2014 Chrysler Town & Country Touring on 2040-cars

2385 US-501, Conway, South Carolina, United States

Engine:3.6L V6 24V MPFI DOHC

Transmission:Automatic

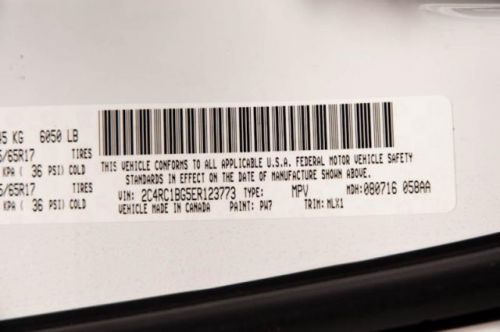

VIN (Vehicle Identification Number): 2C4RC1BG5ER123773

Stock Num: P2549

Make: Chrysler

Model: Town & Country Touring

Year: 2014

Exterior Color: Bright White

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 20889

Sensibility and practicality define the 2014 Chrysler Town Country! Comprehensive style mixed with all around versatility makes it an outstanding choice! With just over 20,000 miles on the odometer, you can be confident that this pre-owned vehicle will provide you reliable transportation. Top features include front dual zone air conditioning, leather upholstery, removable floor console, and remote keyless entry. Smooth gearshifts are achieved thanks to the refined 6 cylinder engine, and for added security, dynamic Stability Control supplements the drivetrain. Our aim is to provide our customers with the best prices and service at all times. Please don't hesitate to give us a call.

Chrysler Town & Country for Sale

2010 chrysler town & country touring(US $18,995.00)

2010 chrysler town & country touring(US $18,995.00) 2014 chrysler town & country touring(US $27,995.00)

2014 chrysler town & country touring(US $27,995.00) 2014 chrysler town & country touring(US $27,995.00)

2014 chrysler town & country touring(US $27,995.00) 2014 chrysler town & country touring(US $27,995.00)

2014 chrysler town & country touring(US $27,995.00) 2014 chrysler town & country touring(US $28,995.00)

2014 chrysler town & country touring(US $28,995.00) 2014 chrysler town & country touring(US $28,995.00)

2014 chrysler town & country touring(US $28,995.00)

Auto Services in South Carolina

X-Treme Audio Inc ★★★★★

Wingard Towing Service ★★★★★

Threlkeld Inc ★★★★★

TCB Automotive & Towing ★★★★★

Rothrock`s Garage ★★★★★

Reynolds Service Center ★★★★★

Auto blog

Chrysler Recalls Over 566,000 Trucks, SUVs

Wed, Oct 29 2014Fiat Chrysler is recalling more than 566,000 trucks and SUVs in two recalls for malfunctioning fuel heaters that can cause fires and a software glitch can disable the electronic stability control. The recalls bring the newly merged company's total for the year to 6.4 million vehicles worldwide and 5.1 million in the U.S. as it continues to struggle with reliability problems. It was not immediately clear whether those totals were annual records. On Tuesday, its longtime quality chief abruptly left after Fiat Chrysler performed poorly in Consumer Reports magazine's annual reliability rankings. The largest of two recalls announced Wednesday covers almost 382,000 Ram 2500 and 3500 pickups and Ram 4500 and 5500 chassis cabs from 2010 through 2014. In trucks with 6.7-Liter Cummins diesel engines, corrosion on a fuel heater terminal could cause overheating, fuel leaks and fires. Chrysler is not aware of any fires or injuries. Owners could be warned by an odor of diesel fuel. Customers will be notified by letters starting in December. Dealers will install upgraded terminals and fuel heater housings could be replaced. The second recall covers more than 184,000 Jeep Grand Cherokee and Dodge Durango SUVs from 2014. A debris cover over a circuit board in the steering column control module can disrupt communications and disable the stability control. The problem was discovered when dealers started getting reports from customers that electronic stability control warning lights were coming on. Fiat Chrysler says it knows of no crashes or injuries caused by the problem. Technicians will upgrade software to fix the SUVs, and customers will be notified in December. Fiat Chrysler has issued 33 global recalls and 27 in the U.S. so far this year. Doug Betts, its longtime quality chief, left the company to pursue other options after Consumer Reports' survey-based rankings this year showed four FiatChrysler brands at the bottom of its list. Dodge, Ram, Jeep and Fiat performed worst of 28 brands ranked by the magazine. Company spokesman Eric Mayne said Fiat Chrysler's recalls average fewer than 200,000 vehicles each, below the industry average of 301,000. That means the company is responding quickly to problems, he said, adding that eight of its 27 U.S. recalls were announced before the company received any consumer complaints. Chrysler is not alone with a high number of recalls so far this year.

What will Detroit do with the abandoned AMC headquarters?

Mon, Dec 28 2015As with so many other industrial and residential properties in Detroit, the former headquarters for the American Motors Corporation is having a hard time finding a reputable buyer. In October the Wayne County Treasurer held a tax foreclosure auction of 25,000 properties that included the AMC building, the starting bid being $500. Nicholas Casab won the building for $500, but the county voided the sale when Casab didn't pay the $232,000 in back property taxes. Detroit authorities haven't commented on the failed sale, but the city has until January 4 to decide if it wants to keep the building. If it doesn't want to hold onto it, the 1.5-million-square-foot property on 57 acres might be ceded to the Wayne County Land Bank Corporation. No matter who holds the deed come January 5, all anyone really wants is for someone to take possession of the building who will actually turn it into something useful and viable. The property opened in 1927 as a factory for the Kelvinator Corporation. Over the following decades, Kelvinator merged with the Nash Motor Company, and that merged entity merged with Hudson Motor Car Co, becoming American Motors. Chrysler took over the building in 1987 when it bought AMC, then shuttered it in 2009. The complex has produced refrigerators, Sikorsky helicopters, Jeeps, AMCs, and was used as an engineering center for Jeeps and other Chrysler products. Having been through several hands in the past six years, it is cited as part of the cycle of abandonment plaguing Detroit. Related Video: News Source: Detroit Free Press Government/Legal Chrysler Jeep Auctions Detroit amc

Stellantis invests more than $100 million in California lithium project

Thu, Aug 17 2023Stellantis said it would invest more than $100 million in California's Controlled Thermal Resources, its latest bet on the direct lithium extraction (DLE) sector amid the global hunt for new sources of the electric vehicle battery metal. The investment by the Chrysler and Jeep parent announced on Thursday comes as the green energy transition and U.S. Inflation Reduction Act have fueled concerns that supplies of lithium and other materials may fall short of strong demand forecasts. DLE technologies vary, but each aims to mechanically filter lithium from salty brine deposits and thus avoid the need for open pit mines or large evaporation ponds, the two most common but environmentally challenging ways to extract the battery metal. Stellantis, which has said half of its fleet will be electric by 2030, also agreed to nearly triple the amount of lithium it will buy from Controlled Thermal, boosting a previous order to 65,000 metric tons annually for at least 10 years, starting in 2027. "This is a significant investment and goes a long way toward developing this key project," Controlled Thermal CEO Rod Colwell said in an interview. The company plans to spend more than $1 billion to separate lithium from superhot geothermal brines extracted from beneath California's Salton Sea after flashing steam off those brines to spin turbines that will produce electricity starting next year. That renewable power is expected to cut the amount of carbon emitted during lithium production. Rival Berkshire Hathaway has struggled to produce lithium from the same area given large concentrations of silica in the brine that can form glass when cooled, clogging pipes. Colwell said a $65 million facility recently installed by Controlled Thermal can remove that silica and other unwanted metals. DLE equipment licensed from Koch Industries would then remove the lithium. "We're very happy with the equipment," he said. "We're going to deliver. There's just no doubt about it." Stellantis CEO Carlos Tavares called the Controlled Thermal partnership "an important step in our care for our customers and our planet as we work to provide clean, safe and affordable mobility." Both companies declined to provide the specific investment amount. Controlled Thermal aims to obtain final permits by October and start construction of a commercial lithium plant soon thereafter, Colwell said. Goldman Sachs is leading the search for additional debt and equity financing, he added.