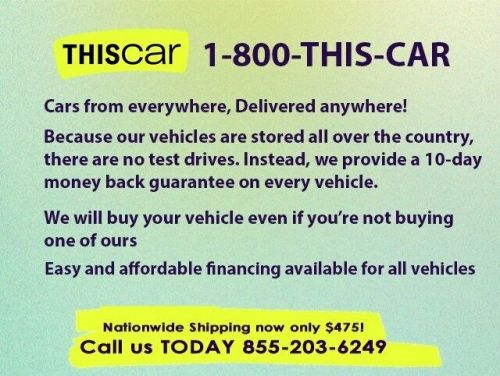

2021 Chrysler Pacifica Touring L on 2040-cars

Tomball, Texas, United States

Engine:6 Cylinder Engine

Fuel Type:Gasoline

Body Type:--

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 2C4RC1BG7MR588764

Mileage: 75598

Make: Chrysler

Trim: Touring L

Drive Type: FWD

Features: --

Power Options: --

Exterior Color: Gray

Interior Color: Gray

Warranty: Unspecified

Model: Pacifica

Chrysler Pacifica for Sale

2017 chrysler pacifica touring-l(US $30,900.00)

2017 chrysler pacifica touring-l(US $30,900.00) 2022 chrysler pacifica touring l(US $27,955.00)

2022 chrysler pacifica touring l(US $27,955.00) 2022 chrysler pacifica limited(US $24,481.10)

2022 chrysler pacifica limited(US $24,481.10) 2020 chrysler pacifica hybrid red s(US $27,599.00)

2020 chrysler pacifica hybrid red s(US $27,599.00) 2021 chrysler pacifica touring l(US $17,300.00)

2021 chrysler pacifica touring l(US $17,300.00) 2022 chrysler pacifica touring l(US $23,500.00)

2022 chrysler pacifica touring l(US $23,500.00)

Auto Services in Texas

Yescas Brothers Auto Sales ★★★★★

Whitney Motor Cars ★★★★★

Two-Day Auto Painting & Body Shop ★★★★★

Transmission Masters ★★★★★

Top Cash for Cars & Trucks : Running or Not ★★★★★

Tommy`s Auto Service ★★★★★

Auto blog

China's Great Wall confirms its interest — in Jeep, or all of FCA

Tue, Aug 22 2017HONG KONG/SHANGHAI — Chinese automaker Great Wall Motor reiterated its interest in Fiat Chrysler Automobiles NV on Tuesday, but said it had not held talks or signed a deal with executives at the Italian-American automaker. China's largest sport utility vehicle manufacturer made a direct overture to Fiat Chrysler on Monday, with an official saying the company was interested in all or part of FCA, owner of the Jeep and Ram truck brands. Automotive News first reported the news, quoting Great Wall Motor President Wang Fengying as saying she planned to contact FCA to discuss acquiring the Jeep brand specifically. Those comments sent FCA shares higher but also raised questions over the ability of China's seventh-largest automaker by sales to buy larger Western rival FCA, or even Jeep, which some analysts value at as much as one-and-a-half times FCA. Great Wall sought to dampen speculation on Tuesday. It confirmed it had studied Fiat Chrysler, but said there was "no concrete progress so far" and "substantial uncertainty" over whether it would eventually bid. "The company has not built any relationship with the directors of FCA nor has the company entered into any discussion or signed any agreements with any officer of FCA so far," the company said in an English-language stock exchange filing. It did not give further detail. Fiat Chrysler stock dipped on the statement on Tuesday. Great Wall said trading in its Shanghai-listed shares would resume on Wednesday after having been suspended. Fiat Chrysler declined to comment on Great Wall's statement. On Monday, it said it had not been approached and was fully committed to implementing its current business plan. FLUSHING OUT RIVALS? Great Wall Motor, which was early to spot China's love of SUVs, had revenue of $14.8 billion last year and sold 1.07 million vehicles - but that compares with FCA's 2016 revenue of 111 billion euros ($130.6 billion). Analysts said Great Wall would need to raise both debt and equity to complete any deal, meaning its chairman Wei Jianjun could lose majority control. One possible scenario, according to analysts at Jefferies, would see Wei keeping a roughly 30 percent stake, while Great Wall would raise $10-$14 billion in debt and $10 billion in equity - hefty for a group currently worth just $16 billion. Ultimately, politics could be the clincher.

Nissan didn't have much say in merger talks, but it had what FCA wanted

Fri, Jun 7 2019TOKYO — Nissan wasn't consulted on the proposed merger between its alliance partner Renault and Fiat Chrysler, but the Japanese automaker's reluctance to go along may have helped bring about the surprise collapse of the talks. While Nissan Motor Co. had a weaker bargaining position from the start, with its financial performance crumbling after the arrest last year of its star executive Carlos Ghosn, it still had as its crown jewel the technology of electric vehicles and hybrids that Fiat Chrysler wanted. The board of Renault, meeting Thursday, didn't get as far as voting on the proposal, announced last week, which would have created the world's third biggest automaker, trailing only Volkswagen AG of Germany and Japan's Toyota Motor Corp. When the French government, Renault's top shareholder with a 15% stake, asked for more time to convince Nissan, Fiat Chrysler Chairman John Elkann abruptly withdrew the offer. Although analysts say reviving the talks isn't out of the question, they say trust among the players appears to have been broken. "The other companies made the mistake of underestimating Nissan's determination to say, 'No,' " said Katsuya Takeuchi, senior analyst at Mitsubishi UFJ Morgan Stanley Securities in Tokyo. The Note, an electric car with a small gas engine to charge its battery, was Japan's No. 1 selling car, the first time in 50 years that a Nissan beat Toyota and Honda. Renault and Fiat Chrysler highlighted possible synergies that come from sharing parts and research costs as the benefits of the merger. But what Fiat Chrysler lacks and really wanted was what's called in the industry "electrification technology," Takeuchi said. With emissions regulations getting stricter around the world, having such technology is crucial. Yokohama-based Nissan makes the world's best-selling electric car Leaf. Its Note, an electric car equipped with a small gas engine to charge its battery, was Japan's No. 1 selling car for the fiscal year through March, the first time in 50 years that a Nissan model beat Toyota and Honda Motor Co. for that title. Nissan is also a leader in autonomous-driving technology, another area all the automakers are trying to innovate. "Although Nissan had no say, its cautionary stance on the merger ended up being very meaningful," Takeuchi said.

Stellantis and LG announce Canadian EV battery joint venture

Wed, Mar 23 2022SEOUL — South Korean battery giant LG Energy Solution (LGES) said on Wednesday it plans to invest $1.5 billion to set up a joint venture with Stellantis in Canada. LGES owns 51% of the joint venture, tentatively named "LGES-STLA JV" and Stellantis owns 49%, LGES said in a regulatory filing. In October, LGES and Stellantis NV struck an electric vehicle (EV) battery production joint venture, targeting to start production by the first quarter of 2024 and aiming to have an annual production capacity of 40 gigawatt hours of batteries. In a separate regulatory filing, LGES said it plans to acquire a stake worth $542 million in ES America to respond to demand from EV startups in the United States. LGES is considering building a factory in Arizona to meet demand in the United States, two people familiar with the matter told Reuters, adding that the plant is expected to primarily produce cylindrical battery cells. LGES has its own factory in Michigan and two battery joint ventures with General Motors in Ohio and Tennessee. "We are considering a new production site, but nothing has been decided yet," said a spokesperson at LGES. LGES, which counts Tesla, GM and Volkswagen among its customers, currently has battery production sites in the United States, China, Poland, Indonesia and South Korea. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Green Plants/Manufacturing Chrysler Dodge Fiat Jeep RAM Electric