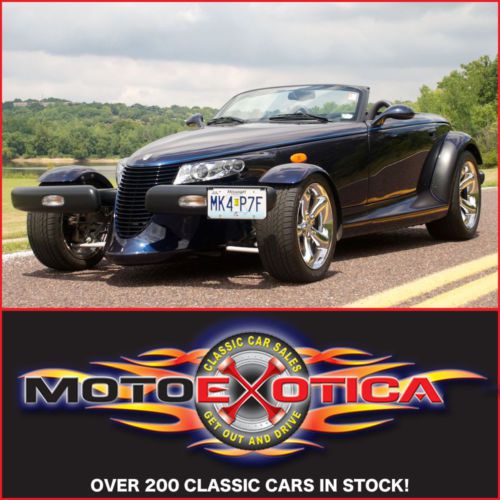

2001 Chrysler Prowler ** Mullholland Edition ** on 2040-cars

La Vergne, Tennessee, United States

|

2001 chrysler prowler with only 54k miles, Drives great with no issues, real head turner gets compliments everywhere it goes and people always stopping to take pictures. It is a mullholland edition which is rare. the car has brand new tires, the car overall is in excellent condition. Will work with buyer to arange to ship the car or pick up. If any questions or concerns you can contact me directly at 615-984-8653

|

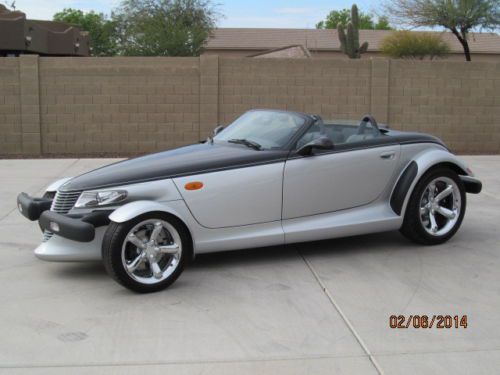

Chrysler Prowler for Sale

*16k miles* must see! free shipping / 5-yr warranty! rare loaded collector(US $35,995.00)

*16k miles* must see! free shipping / 5-yr warranty! rare loaded collector(US $35,995.00) 2002 chrysler prowler base convertible 2-door 3.5l(US $25,000.00)

2002 chrysler prowler base convertible 2-door 3.5l(US $25,000.00) 2001 chrysler prowler - mulholland edition - only 12,787 pampered miles - lqqk!!

2001 chrysler prowler - mulholland edition - only 12,787 pampered miles - lqqk!! Extremely nice! one of the very last ones out of detroit!(US $36,900.00)

Extremely nice! one of the very last ones out of detroit!(US $36,900.00) 2001 plymouth prowler black tie #19 brand new caqr 48 miles all documents mint(US $39,000.00)

2001 plymouth prowler black tie #19 brand new caqr 48 miles all documents mint(US $39,000.00) 2001 chrysler prowler(US $35,995.00)

2001 chrysler prowler(US $35,995.00)

Auto Services in Tennessee

Watson Auto Sales East Inc ★★★★★

Stephen`s Tire & Auto Repair ★★★★★

Southern Cross Towing ★★★★★

Seymour Muffler & Brake ★★★★★

S And J Complete Auto Services ★★★★★

Rods Tire and Auto Center ★★★★★

Auto blog

2022 Chrysler Pacifica Hybrid loses base Touring trim, starts at $48,255

Thu, Oct 28 2021The Chrysler Voyager is going fleet-only for 2022 while the standard 2022 Pacifica picked up some price hikes and some gains and losses in the equipment department. Time to dish on the 2022 Pacifica Hybrid, which, unsurprisingly, follows the majority of the non-hybrid Pacifica template. Mopar Insiders got info on pricing for the revisions Chrysler made to the lineup. The most important change to the overall Pacifica range, according to MI, is that model and option rationalization leaves just 53 combinations instead of the previous 3,550. That's way more than the Honda Odyssey at just seven permutations, but well behind the Toyota Sienna that has 206. The 3.6-liter Pentastar V6 and its eFlite variable transmission don't change, nor does the inability to spec all-wheel drive. What does get added are the new rear-seat reminder and Clean Air Filtration system that Stellantis is sprinkling throughout all its models. That filtration unit captures 95% of particulates in the air including bacteria, allergens, and pollen. The color palette goes the same way as on the non-hybrid Pacifica, dropping from 10 free colors to seven with just three free. Only Bright White, Brilliant Black, and Ceramic Grey will be no charge. Granite Crystal and the new Silver Mist, which replaces Billet Silver, will cost $95. Fathom Blue and Velvet Red will cost $395.  Product planners pulled the AWD option on the non-hybrid Pacifica Touring. For the hybrid, the Touring trim gets pulled completely, and in fact, it's already happened for the end of 2021. That makes the Touring L the new base model, and it makes this year's optional $995 Safety Sphere Group standard equipment for next year. That installs features like ParkSense for front, parallel, and perpendicular parking, and a 360-degree surround view camera. Conversely, the roof rack and side sunshades won't come as standard equipment anymore. MI says next year's MSRP will be $48,255 after the $1,495 destination charge. Comparing that price to the MSRP on Chrysler's 2021 configurator, next year's van will bring a $1,840 increase over 2021. Next year's Limited trim will add the $1,895 Premium and Safety Sphere Group as standard equipment. The package adds the parking aids from above as well as a 19-speaker Harman Kardon audio system with a 760-watt amplifier. There's a change up top, though, this trim giving up its three-pane sunroof for a dual-pane sunroof, as well as shedding the side sunshades.

Brand new cars are being sold with defective Takata airbags

Wed, Jun 1 2016If you just bought a 2016 Audi TT, 2017 Audi R8, 2016–17 Mitsubishi i-MiEV, or 2016 Volkswagen CC, we have some unsettling news for you. A report provided to a US Senate committee that oversees the US National Highway Traffic Safety Administration (NHTSA) and reported on by Automotive News claims these vehicles were sold with defective Takata airbags. And it gets worse. Toyota and FCA are called out in the report for continuing to build vehicles that will need to be recalled down the line for the same issue. That's not all. The report also states that of the airbags that have been replaced already in the Takata recall campaign, 2.1 million will need to eventually be replaced again. They don't have the drying agent that prevents the degradation of the ammonium nitrate, which can lead to explosions that can destroy the airbag housing and propel metal fragments at occupants. So these airbags are out there already. We're not done yet. There's also a stockpile of about 580,000 airbags waiting to be installed in cars coming in to have their defective airbags replaced. These 580k airbags also don't have the drying agent. They'll need to be replaced down the road, too. A new vehicle with a defective Takata airbag should be safe to drive, but that margin of safety decreases with time. If all this has you spinning around in a frustrated, agitated mess, there's a silver lining that is better than it sounds. So take a breath, run your fingers through your hair, and read on. Our best evidence right now demonstrates that defective Takata airbags – those without the drying agent that prevents humidity from degrading the ammonium nitrate propellant – aren't dangerous yet. It takes a long period of time combined with high humidity for them to reach the point where they can rupture their housing and cause serious injury. It's a matter of years, not days. So a new vehicle with a defective Takata airbag should be safe to drive, but that margin of safety decreases with time – and six years seems to be about as early as the degradation happens in the worst possible scenario. All this is small comfort for the millions of people who just realized their brand-new car has a time bomb installed in the wheel or dashboard, or the owners who waited patiently to have their airbags replaced only to discover that the new airbag is probably defective in the same way (although newer and safer!) as the old one.

Mike Manley named CEO of FCA amid Sergio Marchionne health crisis

Sat, Jul 21 2018Mike Manley has been immediately granted "all the powers of CEO" of Fiat Chrysler Automobiles. In a statement, FCA said its Board of Directors made this decision "in order to provide for his full authority and operational continuity for the company." Manley, who has been at the helm of Jeep since 2009 and Ram since 2015, is expected to be named an executive director for FCA after the next shareholder's meeting. In a similar statement, Ferrari said it had "named John Elkann as Chairman and will propose to Shareholders, at a meeting to be called in the coming days, that Louis C. Camilleri be named as CEO." CNH Industrial, a company that makes trucks, agricultural, and industrial equipment and which Marchionne also chairs, named Suzanna Heywood, as his replacement. Sergio Marchionne, who had served as CEO of both FCA and Ferrari, suffered "unexpected complications" as he was recovering from surgery performed earlier this month. FCA's statement adds that these complications "have worsened significantly in recent hours." Marchionne, credited with rescuing Fiat and Chrysler from bankruptcy since taking the wheel at the Italian carmaker in 2004, had been due to step down as the head of Fiat Chrysler next April. His internal successor had yet to be named. Marchionne had previously said he planned to stay on as Ferrari Chairman and CEO until 2021.Reuters contributed to this report.Related Video: Image Credit: Mark Thompson/Getty Hirings/Firings/Layoffs Chrysler Ferrari Fiat Sergio Marchionne