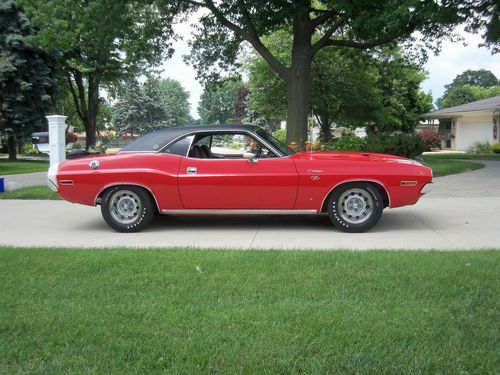

1970 Dodge Challenger Hardtop Red 2-door 383 Magnum Hp 4 Speed on 2040-cars

Plover, Wisconsin, United States

Body Type:Hardtop

Engine:383 Magnum

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Interior Color: Red

Make: Dodge

Number of Cylinders: 8

Model: Challenger

Trim: 383 Magnum

Drive Type: RWD

Mileage: 65,246

Exterior Color: Red

Dodge Challenger for Sale

2012 dodge challenger sxt coupe 2-door 3.6l

2012 dodge challenger sxt coupe 2-door 3.6l 1970 dodge challenger rt/se 440 six pack 4-speed #'s matching w/ broadcast sheet

1970 dodge challenger rt/se 440 six pack 4-speed #'s matching w/ broadcast sheet 2010 dodge challenger r/t hemi supercharged sunroof 45k texas direct auto(US $25,980.00)

2010 dodge challenger r/t hemi supercharged sunroof 45k texas direct auto(US $25,980.00) 1974 dodge challenger 440 plum perfect metallic(US $32,500.00)

1974 dodge challenger 440 plum perfect metallic(US $32,500.00) 1970 dodge challenger rt/se 440 six pack v code 4 spd(US $88,000.00)

1970 dodge challenger rt/se 440 six pack v code 4 spd(US $88,000.00) 2012 dodge challenger srt8 yellow jacket 6.4 hemi 470 horsepower!(US $43,900.00)

2012 dodge challenger srt8 yellow jacket 6.4 hemi 470 horsepower!(US $43,900.00)

Auto Services in Wisconsin

Todd`s Automtv ★★★★★

Sturtevant Auto ★★★★★

Stephan`s Auto Repair ★★★★★

State Auto Sales ★★★★★

Scott`s Towing & Recovery ★★★★★

Schmelz Countryside Volkswagen/Saab Car Sales ★★★★★

Auto blog

Saleen SA-30 Mustang, Camaro and Challenger help celebrate the big 3-0

Fri, 22 Nov 2013After 30 years of tuning performance cars and building racecars, Saleen is celebrating its racing heritage with a limited-production car line called SA-30. Based on the Ford Mustang, Chevrolet Camaro and Dodge Challenger, Saleen will only build 10 of each SA-30 model at a base price of $95,000.

For that money, buyers will get upgraded suspension, brakes and engines, and while the power figures have not been released for the SA-30 620 Camaro and SA-30570 Challenger models, the SA-30 302 Mustang will be the top performer with 625 horsepower. Each car will be painted up in a custom pearl white hue with black and yellow accents, and get white wheels shrouding yellow powder-coated brake calipers. Inside, the SA-30 offerings will all get a proper Saleen interior with black leather and white Alcantara on the seats, along with the expected smattering of SA-30 badges.

On all three SA-30 models, customers will have various options available to further customize their cars, including a rear-seat delete option that transforms each car's cabin into a race-inspired interior with a chassis-strengthening rear cross brace. Perhaps the coolest feature of all, though, is the Saleen Frost-Touch Glass that is an option on the SA-30 302 Mustang. Similar to the Mercedes Sky Control roof first introduced on the Mercedes SLK, the Saleen Frost-Touch Glass allows the Mustang's optional glass roof and rear window to be switched from transparent to opaque at the push of a button.

How Dodge dealers are earning the right to sell Hellcats

Wed, 10 Sep 2014We all hate the idea of the dreaded dealer markup when it comes to buying a highly anticipated new car. Take the 2015 Dodge Challenger SRT Hellcat, for example. You might spend hours reading about its supercharged V8 and speccing the model just right in the configurator, but when it finally comes down to laying down the cash, the dealer adds thousands of dollars as a "market adjustment" on the muscle machine of your dreams. As it turns out, when the Hellcat starts hitting showrooms in the third quarter, Dodge is trying to make sure that's not the case.

Dealer orders for the much-hyped Hellcat recently started, but Dodge boss Tim Kuniskis has put some special caveats in place to ensure that the Hellcat makes it to the road quickly. The initial allocation is based on the number of Dodge products that a showroom has sold in the last 180 days, and a second allotment in December is based on the last 90 days of sales and 30-day turnover. "You sell a lot of Darts for me, Journeys for me, Durangos for me, I'm going to give you the rights to this one, too, because this is a halo of the brand," said Kuniskis to Automotive News.

Furthermore, how quickly the Hellcat sells is also going to decide whether showrooms get more of them. "If you want to market-adjust the car, that's your right. But if your days-on-lot goes above what the other guys that are selling them at MSRP is, they will end up earning the allocation because their days-on-lot will be lower," he said to Automotive News. Obviously, this doesn't prevent dealers from marking up the Challenger SRT, but the strategy certainly discourages it.

Fiat Chrysler profit up as it closes in on retiring its debt

Thu, Apr 26 2018MILAN — Fiat Chrysler Automobiles reduced its debt by more than expected in the first quarter, putting the carmaker well on course to become cash positive later this year. Chief Executive Sergio Marchionne expects to cancel all debt during 2018 — possibly by the end of June — and generate around 4 billion euros ($5 billion) in net cash by the end of the year. Marchionne has said that forecast does not include any one-off measures, nor the impact of the planned spinoff of parts maker Magneti Marelli, which he hopes to execute by early 2019. The world's seventh-largest carmaker said on Thursday net debt had fallen to 1.3 billion euros ($1.6 billion) by the end of March, well below a consensus forecast of 2.6 billion euros in a Thomson Reuters poll of analysts. FCA said capital spending fell 900 million euros in the quarter due to "program timing," which analysts said implied higher investments for the rest of the year. The Italian-American group said first-quarter operating profit rose 5 percent to 1.61 billion euros, below a consensus forecast of 1.74 billion, as a weaker performance from its North American profit center weighed. Shipments there were higher due to the new Jeep Wrangler and Compass models. But currency moves hit revenues and earnings, and costs related to new product launches added to the pressure. FCA's shift to sell more trucks and SUVs boosted margins yet again in North America to 7.4 percent from 7.3 percent in the same quarter a year ago, although they were down from the 8 percent recorded in the preceding three months. Marchionne, preparing to hand over to an internal successor next year, is close to his goal of ending a margin gap with larger U.S. rivals General Motors and Ford. The 65-year-old has said becoming debt free and being able to compete on a par with U.S. peers would mean FCA no longer needed a partner to survive and could well succeed on its own. The CEO has previously said tying up with another carmaker would help to meet the huge costs in an industry investing in electric vehicles and automated driving. FCA shares fell immediately after the results, but recovered to trade up 3 percent at 19.71 euros by 1150 GMT, outperforming a 0.4 percent rise in Europe's blue-chip stock index. ($1 = 0.8214 euros) Reporting by Agnieszka FlakRelated Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.