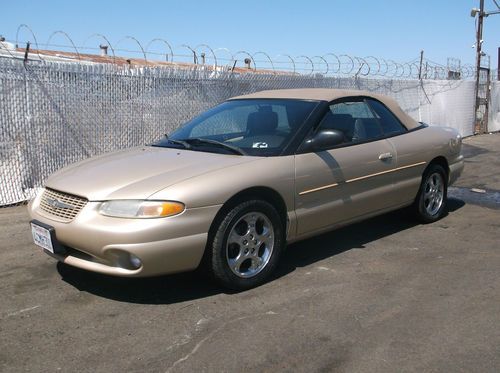

Chrysler Sebring Jxi 1996 on 2040-cars

Tucson, Arizona, United States

Vehicle Title:Clear

Engine:2.5L 2497CC 152Cu. In. V6 GAS SOHC Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Transmission:Automatic

Make: Chrysler

Model: Sebring

Options: Convertible

Trim: JXi Convertible 2-Door

Power Options: Cruise Control

Mileage: 154

Exterior Color: Red

Disability Equipped: No

Interior Color: Brown

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 6

Drive Type: front

Safety Features: Driver Airbag

No paint job; the front windshield is cracked on the right side; the bumper is cracked, needs a freon; but runs great! No problems with the engine. Convertible mechanism works fine. The tires have a warranty at the Discount tires. With a little bit of love and care with car will run for years!

Chrysler Sebring for Sale

1998 chrysler sebring, no reserve

1998 chrysler sebring, no reserve No reserve 2001 73002 miles low miles lxi auto coupe 2doors gold tan leather

No reserve 2001 73002 miles low miles lxi auto coupe 2doors gold tan leather 1999 chrysler sebring convertible jxi v6 loaded!!!!!(US $2,995.99)

1999 chrysler sebring convertible jxi v6 loaded!!!!!(US $2,995.99) Low mileage chrysler sebring 2008

Low mileage chrysler sebring 2008 2001 silver(US $1,800.00)

2001 silver(US $1,800.00) 2004 chrysler sebring limited convertable low miles(US $9,000.00)

2004 chrysler sebring limited convertable low miles(US $9,000.00)

Auto Services in Arizona

Windshield Replacement & Auto Glass Repair Mesa ★★★★★

Valleywide TV Repair ★★★★★

USA Auto Glass Repair ★★★★★

State To State Transmissions ★★★★★

State To State Transmissions ★★★★★

Sooter`s Auto Service Inc ★★★★★

Auto blog

Treasury says auto bailout tally drops to $20.3 billion

Tue, 12 Feb 2013In December, the US Treasury announced that it was going to sell all of its shares in General Motors within 12 to 15 months. The first tranche of the 500-million total shares was purchased by GM, which took 200 million of them at $27.50 per share. That price represents an eight-percent premium over the market price at the time. The remaining 300 million shares will be sold "through various means in an orderly fashion."

Of the $418 billion disbursed through the Troubled Asset Relief Program (TARP), a report in Automotive News indicates that "about 93 percent" has been paid back, and the latest figures put Treasury's loss from the program overall at $55.58 billion. That's a $4.1 billion improvement on the last figure, when the expected red ink added up to $59.68 billion. The auto industry's portion of that loss is estimated to be $20.3 billion, a 16-percent drop from the earlier estimate of $24.3 billion.

The Treasury now owns 19 percent of GM, but if all goes well, there will be no more cause for anyone to utter "Government Motors" by the end of Q1 next year. A loss of some kind is still expected, however. Although GM's stock price is close to $29 at the time of this writing, that's still $4 below its IPO price and well below the $72 share price necessary for the government to come out even on its GM investment. On second thought, maybe the ribbing will continue.

Four-horse race opens up for next Chrysler-Fiat CEO

Mon, 16 Dec 2013

There are some companies that could change leadership overnight and still remain more or less the operations that they are. But some have built themselves up around one central figure. Just ask Carlos Tavares, who found he couldn't escape the long shadow of Renault-Nissan CEO Carlos Ghosn. Tavares recently left to find his own limelight. But Ghosn isn't the only executive who presides over two disparate automakers on opposite ends of the globe.

Having built up Fiat and Chrysler around himself, we can hardly imagine either automaker getting along without Sergio Marchionne. But the day will come when the famously sweater-clad bigwig will step down. The pressing questions remain when when that day will come, and who will take his place. The only solid clues we have are in the statements made mostly by Marchionne himself, but those statements have been all over the place. When speaking to Automotive News in 2012, he said he would step down "no earlier than 2013, no later than 2015." But a year later, he had already seemingly changed his tune, indicating he could still be at the helm in 2016. Fiat chairman John Elkann seems to think Marchionne, 61, could and should stay on longer.

Canada bailed out GM, Chrysler without really knowing what they were getting into

Tue, Dec 2 2014The Auditor General of Canada recently issued a report that makes at least one thing clear: it doesn't know how effective Canadian government loans given to General Motors and Chrysler in 2009 were in ensuring the viability of both companies. That year, the Canadian and Ontario governments dished out $10.8 billion CAD ($9.6B US) to GM and $2.9 billion CAD ($2.6B US) to Chrysler, but hadn't yet sorted out precisely how the funds were to be used before disbursing them. This happened in spite of the fact that, according to a piece in Bloomberg, the loans weren't meant to be handed out until authorities were clear on the manufacturers' plans for reorganization. In fact, federal officials hadn't finished establishing the concessions made by all the involved parties, the pension liabilities, nor the long-term soundness of the automakers' financial positions. On top of that, apparently it didn't keep close tabs on the money after loaning it: the report says that $1B CAD should have been applied to GM Canada pension plans but was instead given to GM to use. Chrysler repaid $1.7 billion, while GM handed back $3.8 billion and Bloomberg believes the feds in Ottawa still own 110 million shares of The General, which, at the stock price as of writing, would be good for another $3.9 billion. Those were mad, bad days, though, and we're not sure what point the report serves, other than to say, "Oh, by the way...." News Source: BloombergImage Credit: Bill Pugliano / Getty Images Government/Legal Chrysler GM bailout