2000 Crysler Sebring Red Convertible 68k Leather on 2040-cars

Orland Park, Illinois, United States

Body Type:Convertible

Vehicle Title:Clear

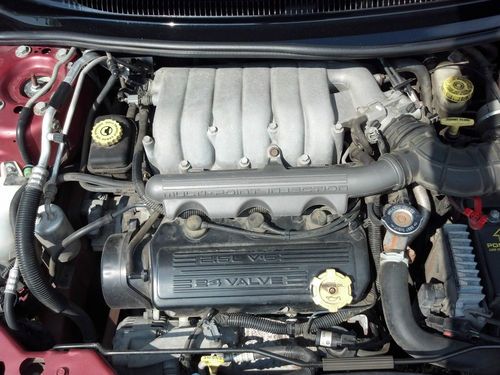

Engine:2.5L 2497CC 152Cu. In. V6 GAS SOHC Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 6

Make: Chrysler

Model: Sebring

Trim: JX Convertible 2-Door

Options: Leather Seats, CD Player, Convertible

Drive Type: FWD

Safety Features: Anti-Lock Brakes

Mileage: 68,000

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: Limited

Exterior Color: Red

Interior Color: Black

Up for auction is a 2000 Crysler Sebring Convertible. This adult drive car has been in the family since day 1 and has had regular maintenance. Mainly a weekend car which is the reason for the low 68K miles. I would rate the overall condition as good. There are a few scratches and door dings typical for age and years. I tried to show flaws with pictures.(Please see pics.) The car is located about 30 miles south of Chicago. Asking 7K or best offer. Thanks for looking.

Chrysler Sebring for Sale

2004 chrysler sebring base convertible 2-door 2.7l(US $1,300.00)

2004 chrysler sebring base convertible 2-door 2.7l(US $1,300.00) 2003 chrysler sebring limited convertible 2-door 2.7l white, leather interior(US $4,995.00)

2003 chrysler sebring limited convertible 2-door 2.7l white, leather interior(US $4,995.00) 2000 chrysler sebring jxi convertible 2-door 2.5l(US $3,500.00)

2000 chrysler sebring jxi convertible 2-door 2.5l(US $3,500.00) 1995 chrysler sebring lxi coupe 2-door 2.5l

1995 chrysler sebring lxi coupe 2-door 2.5l 2004 chrysler sebring

2004 chrysler sebring 2007 chrysler sebring touring sedan 4-door 2.4l(US $6,500.00)

2007 chrysler sebring touring sedan 4-door 2.4l(US $6,500.00)

Auto Services in Illinois

World Class Motor Cars ★★★★★

Wilkins Hyundai-Mazda ★★★★★

Unibody ★★★★★

Turpin Chevrolet Inc ★★★★★

Tuffy Auto Service Centers ★★★★★

Triple T Car Wash Lube & Detail Center ★★★★★

Auto blog

Maserati Levante will borrow Chrysler Pacifica Hybrid's PHEV powertrain

Wed, Mar 9 2016The plug-in hybrid tech from the 2017 Chrysler Pacifica Hybrid minivan will move seriously upmarket into a future version of the Maserati Levante crossover. The PHEV model should arrive around early 2018 or possibly the end of 2017, division boss Harald Wester told Motor Trend. Wester was blunt about the reason for using the minivan's powertrain. "A standalone program would be suicidal so we have to look at FCA," he said to Motor Trend. However, he expects the PHEV to comprise a tiny portion of the luxury CUV's sales volume – possibly as low as six percent. The Pacifica Hybrid will be the first PHEV minivan in the US when it arrives in the second half of 2016. The powertrain combines a 3.6-liter V6 that runs on the more efficient Atkinson cycle, and two electric motors, which are in the gearbox. A 16-kWh lithium-ion battery under the floor stores the energy for the system. Chrysler estimates the setup can carry the minivan 30 miles purely on electric power and achieve 80 MPGe. The first examples of the Levante should arrive in the US in August, according to Motor Trend. Maserati plans initially to offer its luxury crossover here with two twin-turbocharged 3.0-liter V6s. Base models use a version with 350 horsepower and 368 pound-feet of torque. The S trim gets some extra grunt thanks to a tune that makes 430 hp and 427 lb-ft. Both models come with an eight-speed automatic transmission, all-wheel drive, and a limited-slip differential. The Maserati will have a fleet of posh, European crossovers to fight against, and the PHEV will possibly offer an edge to entice a few green-minded, wealthy customers. Related Video:

Ferrari raises $893M, valued at $12B

Wed, Oct 21 2015Ferrari's stock is moving as quickly on the New York Stock Exchange as the brand's iconic sports cars do on the road. The company's incredibly popular initial public offering has already raised $893.1 million by virtue of 17.18 million shares sold for $52 apiece. If the deal's underwriters buy in as well, the figure would grow to $982.4 million. Plus, even after shouldering some of FCA's debt, the automaker carries an enterprise value of $12 billion, Bloomberg reports. Just as the company starts trading on the New York Stock Exchange, the share price is already racing upward, too. As of this writing, Ferrari stock, which is listed under the symbol RACE, is priced at $57.59. At its high so far today, the value reached as high as $60.95. While Ferrari is looking strong, the big winner in this success looks to be FCA because the company should raise $4 billion in the spin-off, according to Bloomberg. With nine percent of the sports car maker on the NYSE and one percent for the underwriters, another 80 percent will be distributed to FCA investors in 2016. When that's through, Exor, the holding company for the Agnelli/Elkann family, should have the largest stake at about 30 percent. Piero Ferrari holds the remaining 10 percent and has no intention to sell it. Related Video: FCA Announces Pricing of Initial Public Offering of Ferrari N.V. Common Shares Fiat Chrysler Automobiles N.V. (NYSE: FCAU/MI: FCA) ("FCA") and its subsidiary Ferrari N.V. ("Ferrari") announce today the pricing of Ferrari's initial public offering of 17,175,000 common shares at an offering price of $52 per share for a total offering size of $893.1 million ($982.4 million if the underwriters exercise the option described below in full). The shares are expected to begin trading on the New York Stock Exchange on Wednesday, October 21, 2015, under the symbol "RACE", and closing of the offering is expected to occur on October 26, 2015. In addition, the underwriters have a 30-day option to purchase an aggregate of up to 1,717,150 common shares of Ferrari from FCA. The offering is intended to be part of a series of transactions to separate Ferrari from FCA. Following completion of this offering, FCA expects to distribute its remaining ownership interest in Ferrari to FCA shareholders at the beginning of 2016. UBS Investment Bank is acting as Global Coordinator for the offering.

Fiat Chrysler shares get a boost after revised Stellantis merger deal with PSA

Tue, Sep 15 2020MILAN — Shares in Fiat Chrysler (FCA) rose sharply in Milan on Tuesday after the car maker and French partner PSA revised the terms of their merger deal, with FCA's shareholders getting a smaller cash payout but a stake in another business. FCA and PSA, which last year agreed to merge to give birth to Stellantis, the world's fourth largest car manufacturer, said late on Monday they had amended the accord to conserve cash and better face the COVID-19 challenge to the auto sector. Milan-listed shares in Fiat Chrysler rose almost 8% by 1000 GMT, while PSA gained 1.5%. Under the revised terms, FCA will cut from 5.5 billion euros ($6.5 billion) to 2.9 billion euros the cash portion of a special dividend its shareholders are set to receive on conclusion of the merger. However, PSA will for its part delay the planned spinoff of its 46% stake in car parts maker Faurecia until after the deal is finalized. That means all Stellantis shareholders — and not just the current PSA investors - will get shares in a company which has a market value of 5.8 billion euros. Based on Stellantis' 50-50 ownership structure, FCA and PSA respective shareholders will each receive a 23% stake in Faurecia. Analysts welcomed the 2.6 billion euros in additional liquidity for Stellantis' balance sheet as well as the increase in projected synergies to more than 5 billion euros from 3.7 billion. There was also further reassurance as the two companies confirmed they expected the deal to close by the end of the first quarter of 2021. "All told, the two players emerge as winners," broker ODDO BHF said in a note. "Of the two, FCA might be a bit more of a winner in the short term given the structure of the deal and the numerous payouts to shareholders to come in the quarters ahead (potentially close to 5 billion euros versus the current capitalization of around 16 billion euros)." The special dividend for FCA shareholders had proved contentious after Italy offered state guarantees for a 6.3 billion euro loan to the company's Italian business. "These announcements should, at last, end the debate over the financial terms of the merger, which had become a big topic and was still penalizing the two groups' share performances," ODDO BHF said. PSA and FCA said they would consider paying out 500 million euros to shareholders in each firm before closing or else a 1 billion euro payout to Stellantis shareholders afterwards, depending on market conditions and company performance and outlook.