1970 Looking 1973 Dodge Challenger Half Finished Project Car. on 2040-cars

Fargo, North Dakota, United States

Transmission:4 speed manual

Vehicle Title:Clear

Fuel Type:Gasoline

Exterior Color: White Sealer primer

Model: Challenger

Interior Color: Black

Trim: coupe

Number of Cylinders: 8

Drive Type: 4 speed

Mileage: 100,000

I am selling my 1970 looking 1973 Dodge Challenger Project car simply because I have a new job and have very little time to finish the car now. The car is pretty much just a shell right now, everything has been taken off of the car. I have had the car since the fall of 2009, I have been working on it in my spare time over the years but I have a new job now and little free time to work on the car. The car is sitting on rollers just to move it around, the suspension has been completely removed. Any rusted areas were either cut out or sandblasted by myself.

Dodge Challenger for Sale

2010 dodge challenger r/t(US $28,995.00)

2010 dodge challenger r/t(US $28,995.00) 2013 dodge challenger r/t classic 5.7l(US $35,000.00)

2013 dodge challenger r/t classic 5.7l(US $35,000.00) Hurst dodge challenger series 5 rare mopar muscle # 13 of only 17 supercharged

Hurst dodge challenger series 5 rare mopar muscle # 13 of only 17 supercharged Hurst dodge challenger series 5 rare mopar muscle # 15 of only 17 supercharged

Hurst dodge challenger series 5 rare mopar muscle # 15 of only 17 supercharged One owner 09 dodge challenger r/t hemi power leather sunroof navigation auto

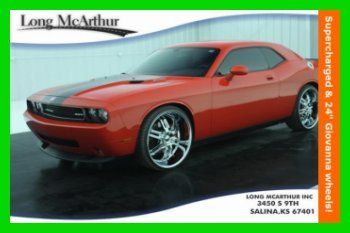

One owner 09 dodge challenger r/t hemi power leather sunroof navigation auto 2008 srt8 6.1 v8 navigation 24" giovanna wheels supercharged corsa exhaust(US $40,000.00)

2008 srt8 6.1 v8 navigation 24" giovanna wheels supercharged corsa exhaust(US $40,000.00)

Auto Services in North Dakota

Everett`s Service ★★★★★

Out There Customs ★★★★

Westlie Motor Company ★★★★

Road Runner Auto Tech Center ★★★★

Rainbow Auto Body ★★★★

Mark`s Hwy 2 Service ★★★★

Auto blog

Lackluster Dodge Dart sales trigger layoffs

Thu, 06 Mar 2014Hidden amidst the overall very positive sales figures that Chrysler released earlier this week were a few disappointments, the biggest of which may be the Dodge Dart. While Dodge sales in general were down 11 percent from a year ago, the Dart's poor figures stood out from the rest - with 4,888 units sold, the Dart was down 37 percent in February.

It comes as little surprise, then, that the automaker has announced layoffs at its assembly plant in Belvidere, IL. According to The Daily Herald, Dodge will temporarily lay off 325 workers "to balance vehicle supply with current sales demand." Put more simply, there are more Darts than buyers at the moment...

We don't think the Dodge Dart is a bad car, but it's playing in a market that offers a few standout sellers, like the Chevy Cruze, Ford Focus, Honda Civic and Toyota Corolla. According to AutoPacific analyst Dave Sullivan, as quoted by The Daily Herald, "great incentives on the Dodge Avenger" are also partly to blame for the Dart's poor showing.

Leno recalls '90s showdown with Tim Allen and his mullet

Wed, Oct 7 2015Not many of us have buddies with garages full of classic cars, but that isn't the case for Jay Leno and Tim Allen. Of course, one of the advantages for two guys with such vast collections is occasionally getting to pit their cars against each other. The two comedians did just that in the mid-'90s with a burnout battle on The Tonight Show between Allen in a race-prepped Mustang and Leno in a drag racer. After some time away from regular television, Leno is returning to the airwaves with a Jay Leno's Garage series premiering on Oct. 7 (tonight) at 10:00 p.m. ET on CNBC. Let this clip serve as another taste of what to expect for the new TV show's mix of comedy and cars. After reminiscing about the old days in a gorgeous garage, the comedians get into two modern machines to reprise the classic challenge – after a little trash talk anyway. Don't worry because the YouTube series isn't going anywhere, though.

Ralph Gilles shares how he imagined a modern-day Dodge Rampage in 1995

Fri, Apr 10 2020Fiat-Chrysler Automobiles (FCA) design boss Ralph Gilles kicked off the company's 24-hour Design Sketch Battle by sharing an image of a mini-truck he drew in 1995. Called Tomahawk GTR, it never reached production. Gilles sketched the Tomahawk GTR when he was about 25 years old. He was a designer at the time, he wasn't promoted to a managerial position until 1998, and his obsession with performance already permeated the cars he drew. The Tomahawk GTR takes the form of a two-door, two-seater pickup with a muscular-looking front end, pronounced wheel arches, and a sizable spoiler over the cargo box. The wheels look almost Porsche-like. "I guess I was dreaming up a modern-day Rampage back then. This must be what happens when a want-to-be racer draws a truck," he wrote on his Instagram page, referencing the small, unibody pickup Dodge made from 1982 to 1984. His sketch moved the company's then-current design language in a sportier direction. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Dodge hasn't released a successor to the Rampage yet, at least not in the United States. The Fiat-based 700 that sister company Ram sells in Mexico is the closest thing available in 2020, but there's no indication it will be sold in America anytime soon. The firm used the Tomahawk name on a Viper-powered motorcycle concept introduced in 2003, and it dusted it off again for an SRT design study created in 2015 for Gran Turismo. We may see a Rampage for the 2020s emerge from the Design Sketch Battle. The photo accompanying FCA's announcement depicted a Dodge Challenger Hellcat turned into a pickup and fitted with a front end borrowed from a Ram 1500. The contest's winners will be announced on Instagram today. Instagram has recently turned into a window through which enthusiasts can peek into Gilles' mind. He published a futuristic-looking sketch in March 2020 that poked fun at the Charger and Challenger owners who leave the yellow protective stripes on their car while potentially shedding light on Dodge's next design language. Design/Style Dodge Truck