2000 Chrysler Town & Country Limited on 2040-cars

Monroe, Connecticut, United States

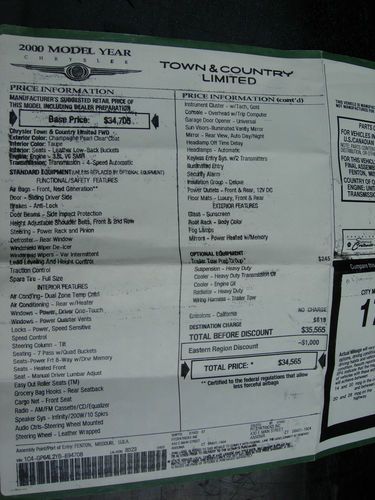

Body Type:Minivan, Van

Vehicle Title:Clear

Engine:3.8

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chrysler

Model: Town & Country

Trim: Chrome

Options: Cassette Player, Leather Seats, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: front wheel

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 161,299

Sub Model: Limited

Exterior Color: Gold

Disability Equipped: No

Interior Color: Gray

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 6

1 Owner - 2000 Chrysler Town & Country fully loaded in great running condition.

Chrysler Town & Country for Sale

1999 chrysler town & country mini van (gold) limited(US $4,000.00)

1999 chrysler town & country mini van (gold) limited(US $4,000.00) We finance! 2006 chrysler town & country touring fwd power sunroof dvd(US $7,300.00)

We finance! 2006 chrysler town & country touring fwd power sunroof dvd(US $7,300.00) Van wheelchair handicap braun power ramp chrysler town country 2005 kneeling(US $13,999.00)

Van wheelchair handicap braun power ramp chrysler town country 2005 kneeling(US $13,999.00) Fwd v6 rear entertainment leather seats navigation used cars near kansas city

Fwd v6 rear entertainment leather seats navigation used cars near kansas city Prices slashed!!(US $1,400.00)

Prices slashed!!(US $1,400.00) Lxi, one owner, clean, minivan, passenger van, 7 passenger

Lxi, one owner, clean, minivan, passenger van, 7 passenger

Auto Services in Connecticut

Tender Car Care ★★★★★

Supreme Auto Collision Inc ★★★★★

Sunoco Ultra Service Center ★★★★★

Pete`s Tire & Oil ★★★★★

Napa Auto Parts - Fair Auto Supply Inc ★★★★★

Moran`s Service Ctr ★★★★★

Auto blog

Marchionne urges industry consolidation, again

Fri, May 29 2015Sergio Marchionne isn't just an instigator of mergers – he's also a staunch advocate for their need in the industry. And he seems convinced another big one will happen in the next few years. "I am absolutely certain that before 2018 there will be a merger," said Marchionne. "It's my personal opinion, based on a gut feeling." Though the terms "absolutely certain" and "gut feeling" would seem to convey vastly different degrees of certainty, his chief's statement would seem to suggest some inside knowledge of an impending deal. Marchionne, of course, brokered the consolidation of the Fiat Chrysler Automobiles empire over which he now presides, and has been actively seeking another merger to help reduce redundancy and overhead between major automakers in the industry. With which automaker he might be seeking such a merger, however, remains a big question. He was recently reported to have approached Mary Barra regarding a potential merger with General Motors, but was said to have been rebuffed. The Italian-Canadian executive may not be alone in his advocacy for industry consolidation, though. Opel chief Karl-Thomas Neumann said that "In principle, Marchionne is right – the auto industry develops the same things ten times over." Bringing major automakers together would ostensibly reduce that redundancy. Marchionne had been linked to a potential takeover of Opel when GM was shedding brands post-bankruptcy, but in the end the Detroit giant opted to keep its European division in-house.

FCA to idle Belvidere Jeep plant again for a week in February

Mon, Feb 3 2020Bloomberg reports that Fiat Chrysler will shut down the Belvidere, Ill., plant that assembles the Jeep Cherokee for a week this month, starting February 17. FCA has been tweaking the plant's headcount and production schedule for a while now, usually downward. The automaker laid off 1,371 workers last February and fired 32 more in May, the same month it eliminated the third production shift. In August, the automaker shut down the plant for one week, then did so again for two weeks last month. As in August and January, FCA explained this month's idling by saying it needs to get production in alignment with demand. Cherokee sales declined 20% in the U.S. last year, helping to account for Jeep's overall 5% domestic drop in 2019. On top of the shutdown, FCA is offering buyouts to certain plant workers among the 3,600 hourly and 300 salaried personnel. The choices are either taking a "separation package" that comes with a $60,000 lump sum payment, or accepting voluntary termination that pays a lump sum based on seniority. Employees that choose a buyout can't return to Chrysler, becoming no longer "eligible for recall, rehire or reemployment." Belvidere personnel have until March 11 to make their decisions. Bloomberg says the aim is to reduce the number of workers with more seniority and higher pay grades; a company spokesperson said the move would "create opportunities for those employees still on layoff," who were lesser-paid. Around 900 of those laid-off workers remain on standby for reassignment to another plant. Analysts predict a soft year for car sales, so FCA might not be the only automaker pruning the rolls. Early estimates have come in below 17 million, and if that comes true, 2020 will be the slowest year since 2014, when 16,531,070 units left lots. The new contract between FCA and the UAW made provisions for Belvidere, which has tempered talk of a total shutdown.The automaker will invest $55 million for "fresh models/features off of the current (KL) platform" that underpins the Cherokee as well as the Chinese-market Jeep Grand Commander (it was previously used for the Dodge Dart and Chrysler 200). Outside of that, some observers think the carmaker could be planning a three-row Chrysler crossover based on the KL platform, akin to the Grand Commander, for the United States. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Weekly Recap: Obama reflects on the auto bailout's legacy

Sat, Jan 23 2016President Obama took a victory lap of sorts this week at the Detroit Auto Show, lauding the industry's progress and reflecting on the decision to bail out General Motors and Chrysler seven years ago. While the rescue was controversial at the time, historians will likely judge the president's actions to help save two of America's industrial symbols in a positive light. Much like Theodore Roosevelt's trust-busting tactics were controversial in the early 20th century, Obama's plan drew fire from critics who argued the free market should be left to its own devices. But providing financial aid and forcing the automakers to restructure had an enduring impact on the US economy. The auto industry has added more than 646,000 jobs since the companies emerged from bankruptcy, including manufacturing and retail positions. Make no mistake, GM and Chrysler were nearly dead in 2009. Now, GM is a powerhouse that's set to capitalize on a market that could see 18 million vehicles sold this year. Chrysler, which was renamed FCA US, survived as part of the Italian-American Fiat Chrysler Automobiles conglomerate. It's also performed well amid the strong industry conditions, though CEO Sergio Marchionne very publicly went looking for alliance partners last year, something from which he's since backed off. While Obama can claim a win, the bailout was actually started by George W. Bush, who provided short-term loans to GM and Chrysler in December 2008. Without that, they might not have made it much past Obama's inauguration. NEWS & ANALYSIS News: Spy Shooters captured the next-gen BMW Z4 during extreme cold weather testing. Analysis: The upcoming Z4 (which might be called the Z5) looks sharp. But the big deal is that BMW's much-anticipated sports-car project with Toyota is coming to fruition. Refresher: BMW and Toyota agreed to work together back in December 2011 and then announced an expansion of that deal to include sports cars in June 2012. Ultimately, it will provide BMW with a new Z4 and Toyota with another sports car, perhaps the Supra replacement. BMW is developing the platform, while Toyota is expected to chip in with hybrid technology. Big picture, this project is a good thing. It's providing enthusiasts with two modern sports cars that Toyota and BMW might not chose to develop on their own. This template has been shown to work, as the Fiat-Mazda alliance produced the MX-5 Miata and 124 Spider. News: The Jeep Grand Cherokee Hellcat was also spied, briefly.