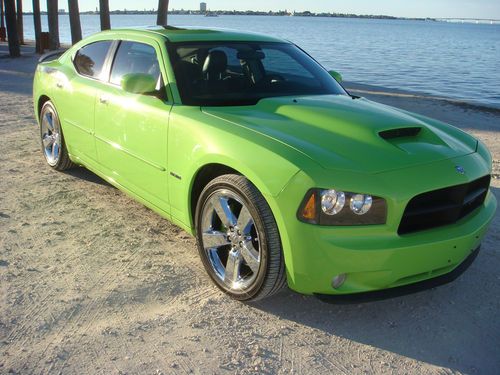

1973 dodge charger rallye 340 auto – number matching mopar 2007 dodge charger r/t hemi daytona sub lime green 42k miles florida car no rust(US $19,995.00)

2007 dodge charger r/t hemi daytona sub lime green 42k miles florida car no rust(US $19,995.00) R/t 5.7l cd 6 speakers dvd-audio mp3 decoder. we finance & take trade ins!

R/t 5.7l cd 6 speakers dvd-audio mp3 decoder. we finance & take trade ins! 2011 dodge charger r/t max -adaptive cruise,nav,alpine,5.7l hemi,htd leather,32k(US $28,980.00)

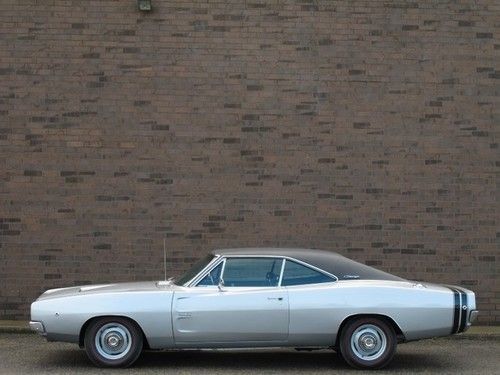

2011 dodge charger r/t max -adaptive cruise,nav,alpine,5.7l hemi,htd leather,32k(US $28,980.00) Numbers matching four speed, broadcast sheet, certicard(US $154,995.00)

Numbers matching four speed, broadcast sheet, certicard(US $154,995.00) 2011(11) dodge charger se only 25824 miles! factory warranty! clean! like new!!!(US $17,995.00)

2011(11) dodge charger se only 25824 miles! factory warranty! clean! like new!!!(US $17,995.00)

Auto Services in California

Z & H Autobody And Paint ★★★★★

Yanez RV ★★★★★

Yamaha Golf Cars Of Palm Spring ★★★★★

Wilma`s Collision Repair ★★★★★

Will`s Automotive ★★★★★

Will`s Auto Body Shop ★★★★★

Auto blog

The Dodge Demon gets a Drag Mode and a lesson in Newtonian physics

Thu, Feb 23 2017It's Thursday morning, which means we have more news on the upcoming Dodge Demon, the pumped-up Challenger Hellcat variant that's looking to cause mayhem at a drag strip near you. This week's video, "Third Law," shows the Demon's revised suspension in action and displays another one of SRT's cryptic messages. Dodge claims that the 6.2-liter supercharged Hemi V8 in the Hellcat twins is compromised because it's fitted to a car that needs to be comfortable on the street in addition to a performer on the drag strip. Not so with the Demon, as Dodge says the car is "designed to be highly competent in all drive modes and configurations," including the all-new Drag Mode. Dodge says details about the new mode will trickle out over the next few weeks, but all the info this week focused on suspension. The "Third Law" in this week's title refers to Isaac Newton and motion: "When one body exerts a force on a second body, the second body simultaneously exerts a force equal in magnitude and opposite in direction on the first body." We're not sure what Newton would have thought seeing the sidewall wrinkling Nitto NT05R drag radials in action, but he'd probably have a reaction of some sort himself. An ideal suspension setup for the drag strip makes for a poor setup on the road. As Dodge puts it, the "old school" way to set up a drag car was to "get the quickest reacting springs upfront, the softest rebound front shocks that wouldn't restrict the springs' reaction, remove any restrictions (sway bar) and increase the compression of the rear shocks." This would give a car great front to rear weight transfer but made for very poor lateral direction control, meaning minor corrections were difficult. The Demon's Drag Mode will use electronics to give the car the best combination of launch and lateral stability. Dodge listed some of the parts to help aid in this goal. They also gave us a few equations that we can't make sense of. Let us know if you have any clues. Hardware: 35 percent lower rate front springs/28 percent lower rate rear springs 75 percent lower rate hollow front sway bar/44 percent lower rate rear sway bar Drag-tuned Bilstein Adaptive Damping Shocks Software: Rear = F/F and Front = F/S F/F – F/S maintained @ wide open throttle (WOT) F/F – F/F < WOT Traction control disabled/ESC maintained Result: 13.5=575@500 Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Dodge Challenger Hellcat X is 805-hp worth of charity [w/video]

Mon, Jul 20 2015Donating to charity is good for the soul. You feel good and help out those in need, and while you should donate out of the goodness of your heart, there's nothing wrong with getting something in return. That's doubly true if that something (or somethings) happen to run on gasoline... a lot of gasoline. For just $3 (plus $40,000 in taxes), you could park not one, but two high-powered Mopars in your driveway. The big item, of course, is the world's most powerful Dodge Challenger Hellcat. Dubbed the Hellcat X after the XF6F, a twin-charged US Navy prototype that evolved into the Hellcat fighter from World War II. Its 6.2-liter, supercharged V8 has been supplemented by a turbocharger, boosting output to 805 horsepower. Because, you know, 707 just wasn't quite enough. It should be noted that the Hellcat X isn't a production model – Fiat Chrysler isn't going to be putting a twin-charged Hemi into production – but that it's a one-off job built for the 2015 Chrysler Nationals at Carlisle. Joining the Hellcat X is a handsome, black 1970 Challenger 440 R/T. Complete with a four-barrel carburetor (yeah, we were hoping for a Six Pack, as well), a pistol-grip shifter, and menacing black paint, this exact car was the star of 2012's "Revolution Reborn" television spot. And if this car's on-air claim to fame isn't enough, rest easy knowing you're the owner of just one of 100 black 440 R/Ts produced in 1970. Now, single tickets do start at $3, although there are larger bundles available, including a $5,000, 6,000-ticket package. Proceeds from the drawing, which is being put on by Dream Giveaway, will go towards New Beginning Children's Home charity, which issues grants to everything from the National Guard Educational Foundation to Mothers Against Drunk Driving. You can check out more on the Hellcat X in the video, below. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Happy Halloween, cats and kittens!

Tue, Oct 31 2017Happy Halloween, everybody. There's no real Hellcat news in this post. No growl of the second-scariest Dodge Challenger SRT's 707-horsepower engine, no shriek of its supercharger. Just a Hellcat on a photo shoot. A little eye candy on Halloween. In a graveyard. With a black cat. (No cats were doomed to hell in the making of this feature.) But a Hellcat is a good kind of scary, so here are some of our previous galleries. And may a Hellcat cross your path soon. View 18 Photos View 17 Photos View 80 Photos Related Video: