Chrysler Town&country Lxi,,,clean Carfax on 2040-cars

Stevensville, Michigan, United States

Body Type:Minivan, Van

Vehicle Title:Clear

Engine:3,8 v6

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chrysler

Model: Town & Country

Trim: minivan

Options: Sunroof, Leather Seats, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: fwd

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 134,800

Sub Model: LXI

Exterior Color: Green

Disability Equipped: No

Interior Color: Tan

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 6

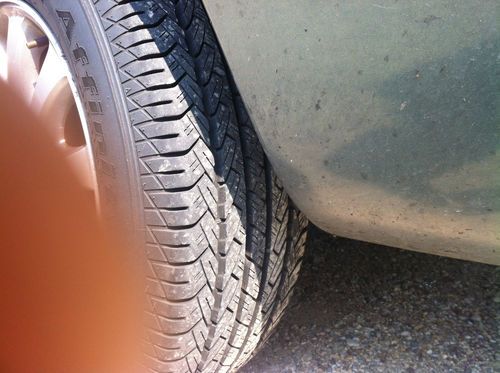

run great,,,smooth shifting,,no smoke engine,,no check engine lights,,,,new tires as you see in pictures ,, ,,new fuel pump.new axels..new battery..plugs and wires....oil change and filter ,add silk 50

transmission oil change and filter,,pcv value ,,belts,,,breaks and routers ,,I bought this van before 4 month and did all this because decided to keep it ,and make it safe drive to my family,,,,,,,,,,,,,,,,,but I bought another car ,,no need .you can drive it any where ,,need only one thing and as my mechanic guy said ,cant effect driving ,,two shocks mount ,,$80 at auto zone ,, nice smooth van for a family ..nice inside with leather seats and front and rear ac(cold ac),,,comfortable captain seats ,every thing work this van ,,with starter from orginal remote..and alarm system

Chrysler Town & Country for Sale

We finance! 2008 chrysler town & country touring fwd dvd(US $13,200.00)

We finance! 2008 chrysler town & country touring fwd dvd(US $13,200.00) 2010 touring plus navigation dual dvd htd seats chrysler town & country 31k(US $21,600.00)

2010 touring plus navigation dual dvd htd seats chrysler town & country 31k(US $21,600.00) 2001 chrysler town & country ltd leather and all options(US $3,100.00)

2001 chrysler town & country ltd leather and all options(US $3,100.00) 2007 chrysler town and country wpc signature series well equipped very clean

2007 chrysler town and country wpc signature series well equipped very clean 2007 chrysler town & country van--new tires & brakes--like new-no reserve

2007 chrysler town & country van--new tires & brakes--like new-no reserve 2010 chrysler town & country wheelchair van with stow away rear ramp system(US $21,800.00)

2010 chrysler town & country wheelchair van with stow away rear ramp system(US $21,800.00)

Auto Services in Michigan

Van Buren Motor Supply Inc ★★★★★

Van 8 Collision ★★★★★

Upholstery Barn ★★★★★

United Auto & Collision ★★★★★

Tuffy Auto Service Centers ★★★★★

Superior Collision ★★★★★

Auto blog

Auto bailout cost the US goverment $9.26B

Tue, Dec 30 2014Depending on your outlook, the US Treasury's bailout of General Motors, Chrysler (now FCA) and their financing divisions under the Troubled Asset Relief Program was either a complete boondoggle or a savvy move to secure the future of some major employers. Regardless of where you fall, the auto industry bailout has officially ended, and the numbers have been tallied. Of the $79.69 billion that the Feds invested to keep the automakers afloat, it recouped $70.43 billion – a net loss of $9.26 billion. The final nail in the coffin for the auto bailout came in December 2014 when the Feds sold its shares in Ally Financial, formerly GMAC. The deal turned out pretty good for the government too because the investment turned a 2.4 billion profit. The actual automakers have long been out of the Treasury's hands, though. The current FCA paid back its loans six years early in 2011, the Treasury sold of the last shares of GM in late 2013. According to The Detroit News, the government's books actually show an official loss on the auto bailouts of $16.56 billion. The difference is because the larger figure does not include the interest or dividends paid by the borrowers on the amount lent. While it's easy to see fault in any red ink on the Feds' massive investment, the number is less than some earlier estimates. At one time, deficits around $44 billion were thought possible, and another put things at a $20.3 billion loss. Outside of just the government losing money, the bailouts might have helped the overall economy. A study from the Center for Automotive Research last year estimated that the program saved 2.6 million jobs and about $284.4 billion in personal wealth. It also indicated that the Feds' reduction in income tax revenue alone from Chrysler and GM going under could have been around $100 billion for just 2009 and 2010, significantly more than any loss in the bailout.

FCA profits surge in second quarter

Fri, Jul 31 2015Fiat Chrysler Automobiles gave the cash register a beating in the second quarter, improving its net profit to 333 million euros ($364M US), which is a 263-percent jump over its reported Q1 profit of 92 million euros ($108M US). At the same time, FCA improved its global profit margin to 7.7 percent. Compared year-over-year, in Q2 2014 FCA reported net profit of 197 million euros making this year's Q2 a 69-percent increase, and profit margins a year ago were 4.9 percent. The two big factors for this increase are strong NAFTA sales and Jeep. In the US alone, Jeep sold 222,940 units in Q2 this year, a jump of almost 20 percent over the same period last year. Revenue in the NAFTA region totaled $18.8 billion, adjusted earnings before interest and taxes were $1.45 billion, both of those numbers more than doubling compared to 2014. The vastly better numbers come on marginally more global sales, 1,181,000 units sold in Q2 2014, 1,193,000 units sold in the same span this year. In the US, FCA began charging dealers one-percent more for vehicles to up the margins, a move that helped boost its US margin from 4.1 percent a year ago to 5.8 percent the first half of this year. The company is holding steady on its guidance of global deliveries at 4.8 million and its net profit guidance at $1.1 to $1.3 billion. It has increased its adjusted outlook for the year to $120.5 billion in revenue, and EBIT to "over $4.93 billion." News Source: Automotive News - sub. req.Image Credit: AP Photo/Carlos Osorio Earnings/Financials Chrysler Fiat Jeep FCA

The mad genius of killing the Dodge Dart and Chrysler 200

Thu, Jan 28 2016Sergio Marchionne isn't crazy. At least not with respect to the recent announcement that Fiat Chrysler Automobiles will cease production of the Dodge Dart and Chrysler 200. Instead of crazy I'd call this CEO ruthlessly pragmatic, and perhaps short-sighted. The latest revisions to FCA's most recent five-year plan tell some truths about the company's finances. In other words, it can't afford to build mainstream sedans. With only 87,392 units sold in 2015, the Dart is an also-ran in the segment. The axe falls easily there - Chrysler hasn't had a compact-car hit since the second-generation Neon. The 200 isn't so cut and dried: Last year sales increased 52 percent, and the 177,889 total for 2015 is more than those for the Subaru Legacy and Kia Optima. But looking at the overall FCA picture the Chrysler 200 has to go, at least from a short-term perspective. The vehicles that make big money – Ram trucks; Jeep's Cherokee, Grand Cherokee, and Wrangler – can't be made fast enough. FCA can't afford to idle the 200's Sterling Heights, MI, assembly plant to cut back on inventory when other plants are running flat out. It seems crazy to throw away 265,000 sales, but FCA is leaving money on the table by not building more profitable vehicles. The Wirecutter's Senior Autos Editor (and former Autoblogger) John Neff agrees. "As bold as it looks from the outside, he's really making a safe bet that their money is better spent on designing better and building more crossovers and trucks. He's probably right about that." But according to Jessica Caldwell, Executive Director of Strategic Analytics at Edmunds, "FCA's strategy of eliminating the Dart and 200 might be short-sighted if gas prices were to rise and Americans, once again, flocked to small vehicles. FCA must have plans to expand the lineup of small SUVs and position them as small-car alternatives in terms of price and fuel efficiency for this strategy to make sense." FCA's latest announcement focuses mainly on the profitable brands and nameplates. There's hardly a mention of Chrysler, Dodge, or Fiat. And future planning is where the plot holes appear. This realignment cuts dead weight from the product portfolio, but FCA's latest announcement focuses mainly on the profitable brands and nameplates. There's hardly a mention of Chrysler, Dodge, or Fiat. So what's Sergio up to? David Sullivan of AutoPacific thinks Marchionne is still looking for another CEO to hug.