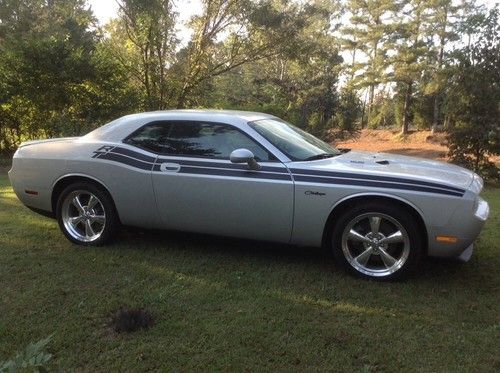

Dodge Challenger R/t Lcdp22 2 Dr Hardtop Silver on 2040-cars

Byron, Georgia, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:V8

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Dodge

Model: Challenger

Trim: TWO DOOR HARDTOP RT

Options: Leather Seats, CD Player

Drive Type: MANUAL

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 1,700

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: RT

Exterior Color: Silver

Interior Color: Black

Warranty: Vehicle does NOT have an existing warranty

2009 two door hardtop dodge challenger RT LCDP22

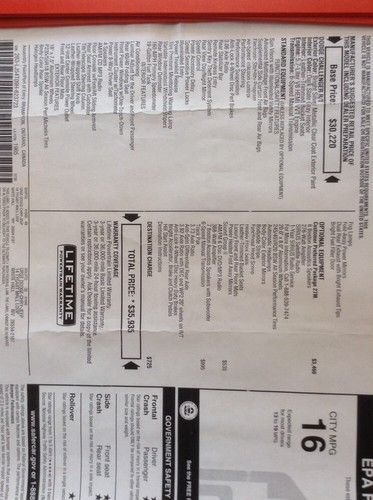

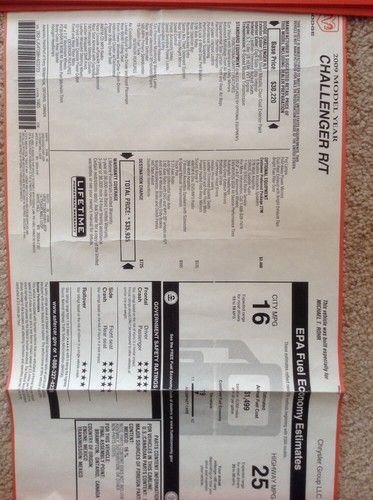

Only 1700 miles. Runs great. Please see the build sheet picture. I will add more pictures. Email me with any questions.

Nothing wrong with the car, just need to sell it before relocated overseas. One owner car.

VIN number is 2B3LJ54T09H623723

Buyer is responsible for all cost of shipping, title transfer, taxes in your state. Please have these arrangements made within 7 days of winning auction.

Dodge Challenger for Sale

1970 dodge challenger

1970 dodge challenger Flawless--like new(US $34,891.00)

Flawless--like new(US $34,891.00) 2011 dodge challenger srt-8 392 hemi. 6 speed manual. 1 owner clean history.(US $36,900.00)

2011 dodge challenger srt-8 392 hemi. 6 speed manual. 1 owner clean history.(US $36,900.00) New 2014 dodge challenger r/t classic - plum crazy(US $33,800.00)

New 2014 dodge challenger r/t classic - plum crazy(US $33,800.00) 2010 r/t 5.7l pink

2010 r/t 5.7l pink 2010 detonator yellow dodge challenger srt8 coupe 2-door 6.1l hemi(US $31,327.00)

2010 detonator yellow dodge challenger srt8 coupe 2-door 6.1l hemi(US $31,327.00)

Auto Services in Georgia

Wishen Motors ★★★★★

WILLIE & BATMAN AUTOMOBILE SERVICE ★★★★★

William Mizell Ford ★★★★★

W.T. Standard & Assoc. ★★★★★

Unlimited Motor Cars ★★★★★

Toyota Mall Of Georgia ★★★★★

Auto blog

Stellantis moves to set up its own lending unit

Sat, Sep 4 2021Stellantis is buying Houston-based auto lender First Investors Financial Services Group to set up its own finance arm in the U.S., a move that should support sales and eventually boost profit. The only major traditional automaker in the U.S. without its own finance company agreed to pay $285 million to a group of investors led by Gallatin Point Capital and Jacobs Asset Management, according to a statement. The transaction is expected to close by year-end. Stellantis was formed via the merger between Fiat Chrysler and PSA Group early this year. Carlos Tavares, the PSA boss who became the combined company’s chief executive officer, called the deal to acquire First Investors a milestone that will increase earnings and enhance customer loyalty. “Direct ownership of a finance company in the U.S. is a white-space opportunity which will allow Stellantis to provide our customers and dealers a complete range of financing options,” Tavares said Wednesday in the statement. Having an in-house finance company has helped rivals General Motors Co. and Ford Motor Co. pad profits, especially during the global semiconductor shortage that has limited production and crimped sales. GM bought subprime lender AmeriCredit Corp. in 2010 and renamed it GM Financial. The operation generated a $2.76 billion profit in the first half -- roughly a third of the companyÂ’s adjusted earnings before interest and taxes. Trouble for Santander? The First Investors acquisition could spell trouble for Chrysler Capital, the operation that Santander Consumer USA Holdings Inc. and Chrysler set up in 2013 before the U.S. automaker completed its merger with Fiat. In a statement, Santander Consumer said itÂ’s committed to supporting Stellantis through the term of their existing agreement and its transition. Santander Consumer will also have “ongoing conversations with Stellantis about long-term mutually beneficial opportunities beyond 2023,” the company said, adding that its consumer business remains strong and has “delivered solid results for our shareholders.” This, along with support from its parent company, will allow the lender to “pursue additional opportunities as they arise.” The lenderÂ’s U.S.-listed stock fell 1.5% in New York trading Wednesday after Bloomberg reported Stellantis was preparing to announce a new finance partner. Stellantis shares rose as much as 1.3% in Paris trading Thursday.

Rare Dodge Daytona found in barn heads for auction

Tue, Dec 15 2015An American icon is headed to Mecum's Kissimmee, Florida auction next January. Charlie Lyons, owner of a restoration shop focused on old Chrysler products, got a lead on a two-owner 1969 Dodge Charger Daytona that had been sitting in a barn in Glenwood, Alabama for decades. Dodge built 560 Charger Daytonas (Canada and US production) to homologate the model for NASCAR racing, and then that car and the successor Plymouth Superbird terrorized NASCAR tracks for 18 months. The production car, however, 18 feet long and considered ugly, wasn't popular at the time, so many were beat up or simply disappeared. Around 385 are thought to exist today. Lyons said the first owner of this car was the town judge, who bought it for his wife. In 1974 the second owner - just 18 years old at the time - bought it for $1,800 so he could drive it to Panama City, Florida, for Spring Break, and had flames painted on the front fenders and the scallops trimmed in white. Otherwise this barn find is complete and stock, with matching numbers throughout, R4 Charger Red paint and a white tail, bucket seats, center console, three-speed TorqueFlite automatic, and 20,553 miles on the 440-cubic-inch Magnum V8. Hot Rod has the long story of how Lyons found the car and convinced the owner to sell for what he jokingly called "a shoebox full of folded money." Hagerty says a concours-worthy model can command $262,000. Mecum's pre-sale estimate for this Charger Daytona is $150,000 to $180,000. That sounds steep, but Mecum did sell another perfectly restored Hemi-powered 1969 Charger Daytona for $900,000 at this year's Kissimmee auction to actor David Spade. Related Video:

Fiat Chrysler posts record Q3 profit thanks to U.S. trucks and Jeep

Wed, Oct 28 2020MILAN — A rebound in car production in Fiat Chrysler on Wednesday reported record third-quarter earnings as production returned to nearly pre-pandemic levels. The Italian-American automaker, which is finalizing its full merger with French rival PSA Peugeot, reported a net profit in the three months ending Sept. 30 of $1.4 billion (1.2 billion euros). That compares with a loss of 179 million euros a year earlier. The carmaker reported adjusted earnings before tax and interest in North America of 2.5 billion euros. That offset deepening losses in Europe, Asia and at its Maserati luxury marquee. Latin America, the only other region to post a profit, saw it narrow by two-thirds to 46 million euros. “Our record results were driven by our teamÂ’s tremendous performance in North America,” CEO Mike Manley said in a statement. Overall, the carmaker said global earnings before tax and interest were a record 2.3 billion euros despite a 6% fall in revenues to 26 billion euros. Global shipments were down 3%, due largely to plant retooling in North American to produce the new Jeep Grand Wagoneer in the luxury SUV segment and the discontinuation of the Dodge Grand Caravan classic minivan. Fiat Chrysler announced earlier Wednesday that its merger with PSA Peugeot is on track to be finalized by the end of the first quarter of 2021, as planned. To meet regulatory concerns, the French carmaker is selling a small stake in a components maker to get below 40% ownership. The new automaker, to be called Stellantis, will be the fourth biggest producer in the world. Earnings/Financials Chrysler Dodge Fiat Jeep RAM Citroen Peugeot