Touring Convertible 2.7l V6 Mpi Dohc 24v Cd Heated Leather Seats on 2040-cars

Youngstown, Ohio, United States

Vehicle Title:Clear

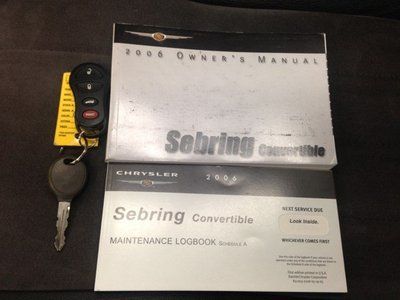

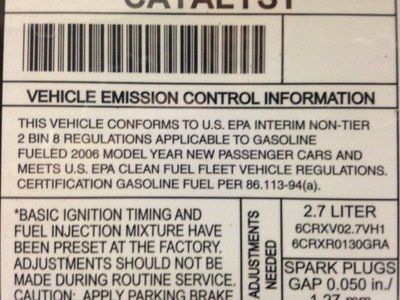

Engine:2.7L 2700CC 167Cu. In. V6 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Convertible

Fuel Type:GAS

Make: Chrysler

Warranty: Unspecified

Model: Sebring

Trim: Touring Convertible 2-Door

Options: Leather Seats

Power Options: Power Windows

Drive Type: FWD

Mileage: 41,137

Number of Doors: 2 Generic Unit (Plural)

Sub Model: Touring

Exterior Color: Black

Number of Cylinders: 6

Interior Color: Gray

Chrysler Sebring for Sale

2007 base sedan fwd single cd cruse gray cloth analog clock 101k miles

2007 base sedan fwd single cd cruse gray cloth analog clock 101k miles 2010 chrysler sebring limited auto power heated leather keyless kchydodge(US $11,485.00)

2010 chrysler sebring limited auto power heated leather keyless kchydodge(US $11,485.00) 2004 chrysler sebring touring convertible 2-door 2.7l

2004 chrysler sebring touring convertible 2-door 2.7l 2.4 dohc automatic new tires only 44,700 miles cloth trim good power vinyl top(US $5,977.00)

2.4 dohc automatic new tires only 44,700 miles cloth trim good power vinyl top(US $5,977.00) 2002 chrysler sebring limited convertible 2-door 2.7l(US $3,895.00)

2002 chrysler sebring limited convertible 2-door 2.7l(US $3,895.00) 2000 chrysler sebring lxi convertible 2.5l v6 leather loaded no reserve

2000 chrysler sebring lxi convertible 2.5l v6 leather loaded no reserve

Auto Services in Ohio

Zerolift ★★★★★

Worthington Towing & Auto Care Inc ★★★★★

Why Pay More Motors ★★★★★

Wayne`s Auto Repair ★★★★★

Walt`s Auto Inc ★★★★★

Voss Collision Centre ★★★★★

Auto blog

Chrysler 'at war' with world's largest Viper club?

Tue, 27 Aug 2013The situation was bound to boil over at some point. Grumblings from former and current members of the Viper Club of America, and letters sent from Chrysler to VCA president Lee Stubberfield, allege that the non-profit club is being run illegally as a for-profit business, Jalopnik reports.

The trouble reportedly started in 2007, when VCA member and former club national president Chris Marshall is alleged to have taken a paid position at the club courtesy of the acting board members at the time. By 2010, with the demise of the Dodge Viper looming, the VCA reportedly made a deal with Chrysler to to acquire a stash of old parts and tooling for the Viper. The stash would then be sold by the newly formed Viper Parts of America, a company that was supposed to be run by Marshall, Jalopnik reports.

This sounds like shady business to us - at the very least a conflict of interest. And it's said that the VCA will not hesitate to suspend - for a year or more - the memberships of those who oppose it.

Canada bailed out GM, Chrysler without really knowing what they were getting into

Tue, Dec 2 2014The Auditor General of Canada recently issued a report that makes at least one thing clear: it doesn't know how effective Canadian government loans given to General Motors and Chrysler in 2009 were in ensuring the viability of both companies. That year, the Canadian and Ontario governments dished out $10.8 billion CAD ($9.6B US) to GM and $2.9 billion CAD ($2.6B US) to Chrysler, but hadn't yet sorted out precisely how the funds were to be used before disbursing them. This happened in spite of the fact that, according to a piece in Bloomberg, the loans weren't meant to be handed out until authorities were clear on the manufacturers' plans for reorganization. In fact, federal officials hadn't finished establishing the concessions made by all the involved parties, the pension liabilities, nor the long-term soundness of the automakers' financial positions. On top of that, apparently it didn't keep close tabs on the money after loaning it: the report says that $1B CAD should have been applied to GM Canada pension plans but was instead given to GM to use. Chrysler repaid $1.7 billion, while GM handed back $3.8 billion and Bloomberg believes the feds in Ottawa still own 110 million shares of The General, which, at the stock price as of writing, would be good for another $3.9 billion. Those were mad, bad days, though, and we're not sure what point the report serves, other than to say, "Oh, by the way...." News Source: BloombergImage Credit: Bill Pugliano / Getty Images Government/Legal Chrysler GM bailout

NHTSA preparing to wallop FCA, automaker 'failed to do its job'

Sat, Jul 4 2015As embattled the National Highway Traffic Safety Administration may be, but that certainly doesn't mean it isn't willing or able to put the smack down on automakers that violate its recall procedures. Following a public hearing on Thursday, the government safety arm is preparing what will likely be some very serious punishments for Fiat Chrysler Automobiles. FCA stands accused of mishandling 23 individual recalls covering some 11 million vehicles since 2013, with NHTSA claiming the Italian-American automaker kept it "in the dark," failing to notify the government of safety defects. Uncle Sam also alleges that FCA failed to notify consumers of important safety notices and didn't provide a steady supply of replacement parts. For these charges, the automaker could be fined up to $35 million per recall, which could mean a maximum of $805 million in fines. FCA could also be forced to buy back the unrepaired vehicles. "We have serious concerns with Fiat Chrysler notifications to owners and to NHTSA about its recalls. In every one of the 23 recalls, we have identified ways in which Fiat Chrysler failed to do its job," Jennifer Timian, the head of the Office of Defects Investigation, said during the FCA hearing, The Detroit News reports. The company also "repeatedly failed to provide NHTSA with other critical information about its recalls, including changes to the vehicles impacted by the recalls and its plans for remedying those vehicles." Fiat Chrysler, for its part, didn't really fight back during its hearing, although Scott Kunselman (shown above during the hearing), the senior vice president of vehicle safety and regulatory affairs at FCA, did tell The News that, "We absolutely had no mis-intent." "The plan is to move forward," Kunselman said, adding that the company has "fallen short," and that "some of the things we've done were sloppy." NHTSA administrator Mark Rosekind told The News that the regulator would issue its sanctions by the end of July, adding that he saw no way that FCA could avoid punishment.