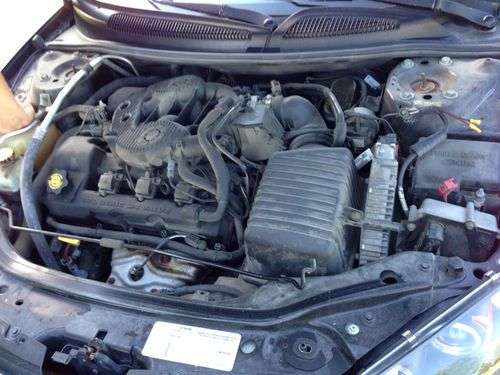

Limited 2.4l Cd Front Wheel Drive Power Steering Abs 4-wheel Disc Brakes A/c on 2040-cars

Littleton, Colorado, United States

Body Type:Sedan

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Make: Chrysler

Model: Sebring

Warranty: Unspecified

Mileage: 51,464

Sub Model: Limited

Options: Leather Seats

Exterior Color: Silver

Power Options: Power Windows

Interior Color: Black

Number of Cylinders: 4

Chrysler Sebring for Sale

2002 chrysler sebring gtc convertible 2-door 2.7l (red)

2002 chrysler sebring gtc convertible 2-door 2.7l (red) 2009 chrysler sebring lx sedan 4-door 2.7l(US $6,995.00)

2009 chrysler sebring lx sedan 4-door 2.7l(US $6,995.00) 2002 chrysler sebring gtc convertible 2-door 2.7l(US $4,995.00)

2002 chrysler sebring gtc convertible 2-door 2.7l(US $4,995.00) 2002 chrysler sebring convertible limited lxi(US $4,500.00)

2002 chrysler sebring convertible limited lxi(US $4,500.00) Lxi convertible 2.7l cd front wheel drive tires - front all-season fog lamps a/c

Lxi convertible 2.7l cd front wheel drive tires - front all-season fog lamps a/c 2004 chrysler sebring lx sedan 4-door 2.4l(US $1,000.00)

2004 chrysler sebring lx sedan 4-door 2.4l(US $1,000.00)

Auto Services in Colorado

Volvo Specialists Svc ★★★★★

The 4Wheeler ★★★★★

Spec-Wheels of America ★★★★★

Six Stars Auto Service ★★★★★

Simpson Brothers Garage ★★★★★

Santos Muffler Auto ★★★★★

Auto blog

Stellantis tells UK: Change Brexit deal or watch car plants close

Wed, May 17 2023LONDON - British car plants will close with the loss of thousands of jobs unless the Brexit deal is swiftly renegotiated, Stellantis has told the UK parliament, the latest in a series of warnings from the industry since the country left the European Union. The world's No. 3 carmaker by sales and owner of 14 brands including Vauxhall, Peugeot, Citroen and Fiat said that under the current deal it would face tariffs when exporting electric vans to Europe from next year, when tougher post-Brexit rules come into force. "If the cost of EV (electric vehicle) manufacturing in the UK becomes uncompetitive and unsustainable, operations will close," Stellantis said in a submission to a House of Commons committee examining the prospects for Britain's EV industry. Stellantis urged the government to reach an agreement with the European Union about extending the current rules on the sourcing of parts until 2027 instead of the planned 2024 change. In response, a government spokesperson said the business secretary had raised the issue with the EU. "Watch this space, because we are very focused on making sure that the UK gets EV and manufacturing capacity," Britain's finance minister Jeremy Hunt said on Wednesday at a British Chambers of Commerce event. The potentially existential problem facing Britain's car industry is closely tied to the shift to EVs. Under the trade deal agreed when Britain left the bloc, 45% of the value of an EV being sold in the European Union must come from Britain or the EU from 2024 to avoid tariffs. The problem is that a battery pack can account for up to half a new EV's cost. Batteries are also heavy and expensive to move long distances. Experts have been warning since Britain left the EU at the end of 2020 that the country would need a number of EV battery gigafactories or potentially lose a hefty chunk of its car industry. Only Japan's Nissan has a small EV battery plant in Sunderland, with a second one on the way. Cost of failure Britishvolt, a startup which received UK government support for an ambitious 3.8 billion pound ($4.80 billion) battery plant at a site in northern England, filed for administration in January after struggling to raise funds. The company was then bought by Australia's Recharge Industries, which has yet to unveil plans for the site.

U.S. auto sales fall in July, as Detroit dials back on inventory, rental sales

Tue, Aug 1 2017DETROIT — U.S. carmakers said on Tuesday they continued to slash low-margin sales to daily rental fleets in July as General Motors, Ford and Fiat Chrysler Automobiles struggled to curb a slide in retail sales. July is on track to be the fifth straight month in which the annual pace of car and light truck sales declined from the same month a year ago, in part because of fewer fleet sales, analysts and industry executives said. July 2016 sales hit a strong 17.9-million-vehicle pace. GM said the seasonally adjusted annual sales rate fell to an estimated 16.9 million vehicles in July. At midmorning on Tuesday, GM shares were down 3.4 percent at $34.77, Ford was down 2.8 percent at $10.91, and Fiat Chrysler shares were down 0.3 percent at $12.05 in New York. GM sales dropped 15 percent from a year ago to 226,107 vehicles, as the company cut rental fleet sales more than 80 percent. The automaker said inventories of unsold vehicles at month's end were 104 days, down from 105 days at the end of June. GM has promised investors to reduce inventories to 70 days by year-end. Ford said its July sales dipped 7.5 percent to 200,212 vehicles, as it cut fleet sales more than 26 percent. Inventories fell to 77 days from 79 the previous month. Fiat Chrysler said sales dropped 10 percent to 161,477, as it also cut back sales to daily rental fleets. Among the top Japanese companies, only Toyota reported a year-to-year gain, with sales up 4 percent to 222,057 — just 4,000 units behind GM. Honda sales were down 1 percent to 150,980 — its first-quarter sales continuing to decline in North America but seeing a big increase in China. And Nissan sales fell 3 percent to 128,295. GM, Ford and Fiat Chrysler have cautioned that second-half financial results likely will be lower than first-half results, in part reflecting production cuts in North America and pricing pressures. The automakers this year have been deliberately dialing back sales to rental-car companies, which often generate little to no profit, while struggling to keep retail sales from sagging further, according to industry analysts. Industry consultant LMC cut its full-year forecast for new vehicle sales to 17 million vehicles. Automakers sold a record 17.55 million vehicles in the United States in 2016.

Treasury says auto bailout tally drops to $20.3 billion

Tue, 12 Feb 2013In December, the US Treasury announced that it was going to sell all of its shares in General Motors within 12 to 15 months. The first tranche of the 500-million total shares was purchased by GM, which took 200 million of them at $27.50 per share. That price represents an eight-percent premium over the market price at the time. The remaining 300 million shares will be sold "through various means in an orderly fashion."

Of the $418 billion disbursed through the Troubled Asset Relief Program (TARP), a report in Automotive News indicates that "about 93 percent" has been paid back, and the latest figures put Treasury's loss from the program overall at $55.58 billion. That's a $4.1 billion improvement on the last figure, when the expected red ink added up to $59.68 billion. The auto industry's portion of that loss is estimated to be $20.3 billion, a 16-percent drop from the earlier estimate of $24.3 billion.

The Treasury now owns 19 percent of GM, but if all goes well, there will be no more cause for anyone to utter "Government Motors" by the end of Q1 next year. A loss of some kind is still expected, however. Although GM's stock price is close to $29 at the time of this writing, that's still $4 below its IPO price and well below the $72 share price necessary for the government to come out even on its GM investment. On second thought, maybe the ribbing will continue.