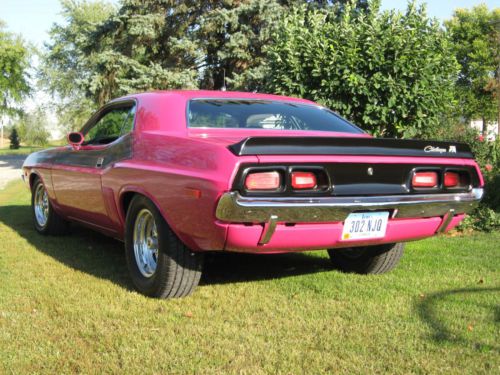

Dodge Challenger T/a Tribute Panther Pink 340 4/speed Mopar No R/t Or Hemi on 2040-cars

Iowa City, Iowa, United States

|

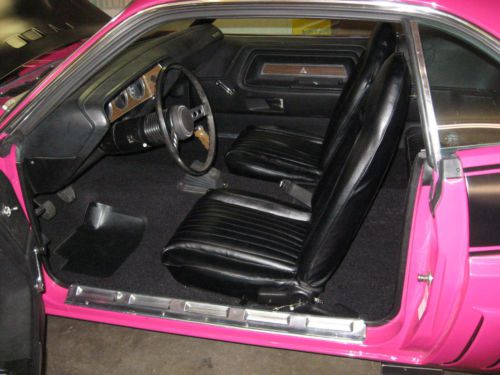

Southern car virtually rust free built as a T/A Tribute, Glass T/A hood, Fresh 70 date code HP 340 with J heads, Pistol Grip 4/speed transmission, Fresh 8.75 - 3.55 Sure Grip rear end, Newly recovered seats, new carpet and headliner. Front disc. brakes, drum rear, all new suspension, manual steering gear, none power brakes. Car drives nice and runs strong. Check out the pictures, any questions please ask. I do have the car for sale locally so I reserve the right to end auction early if needed - - -

Thanks for looking |

Dodge Challenger for Sale

2011 dodge challenger srt8 srt-8 392 navigation hemi stripes heated seats 18k(US $34,920.00)

2011 dodge challenger srt8 srt-8 392 navigation hemi stripes heated seats 18k(US $34,920.00) 2012 dodge challenger sxt v6 auto spoiler alloys 37k mi texas direct auto(US $22,480.00)

2012 dodge challenger sxt v6 auto spoiler alloys 37k mi texas direct auto(US $22,480.00) 5.7l v8 hemi automatic leather sunroof navigation bluetooth racing stripes mp3

5.7l v8 hemi automatic leather sunroof navigation bluetooth racing stripes mp3 6.4l v8 hemi 392 automatic leather sunroof harman kardon navigation bluetooth cd

6.4l v8 hemi 392 automatic leather sunroof harman kardon navigation bluetooth cd 2008 srt8 dodge challenger(US $27,000.00)

2008 srt8 dodge challenger(US $27,000.00) Incredible vehicle! 1 owner, no accidents, low miles, true muscle -- we finance!(US $35,900.00)

Incredible vehicle! 1 owner, no accidents, low miles, true muscle -- we finance!(US $35,900.00)

Auto Services in Iowa

Woody`s Auto Repair Service ★★★★★

Stew Hansen Dodge Ram Chrysler Jeep ★★★★★

Scotty`s Body Shop ★★★★★

Priority 1 Automotive Services ★★★★★

Perfection Auto Repair ★★★★★

Osborne Oil ★★★★★

Auto blog

Stellantis moves to set up its own lending unit

Sat, Sep 4 2021Stellantis is buying Houston-based auto lender First Investors Financial Services Group to set up its own finance arm in the U.S., a move that should support sales and eventually boost profit. The only major traditional automaker in the U.S. without its own finance company agreed to pay $285 million to a group of investors led by Gallatin Point Capital and Jacobs Asset Management, according to a statement. The transaction is expected to close by year-end. Stellantis was formed via the merger between Fiat Chrysler and PSA Group early this year. Carlos Tavares, the PSA boss who became the combined company’s chief executive officer, called the deal to acquire First Investors a milestone that will increase earnings and enhance customer loyalty. “Direct ownership of a finance company in the U.S. is a white-space opportunity which will allow Stellantis to provide our customers and dealers a complete range of financing options,” Tavares said Wednesday in the statement. Having an in-house finance company has helped rivals General Motors Co. and Ford Motor Co. pad profits, especially during the global semiconductor shortage that has limited production and crimped sales. GM bought subprime lender AmeriCredit Corp. in 2010 and renamed it GM Financial. The operation generated a $2.76 billion profit in the first half -- roughly a third of the companyÂ’s adjusted earnings before interest and taxes. Trouble for Santander? The First Investors acquisition could spell trouble for Chrysler Capital, the operation that Santander Consumer USA Holdings Inc. and Chrysler set up in 2013 before the U.S. automaker completed its merger with Fiat. In a statement, Santander Consumer said itÂ’s committed to supporting Stellantis through the term of their existing agreement and its transition. Santander Consumer will also have “ongoing conversations with Stellantis about long-term mutually beneficial opportunities beyond 2023,” the company said, adding that its consumer business remains strong and has “delivered solid results for our shareholders.” This, along with support from its parent company, will allow the lender to “pursue additional opportunities as they arise.” The lenderÂ’s U.S.-listed stock fell 1.5% in New York trading Wednesday after Bloomberg reported Stellantis was preparing to announce a new finance partner. Stellantis shares rose as much as 1.3% in Paris trading Thursday.

Dodge Viper and Jaguar XK revival | Autoblog Podcast #543

Thu, May 31 2018On this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Green Editor John Beltz Snyder and Consumer Editor Jeremy Korzeniewski. We talk the possible rebirth of the Dodge Viper and Jaguar XK, as well as the recent goings-on at Tesla. Then we share some of our experiences driving in Europe. We also discuss the cars we've been driving, and help spend another listener's hard-earned dough in this week's "Spend My Money" segment. Autoblog Podcast #543 Your browser does not support the audio element. Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Dodge Viper and Jaguar XK to make a return? Tesla Model 3 braking issues and Elon Musk vs. media Driving in Europe Cars we've been driving: Porsche Panamera Turbo S E-Hybrid Sport Turismo, Infiniti QX50, Range Rover Velar Spend my money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: Auto News Green Podcasts Dodge Infiniti Jaguar Land Rover Porsche Tesla Car Buying Used Car Buying Driving Safety Performance jaguar xk infiniti qx50

China's Great Wall confirms its interest — in Jeep, or all of FCA

Tue, Aug 22 2017HONG KONG/SHANGHAI — Chinese automaker Great Wall Motor reiterated its interest in Fiat Chrysler Automobiles NV on Tuesday, but said it had not held talks or signed a deal with executives at the Italian-American automaker. China's largest sport utility vehicle manufacturer made a direct overture to Fiat Chrysler on Monday, with an official saying the company was interested in all or part of FCA, owner of the Jeep and Ram truck brands. Automotive News first reported the news, quoting Great Wall Motor President Wang Fengying as saying she planned to contact FCA to discuss acquiring the Jeep brand specifically. Those comments sent FCA shares higher but also raised questions over the ability of China's seventh-largest automaker by sales to buy larger Western rival FCA, or even Jeep, which some analysts value at as much as one-and-a-half times FCA. Great Wall sought to dampen speculation on Tuesday. It confirmed it had studied Fiat Chrysler, but said there was "no concrete progress so far" and "substantial uncertainty" over whether it would eventually bid. "The company has not built any relationship with the directors of FCA nor has the company entered into any discussion or signed any agreements with any officer of FCA so far," the company said in an English-language stock exchange filing. It did not give further detail. Fiat Chrysler stock dipped on the statement on Tuesday. Great Wall said trading in its Shanghai-listed shares would resume on Wednesday after having been suspended. Fiat Chrysler declined to comment on Great Wall's statement. On Monday, it said it had not been approached and was fully committed to implementing its current business plan. FLUSHING OUT RIVALS? Great Wall Motor, which was early to spot China's love of SUVs, had revenue of $14.8 billion last year and sold 1.07 million vehicles - but that compares with FCA's 2016 revenue of 111 billion euros ($130.6 billion). Analysts said Great Wall would need to raise both debt and equity to complete any deal, meaning its chairman Wei Jianjun could lose majority control. One possible scenario, according to analysts at Jefferies, would see Wei keeping a roughly 30 percent stake, while Great Wall would raise $10-$14 billion in debt and $10 billion in equity - hefty for a group currently worth just $16 billion. Ultimately, politics could be the clincher.