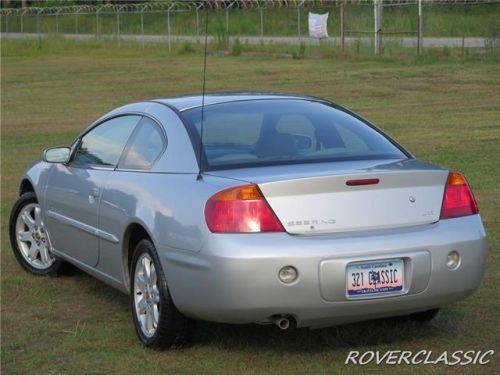

2000 Chrysler Sebring Jxi on 2040-cars

Halifax, Pennsylvania, United States

Vehicle Title:Clean

Engine:2.5L Gas V6

Year: 2000

VIN (Vehicle Identification Number): 3C3EL55H9YT241177

Mileage: 51453

Interior Color: Black

Number of Seats: 4

Trim: JXI

Number of Cylinders: 6

Make: Chrysler

Drive Type: FWD

Fuel: gasoline

Model: Sebring

Exterior Color: Silver

Number of Doors: 2

Chrysler Sebring for Sale

2004 chrysler sebring limited low 68k miles 2 owner clean carfax(US $5,999.00)

2004 chrysler sebring limited low 68k miles 2 owner clean carfax(US $5,999.00) 2001 chrysler sebring lxi(US $3,800.00)

2001 chrysler sebring lxi(US $3,800.00) 2005 chrysler sebring(US $2,900.00)

2005 chrysler sebring(US $2,900.00) 2008 chrysler sebring(US $6,900.00)

2008 chrysler sebring(US $6,900.00) 2008 chrysler sebring touring(US $5,950.00)

2008 chrysler sebring touring(US $5,950.00) 2005 chrysler sebring convertible touring automatic v6(US $6,950.00)

2005 chrysler sebring convertible touring automatic v6(US $6,950.00)

Auto Services in Pennsylvania

Zuk Service Station ★★★★★

york transmissions & auto center ★★★★★

Wyoming Valley Motors Volkswagen ★★★★★

Workman Auto Inc ★★★★★

Wells Auto Wreckers ★★★★★

Weeping Willow Garage ★★★★★

Auto blog

Dodge not being dropped by Chrysler, CEO reaffirms

Mon, 16 Sep 2013Dodge isn't going anywhere. Despite some rumor and speculation over the future of the crosshair grille and the cars that wear it, Dodge brand boss, Tim Kuniskis, sat down with TheDetroitBureau.com, explaining that the marque isn't going anywhere. His sentiments echo those of SRT boss Ralph Gilles, who told a group of enthusiasts in July that "Dodge is here to stay!"

Dodge's death won't be "a part of a master plan to consolidate brands," Kuniskis told TheDetroitBureau.com. Instead, the brand, which is ultimately under the command of Fiat/Chrysler CEO, Sergio Marchionne, will likely ditch some of its badge-engineered models, like the Dodge Grand Caravan. A more focused Dodge, which was something Gilles has already hinted at, will likely see it exploring areas of the market that haven't been exploited by other Chrysler brands.

Kuniskis, not surprisingly, wasn't willing to delve into any detailed product plans, telling TDB that the size of the brand's lineup "remains to be seen." Regardless of how big the brand actually ends up being (it is presently Chrysler's volume brand - and not by a little), hopefully the statements from Kuniskiss can put the rumors of a Dodge closure to bed.

Renault wants to merge with Nissan, then go after Fiat Chrysler

Wed, Mar 27 2019The late Sergio Marchionne used to say consolidation would be the only way to compete against the biggest global carmakers. The company looks certain to fulfill that goal, but perhaps not in the way he intended. The Financial Times reports that Renault wants to begin merger talks with Nissan in the next 12 months. Assuming a merger gets completed, the plan is for the combined company to then pursue another merger, with Fiat Chrysler a prime target. Renault, Nissan, and Mitsubishi have been busy since cutting ties with ex-alliance boss Carlos Ghosn. They formed a new alliance board with Renault chairman Jean-Dominique Senard at the helm, Renault has shrunk the size of its board while Nissan added more outside directors, and the two agreed to a new governance structure to ease operational decision making. All three automakers have walked away from Ghosn-era goals to sell 14 million cars and find 10 billion euros in savings by 2022. New strategic plans for all three car companies are in the works. With stability in sight, it's said Senard wants to succeed where Ghosn failed a full-fledged merger between Renault and Nissan with talks to begin "as soon as possible." Ghosn's pursuit of a merger last year in attempt to make the 20-year-old alliance "irreversible" is part of what led to his downfall, with Nissan executives including CEO Hiroto Saikawa against the push. The new effort is presented as larger scale being the only way for the alliance to take on companies like Volkswagen and Toyota. But the Nissan-Renault-Mitsubishi trio sold 10.76 million cars around the world last year, second to Volkswagen with 10.83 million sales, ahead of Toyota with 10.39 million. If Nissan hadn't suffered a 2.8 percent dip in sales, the alliance would have taken the top spot. If a little scale is good that means more is better, right? Pulling Fiat Chrysler into the alliance would add around 5 million annual sales, and would be another move in Ghosn's footsteps. The former honcho is said to have "held talks with FCA" about some kind of union within the past three years. The French government, which has a 15 percent stake in Renault and double voting rights, shut down the initiative. It's not clear if FCA will be an independent company by the time a potential Nissan-Renault merger closed, though.

Consumer Reports says Ram 1500 tops fuel economy fight [w/video]

Wed, Aug 27 2014Consumer Reports takes its independent vehicle testing procedures seriously. In an era when we have to question the EPA's official ratings thanks to recent re-evaluations from Ford and Hyundai, an independent voice is important. So, when CR says something is the best, it's worth paying attention to. The Ram 1500 EcoDiesel has "about the same fuel-economy numbers that we typically see in a midsized SUV." Jake Fisher In this case, CR took a look at the fuel economy of the 2014 Ram 1500 EcoDiesel and found that it came out on top of the fullsize pickup truck pack. The Ram did so with 20 miles per gallon overall and 27 mpg on the highway. CR gave the truck a total road test score of 82. The EPA says that the EcoDiesel 1500 gets 28 mpg on the highway, 20 mpg city and 23 mpg combined. Comparing official EPA numbers, the Ram is also the best among trucks in its class. It's nice when people agree on something. As we know from first-hand, long-distance experience, you can push the 1500 EcoDiesel to 38 mpg. CR found in its own testing that the truck had, "about the same fuel-economy numbers that we typically see in a midsized SUV," said Jake Fisher, CR's director of automotive testing, in a statement. Speaking of midsized SUVs, CR also announced this week that the new Toyota Highlander Hybrid got the top spot in CR's ratings in that category. CR liked pretty much everything about the SUV, saying that the "transitions between electric power and the gas engine are seamless" and that, "the new Highlander also handles better, with a steadier ride and reduced body lean in corners." You can find more at the CR website, in the October print issue of Consumer Reports or in the video and press release below. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. RAM ECODIESEL 1500 TOPS CONSUMER REPORTS FULL-SIZE PICKUP TRUCK RATINGS Redesigned Toyota Highlander Hybrid Climbs to Top of Midsized SUV List Yonkers, N.Y.- The Ram 1500 EcoDiesel climbed to the top of Consumer Reports' full-size pickup truck ratings with an impressive performance in the organization's fuel economy tests. The EcoDiesel (82 point overall road test score) turned in a best-in-class fuel economy of 20 mpg overall and 27 mpg on the highway, to help it score better than the previously tested Ram 1500 V8 (81) regular gas version and Chevrolet Silverado 1500 LT (80).