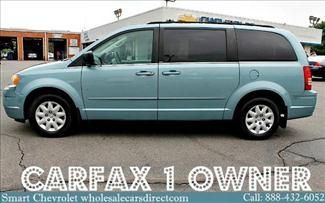

2005 Chrysler Town & Country, No Reserve on 2040-cars

Orange, California, United States

Body Type:Minivan, Van

Engine:6

Vehicle Title:Clear

Fuel Type:Gasoline

Number of Cylinders: 6

Make: Chrysler

Model: Town & Country

Trim: MINIVAN

Warranty: Vehicle does NOT have an existing warranty

Drive Type: UNKNOWN

Options: CD Player

Mileage: 140,740

Power Options: Cruise Control, Power Locks, Power Windows

Exterior Color: Silver

Interior Color: Gray

Chrysler Town & Country for Sale

Wheelchaie van vmi(US $23,500.00)

Wheelchaie van vmi(US $23,500.00) 99 chrysler town and country limited very nice mini-van!!(US $1,975.00)

99 chrysler town and country limited very nice mini-van!!(US $1,975.00) Used chrysler town & country minivan 7 passenger vans we finance dodge autos 4dr

Used chrysler town & country minivan 7 passenger vans we finance dodge autos 4dr 2011 chrysler town & country touring-l(US $21,491.00)

2011 chrysler town & country touring-l(US $21,491.00) 2006 gold automatic v6 leather *low miles:43k 3rd row minivan

2006 gold automatic v6 leather *low miles:43k 3rd row minivan 205 touring~pwr drs/hatch~bruno curb sider lift ~jazzy 1103 ultra~hand controls(US $12,995.00)

205 touring~pwr drs/hatch~bruno curb sider lift ~jazzy 1103 ultra~hand controls(US $12,995.00)

Auto Services in California

Yes Auto Glass ★★★★★

Yarbrough Brothers Towing ★★★★★

Xtreme Liners Spray-on Bedliners ★★★★★

Wolf`s Foreign Car Service Inc ★★★★★

White Oaks Auto Repair ★★★★★

Warner Transmissions ★★★★★

Auto blog

Fiat seeking autonomous partnerships with Uber and Amazon

Fri, Jun 10 2016If Fiat Chrysler Automobiles CEO Sergio Marchionne can't find another automaker to partner with, he'll have to look elsewhere. Like, outside the traditional automotive industry entirely, if recent reports are to be believed. According to Bloomberg and Business Insider, Fiat is pursuing relationships with Uber and Amazon for self-driving vehicles. This news comes shortly after FCA announced an official tie-up with Google to turn 100 Chrysler Pacifica minivans into autonomobiles. Uber might want to venture into self-driven vehicles for its ride-hailing service, cutting out the expense of human drivers. For its part, Amazon could use autonomous vehicles for deliveries from its online shopping destinations. FCA's interest in these endeavors seems to revolve around their vehicles being used as platforms for software and bespoke hardware setups created by the tech companies. There's no indication of what vehicles FCA would provide to either Uber or Amazon, but something minivan shaped could capably serve both the ride-sharing and package delivery service industries. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. News Source: Bloomberg, Business InsiderImage Credit: Jeff Kowalsky/Bloomberg via Getty Green Chrysler Fiat Transportation Alternatives Technology Emerging Technologies Autonomous Vehicles Uber Sergio Marchionne FCA Amazon

Lee Iacocca, Chrysler's savior and godfather of the Mustang, dies at 94

Wed, Jul 3 2019Lee Iacocca, a charismatic U.S. auto industry executive and visionary, who gave America the Ford Mustang and Chrysler minivan, and was celebrated for saving Chrysler from going out of business, died at the age of 94, the Washington Post reported. He died Tuesday at his home in Bel-Air, California of complications from Parkinson's disease, his daughter Lia Iacocca Assad told the Post. During a nearly five-decade career in Detroit that began in 1946 at Ford Motor Co, the proud son of Italian immigrants made the covers of Time, Newsweek and the New York Times Sunday Magazine in stories portraying him as the avatar of the American Auto Age. One of the first celebrity U.S. chief executives, his autobiography made best-seller lists in the mid-1980s. Iacocca was a cracker-jack salesman. He encouraged his design teams to be bold, and they responded with sports cars that appealed to baby boomers in the 1960s, fuel-efficient models when gasoline prices soared in the 1970s, and the first-ever, family-oriented minivan in the 1980s that led its segment in sales for 25 years. "I don't know an auto executive that I've ever met who has a feel for the American consumer the way he does," late United Auto Workers Union President Douglas Fraser had said. "He's the greatest communicator who's ever come down the pike in the history of the industry." Iacocca also had some duds, such as the Ford Pinto, an economy car that became notorious for exploding fuel tanks. "You don't win 'em all," he said of the Pinto. Iacocca won a place in business history when he pulled Chrysler, now part of Fiat Chrysler Automobiles, from the brink of collapse in 1980, rallying support in U.S. Congress for $1.2 billion in federally guaranteed loans and persuading suppliers, dealers and union workers to make sacrifices. He cut his salary to $1 a year. Iacocca was often described as a demanding and volatile boss who sometimes clashed with fellow executives. "He could get mad as hell at you, and once it was done he let it go. He wouldn't stay mad," said Bud Liebler, vice president of communications at Chrysler during the 1980s and 1990s. "He liked to bring an issue to its head, get it resolved. You always knew where you stood with him." Iacocca often spoke of his immigrant roots and how America rewards hard work.

Which of these five plug-ins should win the 2017 Green Car of the Year?

Tue, Nov 8 2016It's going to be a competitive race for the 2017 Green Car Of The Year. With a minivan in the running for the first time in ages, the five finalists announced by Green Car Journal today include five very different plug-in vehicles. As Ron Cogan, the editor and publisher of Green Car Journal, said in a statement, "electrification is now considered by most automakers an essential technology for current and future high-efficiency models." Let's check out the list: Toyota Prius Prime, the updated plug-in version of the world's best-selling hybrid. Chevy Bolt, GM's all-new entry into the long-range EV game. Chrysler Pacifica, a family hauler with the ability to go 30 miles on electric power. Kia Optima. The nomination is for the full line-up, but really the hybrid and plug-in hybrid models are the green stars here. BMW 330e iPerformance, one of the automaker's many new plug-in hybrids that bring battery power to models outside the i sub-brand. Green Car Journal will announce the winners at the Los Angeles Auto Show on November 17th, along with some, "other green transportation announcements," whatever that means. Last year, the winner was the 2016 Chevy Volt, the first model to snatch up two wins. Which do you think should win this year? Related Video: News Source: Green Car JournalImage Credit: REUTERS/Kevork Djansezian Green LA Auto Show BMW Chevrolet Chrysler Kia Toyota Chevy Bolt chrysler pacifica green car of the year toyota prius prime bmw 330e