2011 Chrysler Town & Country Silver, Clear Title on 2040-cars

Saint Clair Shores, Michigan, United States

|

2011 Chrysler Town & Country Silver color, low mileage, under warranty, Leather seats, DVD Entertainment, Navagation System, Shades in second and thrid seats, Stow N Go Seating, Power Outlets

|

Chrysler Town & Country for Sale

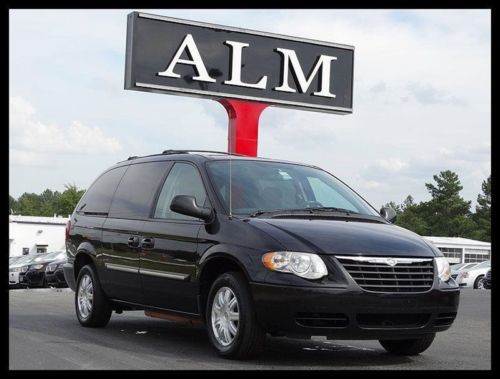

2006 chrysler town & country lwb(US $7,750.00)

2006 chrysler town & country lwb(US $7,750.00) 2010 chrysler town & country limited handicap accessible van(US $24,500.00)

2010 chrysler town & country limited handicap accessible van(US $24,500.00) 2007 town and country

2007 town and country Limited!serviced!navigation!back up camera!dvd system! swivel 'n go !warranty!08(US $12,980.00)

Limited!serviced!navigation!back up camera!dvd system! swivel 'n go !warranty!08(US $12,980.00) Nice family town and country 06 sunrrof and stown go seats(US $5,750.00)

Nice family town and country 06 sunrrof and stown go seats(US $5,750.00) 08 3rd row seating heated leather dvd player sirius radio remote start

08 3rd row seating heated leather dvd player sirius radio remote start

Auto Services in Michigan

Waterford Collision Inc ★★★★★

Varney`s Automotive Parts ★★★★★

Tuffy Auto Service Centers ★★★★★

Tuffy Auto Service Centers ★★★★★

Tri County Motors ★★★★★

The Brake Shop ★★★★★

Auto blog

Chrysler stays IPO until 2014

Mon, 25 Nov 2013There will not be a Chrysler IPO in 2013. Fiat, according to a report from Forbes, has announced that it will not be able to make the American brand's initial public offering before the end of the year, saying that the short, five-week window that makes up the rest of 2013 is "not practicable."

Not surprisingly, the issue with the Chrysler IPO is the same as it's always been - a disagreement between parent company Fiat, which owns 58.5 percent of the Chrysler Group and a UAW healthcare trust, which owns 41.5 percent. Fiat wants to buy out the UAW VEBA healthcare trust, which is responsible for shouldering retiree healthcare costs, but the two sides are hung up on an actual price tag for the remaining two-fifths of the company.

The original idea saw an IPO as a way of setting a fair market price for the remaining shares, although it's not entirely clear what broke down and led to a delay of the IPO plan. As Forbes points out, by waiting until 2014, Chrysler could be risking a cool-off in the IPO market, which could mean less money in its pocket when the automaker finally goes public.

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.

Next Chrysler minivan to get optional AWD, nine-speed auto

Wed, 19 Feb 2014

"The minivan package has always been a sacred thing ... it's basically a life tool" - Ralph Gilles

The stalwart duo of Chrysler minivans will be reduced by half in the vehicle's next generation, with the Dodge Grand Caravan likely going away in favor of a new people-mover-type vehicle. And while the reworked Chrysler Town & Country shouldn't radically shake up the usual minivan formula, a new report from Automotive News suggests that some new technologies and thoughtful updates are in the cards for our Canadian-built van.