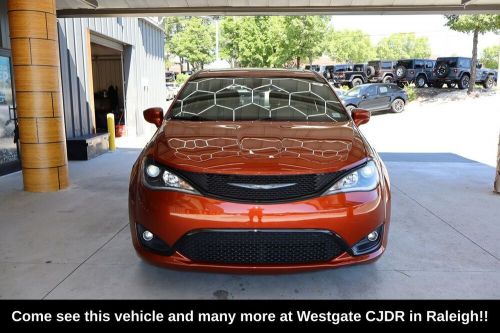

2018 Chrysler Pacifica Touring Plus on 2040-cars

Engine:3.6L V6 24V VVT

Fuel Type:Gasoline

Body Type:4D Passenger Van

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 2C4RC1FG6JR189043

Mileage: 81768

Make: Chrysler

Trim: Touring Plus

Features: --

Power Options: --

Exterior Color: Copper Pearlcoat

Interior Color: Black

Warranty: Unspecified

Model: Pacifica

Chrysler Pacifica for Sale

2021 chrysler pacifica touring l 4dr mini van(US $46,995.00)

2021 chrysler pacifica touring l 4dr mini van(US $46,995.00) 2023 chrysler pacifica touring l(US $24,310.30)

2023 chrysler pacifica touring l(US $24,310.30) 2022 chrysler pacifica touring l fwd(US $30,950.00)

2022 chrysler pacifica touring l fwd(US $30,950.00) 2022 chrysler pacifica touring l(US $21,682.00)

2022 chrysler pacifica touring l(US $21,682.00) 2022 chrysler pacifica touring l(US $26,994.00)

2022 chrysler pacifica touring l(US $26,994.00) 2007 chrysler pacifica touring(US $4,995.00)

2007 chrysler pacifica touring(US $4,995.00)

Auto blog

NHTSA investigates a million-plus Jeep Cherokees for parking brake issue

Tue, Jul 26 2022The National Highway Transportation Safety Administration (NHTSA) is investigating a potential safety issue that could be present in more than 1 million Jeep Cherokees sold for the 2014-2020 model years. Per owner complaints, these cars may be equipped with an electronic parking brake control module that is susceptible to water intrusion. If the water causes a short, it can result in uncommanded activation of the parking brake while the vehicle is in motion, which can lead to a stall, NHTSA says. If you follow Jeep Cherokee news closely (and who doesn't?), this issue may ring a bell. That's because Jeep was on the hook for recalling the Cherokee for water intrusion into the liftgate control module, which is fitted right next to the parking brake module. In that instance, short circuits had the potential to cause a fire, which has not so far been indicated as a potential side effect of the new parking brake issue, but any time electricity is involved, there's usually at least some risk for ignition. The Cherokee is just one of four Stellantis models with a new open investigation, the Detroit Free Press reported Tuesday. NHTSA is also looking into reports of a transmission problem that could strand owners of 2019-2021 Chrysler Pacifica plug-in hybrid minivans and a crankshaft and/or camshaft position sensor problem that could cause a stall in the 2016 Dodge Journey and Jeep Compass. Between the two, these investigations cover an additional 300,000 vehicles. None of these vehicles are being recalled at this point, however a NHTSA investigation is the first major step toward a recall being initiated. The regulator will work with Stellantis to determine whether a recall is necessary. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Government/Legal Chrysler Dodge Jeep Ownership Safety SUV

Autoblog Minute: Marchionne seems prepared to lead FCA in takeover of GM

Fri, Sep 4 2015FCA CEO Sergio Marchionne wants industry consolidation but without any deal takers it seems as though he's ready to consider a hostile takeover. Autoblog's Chris McGraw reports on this edition of Autoblog Minute with commentary from Autoblog editor-in-chief Mike Austin. Show full video transcript text [00:00:00] It's no secret that FCA CEO Sergio Marchionne wants industry consolidation but without any deal takers it seems as though he's ready to consider a hostile takeover. I'm Chris McGraw and this is your Autoblog Minute. Marchionne is tired of waiting for the industry to get on board with his consolidation plan. In an interview with Automotive News Marchionne was quoted as saying, "it would be unconscionable not to force a partner." And when pushed further about the nature of any potential takeover plan the FCA chief had this to say: "Not hostile. There are varying degrees of hugs. I can hug you nicely, I can hug you tightly, I can hug you like a bear, I can really hug you. Everything starts with physical contact. Then it can degrade, but it starts with physical contact." Metaphor aside, Marchionne suggests his numbers for a GM-FCA merger are irrefutable, pointing to potential global earnings of a 30 billion dollars. Without a merger deal on the horizon we have to wonder if an FCA takeover of GM even possible. For more we go to Autoblog's Mike Austin: [Mike Austin Interview] Marchionne says GM won't take his phone calls, and while he admits a merger with GM would be a hard road to haul it's one he's still determined to travel. We'll continue to monitor the story as it develops. For Autoblog, I'm Chris McGraw. Autoblog Minute is a short-form video news series reporting on all things automotive. Each segment offers a quick and clear picture of what's happening in the automotive industry from the perspective of Autoblog's expert editorial staff, auto executives, and industry professionals. UAW/Unions Chrysler Fiat GM Autoblog Minute Videos Original Video

Why a Renault-FCA merger could be good news for Nissan, Mitsubishi

Fri, May 31 2019TOKYO — Nissan's advanced technologies including platforms and electric powertrains could give it leverage in a merger involving Renault and Fiat Chrysler, thanks to a royalty system it has with the former, two people with knowledge of the matter said. A merged Renault-Fiat Chrysler could face an extra hurdle each time it uses technology developed by Nissan or Mitsubishi Motors, while the two Japanese automakers stand to gain a client in Fiat Chrysler (FCA), one of the people said. Both sources declined to be identified because of the sensitivity of the matter. Nissan's technology, particularly in electrification and emissions reduction, could give it some sway in the $35 billion potential tie-up between Renault and FCA, even as its stake in the newly formed company would be diluted. Currently Renault SA pays less for technology developed by Nissan than the Japanese automaker pays for French technology, a third person said. This has long been a sticking point for Nissan, and an area where Nissan could seek more favorable terms. "Whenever Nissan transfers platform, powertrain or other technology to Renault, there is a margin or royalty which Renault has to pay for use of that tech," one of the people said. "In that sense, FCA, if everything went well, would become another 'client' of ours and that's good. More business for us." A Nissan spokesman declined to comment on its royalty system. The potential Renault-FCA deal has complicated the Japanese automaker's already uneasy alliance with Renault. A further deal with Fiat Chrysler looks likely at least in the near term to weaken Nissan's influence in the 20-year-old partnership. Renault owns a 43.4% stake in Nissan and is its top shareholder. Nissan holds a 15% non-voting stake in Renault and would see that diluted to 7.5% after the FCA deal, albeit with voting rights. The imbalance between the two has long rankled Nissan, which is by far the larger company. Alliance imbalance Renault had previously angled for a merger with Nissan but has been rebuffed by CEO Hiroto Saikawa. Securing benefits from the merger deal will be important for Saikawa, who is grappling with poor financial performance while he struggles to right the company after the ouster of former chairman Carlos Ghosn last year.