Flexfuel Leather Roof Rack 3rd Row Stow N Go Dvd Mp3 Sirius Xm Uconnect Camera on 2040-cars

New Braunfels, Texas, United States

Body Type:Minivan, Van

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 6

Make: Chrysler

Model: Town & Country

Mileage: 32,524

Warranty: Vehicle has an existing warranty

Sub Model: Touring

Exterior Color: White

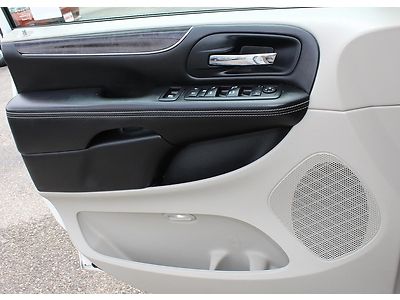

Interior Color: Gray

Chrysler Town & Country for Sale

Flexfuel leather roof rack 3rd row stow n go dvd mp3 sirius xm uconnect camera

Flexfuel leather roof rack 3rd row stow n go dvd mp3 sirius xm uconnect camera Flexfuel leather roof rack 3rd row stow n go dvd mp3 sirius xm uconnect camera

Flexfuel leather roof rack 3rd row stow n go dvd mp3 sirius xm uconnect camera Clean caefax(US $4,200.00)

Clean caefax(US $4,200.00) 04 platinum/one owner/leather/quads/dvd/tv/power doors/power liftgate/bargain(US $6,900.00)

04 platinum/one owner/leather/quads/dvd/tv/power doors/power liftgate/bargain(US $6,900.00) Sliding door factory warranty rear a/c back up camera off lease only(US $17,999.00)

Sliding door factory warranty rear a/c back up camera off lease only(US $17,999.00) Handicap conversion(US $9,950.00)

Handicap conversion(US $9,950.00)

Auto Services in Texas

Z Rated Automotive Sales & Service ★★★★★

Xtreme Tinting & Alarms ★★★★★

Wayne`s World of Cars ★★★★★

Vaughan`s Auto Glass ★★★★★

Vandergriff Honda ★★★★★

Trade Lane Motors ★★★★★

Auto blog

2017 Chrysler Pacifica will start at $29,590

Fri, Mar 11 2016Early reports suggested the 2017 Chrysler Pacifica would be more expensive than the outgoing model, but that's not entirely the case. The new minivan's base LX trim starts at $29,590 (after $995 destination) versus $30,990 for the 2016 Town & Country. The latest vehicle's prices are also in line with its competitors. All Pacificas have amenities like Active Noise Cancellation and the model's famous Stow 'n Go seats. For $31,490, customers can upgrade to the Touring trim to get SiriusXM satellite radio, power sliding doors, and automatic headlights. The Touring-L adds a little more luxury for $35,490 with features like rear parking assist, blind spot monitoring, and leather seats, which are heated for the front row. The Touring-L Plus at $38,80 includes even more useful items like a seven-inch driver display, 8.4-inch Uconnect infotainment system, heated steering wheel, heated second-row seats, and an upgraded stereo. The top of the Pacifica range is the Limited trim for $43,490, which piles on even more luxuries to haul the family around in style. The amenities include Nappa leather, ventilated front seats, an integrated vacuum, 3D navigation, HID headlights, LED foglights, panoramic sunroof, and hands-free doors and liftgate. It seems perfect for a road trip. Compared to the competition, the Pacifica has good fuel economy and similar pricing (all of which include destination). For example, the 2016 Honda Odyssey starts at $30,300 and can go up to $45,775 for the top Touring Elite model. The situation is similar with the Toyota Sienna, which ranges between $29,750 and $46,170 for the most expensive two-wheel drive version. The rapidly aging Nissan Quest starts out cheaper at $27,480 but tops out at $44,130. However, the Kia Sedona is significantly cheaper than the Pacifica, starting at $27,295 and going to $40,795 for the highest trim. The only potential downside to the Pacifica's pricing is FCA's discontinuation of the Dodge Grand Caravan. The model started at just $23,090 and topped out at $31,990, which gave the automaker a range of less expensive trims to lure price conscious customers. The company has lost that market advantage. We look forward to spending more time with the 2017 Pacifica when it arrives at dealers this spring. The Hybrid joins the lineup in the second half of the year.

Automakers not currently promoting EVs are probably doomed

Mon, Feb 22 2016Okay, let's be honest. The sky isn't falling – gas prices are. In fact, some experts say that prices at the pump will remain depressed for the next decade. Consumers have flocked to SUVs and CUVs, reversing the upward trend in US fuel economy seen over the last several years. A sudden push into electric vehicles seems ridiculous when gas guzzlers are selling so well. Make hay while the sun shines, right? A quick glance at some facts and figures provides evidence that the automakers currently doubling down on internal combustion probably have some rocky years ahead of them. Fiat Chrysler Automobiles is a prime example of a volume manufacturer devoted to incremental gains for existing powertrains. Though FCA will kill off some of its more fuel-efficient models, part of its business plan involves replacing four- and five-speed transmissions with eight- and nine-speed units, yielding a fuel efficiency boost in the vicinity of ten percent over the next few years. Recent developments by battery startups have led some to suggest that efficiency and capacity could increase by over 100 percent in the same time. Research and development budgets paint a grim picture for old guard companies like Fiat Chrysler: In 2014, FCA spent about $1,026 per car sold on R&D, compared with about $24,783 per car sold for Tesla. To be fair, FCA can't be expected to match Tesla's efforts when its entry-level cars list for little more than half that much. But even more so than R&D, the area in which newcomers like Tesla have the industry licked is infrastructure. We often forget that our vehicles are mostly useless metal boxes without access to the network of fueling stations that keep them rolling. While EVs can always be plugged in at home, their proliferation depends on a similar network of charging stations that can allow for prolonged travel. Tesla already has 597 of its 480-volt Superchargers installed worldwide, and that figure will continue to rise. Porsche has also proposed a new 800-volt "Turbo Charging Station" to support the production version of its Mission E concept, and perhaps other VW Auto Group vehicles. As EVs grow in popularity, investment in these proprietary networks will pay off — who would buy a Chevy if the gas stations served only Ford owners? If anyone missed the importance of infrastructure, it's Toyota.

Nissan is optimistic about FCA partnership, but wants the right terms

Mon, Jun 3 2019BEIJING – Nissan is optimistic about partnering with a combined Renault and Fiat Chrysler (FCA), as long as it can protect the ownership of technology developed over two decades of working with Renault, a senior executive told Reuters. The executive, who declined to be identified because he is not authorized to speak to the media, said he was cautiously optimistic about the possibility of generating "synergies" by sharing Nissan's autonomous drive know-how, electrification and greenhouse-gas-scrubbing technologies for powertrains. But he said the possible $35 billion merger of Renault and FCA would not give FCA the automatic right to use those technologies, which it needs to meet stringent emissions regulations and better compete in a industry being transformed by electric vehicles. He also floated the possibility that Nissan could look at boosting its stake in Renault, or a merged Renault-FCA, to gain more say in shaping the future of the alliance. "We would go ahead with partnering or cooperating with FCA only if we can guarantee tangible benefits from sharing technologies with FCA and only if we can work out conditions that are satisfactory to us," the Yokohama-based executive said. "If Renault wants to pursue this deal, we feel we need to look seriously at supporting them," he said. The executive's comments highlight how Nissan could look to leverage its advanced technology to gain greater bargaining power with a merged Renault-FCA. Renault is Nissan's top shareholder with a 43.4% shareholding, while Nissan holds a 15% non-voting stake in the French automaker. That unequal partnership has long rankled Nissan, which is the bigger company by far. A Nissan spokesman referred Reuters to a statement issued on Monday, where Nissan Chief Executive Hiroto Saikawa said: "I believe that the potential addition of FCA as a new member of the alliance could expand the playing field for collaboration and create new opportunities for further synergies." "That said, the proposal currently being discussed is a full merger which — if realized — would significantly alter the structure of our partner Renault. This would require a fundamental review of the existing relationship between Nissan and Renault," Saikawa said, adding that Nissan would analyze and consider its "existing contractual relationships". BOOSTING STAKE?