2006 Chrysler Pacifica Base on 2040-cars

800 N Central Expressway, McKinney, Texas, United States

Engine:3.5L V6 24V MPFI SOHC

Transmission:4-Speed Automatic

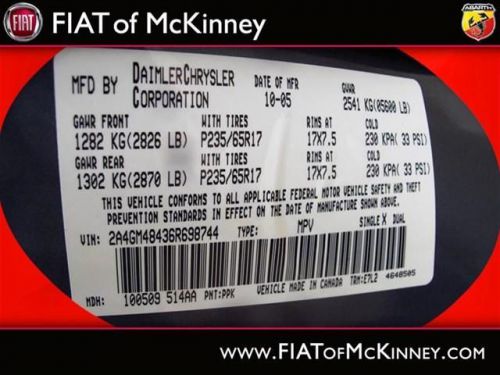

VIN (Vehicle Identification Number): 2A4GM48436R698744

Stock Num: 14F083A

Make: Chrysler

Model: Pacifica Base

Year: 2006

Exterior Color: Green

Interior Color: Light Taupe

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 118576

FIAT of McKinney is offering this clean and reliable 2006ChryslerPacifica All Around hero!!! This is the vehicle for you if you're looking to get great gas mileage on your way to work!!! Chrysler FEVER.. Safety equipment includes: ABS, Passenger Airbag, Knee airbags - Driver...Oh, and did you notice that it's generously equipped with: Power locks, Power windows, Auto, Air conditioning, Front air conditioning zones - Dual.... Please contact our Pre-Owned Sales Department at 888-871-9401. Large selection of new and preowned vehicles. We have access to over 2000 pre-owned vehicles so if we do not have it, we can find it for you. We also deliver to most places in Texas and Oklahoma...call us for more details!

Chrysler Pacifica for Sale

2004 chrysler pacifica(US $7,978.00)

2004 chrysler pacifica(US $7,978.00) 2004 chrysler pacifica(US $4,505.00)

2004 chrysler pacifica(US $4,505.00) 2007 chrysler pacifica touring(US $9,488.00)

2007 chrysler pacifica touring(US $9,488.00) 2007 chrysler pacifica touring(US $11,488.00)

2007 chrysler pacifica touring(US $11,488.00) 2004 chrysler pacifica(US $9,852.00)

2004 chrysler pacifica(US $9,852.00) 2007 chrysler pacifica

2007 chrysler pacifica

Auto Services in Texas

Zepco ★★★★★

Xtreme Motor Cars ★★★★★

Worthingtons Divine Auto ★★★★★

Worthington Divine Auto ★★★★★

Wills Point Automotive ★★★★★

Weaver Bros. Motor Co ★★★★★

Auto blog

Junkyard Gem: 2002 Chrysler PT Cruiser Dream Cruiser Series 1

Sun, Feb 23 2020It has become fashionable to hate the PT Cruiser these days, but Chrysler really hit a home run with the idea of a retro-looking, Neon-based vehicle that — legally speaking — qualified as a light truck according to American regulations and thus didn't need to comply with the costly fuel-economy and crash-safety rules applied to cars. PT Cruisers sold like crazy for the first half of the 2000s and even developed something of a cult followingÂ… but familiarity bred contempt once every parking lot and traffic jam in the country filled up with cute-looking retrowagons. I didn't start seeing many of these cars trucks in junkyards until about a decade ago, at which point the Chrysler section of every yard instantly became about 50% PT Cruisers. Most of the time, I ignore them as car-graveyard background noise, but the rare turbocharged Cruisers or those with manual transmissions can catch my eye, as well as those with weird body kits. The more interesting special-edition PT Cruisers also seem worth documenting as historically significant Junkyard Gems, and here's one of the rarest of all: a Dream Cruiser Series 1, found last summer in Colorado. Inspired by Detroit's Woodward Dream Cruise, the '02 Dream Cruiser Series 1 was the first of many special-edition PT Cruisers (if you're going to collect them all, you'll need to find a Pacific Coast Highway Edition, a Sunset Boulevard Edition, a Woodie Edition, and all the subsequent Dream Cruiser Series cars). All the Series 1 Dream Cruisers came in metallic Inca Gold paint, allegedly inspired by the paint on the 1998 Pronto Cruiser concept car. Chrysler planned to build 7,500 of these cars trucks, but I cannot verify actual production numbers. This is the first I've seen in a self-service wrecking yard, at any rate. The Dream Cruiser Series 1 got leather seats and interesting gold-trimmed interior surfaces. This one looks a bit rough inside, but we can assume it was glorious when new. Resale value on the PT Cruiser has cratered in recent years, so even a runner has little chance of evading the cold steel jaws of the crusher, once it starts to rust. Because every performance upgrade you can do with a Neon can also be done to a PT Cruiser, it would be possible to swap all the relevant mechanical bits from an SRT-4 Neon into a snazzy-looking Dream Cruiser and have the quickest PT Cruiser in your timezone. You should do this. This content is hosted by a third party. To view it, please update your privacy preferences.

Chrysler Recalls Jeep SUVs For Ignition Switches

Wed, Jul 23 2014The ignition switch defects that engulfed General Motors are now a rapidly growing problem at Chrysler. Chrysler said Tuesday it is recalling up to 792,300 older Jeep SUVs worldwide because the ignition switches could fall out of the "run" position, shutting off the engine and disabling air bags as well as power-assisted steering and braking. That's the same problem that has forced GM to recall more than 15 million cars over the last six months. Chrysler's recall covers 2005-2007 Grand Cherokees and 2006-2007 Commanders. The company said it is not sure exactly how many will be recalled, but said it will notify customers by mid-September. Chrysler said an outside force such as a driver's knee can knock switches out of the "run" position. Engineers are working on a fix. The Auburn Hills, Michigan-based automaker, now part of Fiat Chrysler Automobiles NV, said it knows of no related injuries and only one accident. But it said owners should keep clearance between their knees and keys until repairs are made. Chrysler has now recalled more than 1.7 million vehicles for ignition-switch problems. In June, the company added 696,000 minivans and SUVs to a 2011 recall to fix faulty ignition switches. Those recalls covered Dodge Journey SUVs and Chrysler Town & Country, Dodge Caravan and Volkswagen Routan minivans - which Chrysler made for the German automaker - from the 2007 to 2010 model years. Tuesday's recall is the outgrowth of two investigations opened by U.S. safety regulators last month as part of a broader probe into ignition-switch and air-bag problems across the auto industry. The agency wouldn't say Tuesday whether its investigation could lead to recalls at other automakers. The National Highway Traffic Safety Administration said in June that it was investigating Jeep Commanders and Grand Cherokees after getting 32 complaints that a driver's knee can hit the key fob or key chain, causing the ignition switch to move out of position. The federal investigation is still open. The agency said Tuesday that it is requesting additional information from Chrysler to ensure that its repairs will be effective. The investigations and recalls come after GM bungled an ignition-switch recall of older small cars. GM acknowledged that it knew of the ignition problem for more than a decade but failed to recall the cars until earlier this year, when it recalled 2.6 million small cars such as the Chevrolet Cobalt.

Stellantis expects to hit emissions target without Tesla's help

Tue, May 4 2021Franco-Italian carmaker Stellantis expects to achieve its European carbon dioxide (CO2) emissions targets this year without environmental credits bought from Tesla, its CEO said in an interview published on Tuesday. Stellantis was formed through the merger of France's PSA and Italy's FCA, which spent about 2 billion euros ($2.40 billion) to buy European and U.S. CO2 credits from electric vehicle maker Tesla over the 2019-2021 period. "With the electrical technology that PSA brought to Stellantis, we will autonomously meet carbon dioxide emission regulations as early as this year," Stellantis boss Carlos Tavares said in the interview with French weekly Le Point. "Thus, we will not need to call on European CO2 credits and FCA will no longer have to pool with Tesla or anyone." California-based Tesla earns credits for exceeding emissions and fuel economy standards and sells them to other automakers that fall short. European regulations require all car manufacturers to reduce CO2 emissions for private vehicles to an average of 95 grams per kilometer this year. A Stellantis spokesman said the company is in discussions with Tesla about the financial implications of the decision to stop the pooling agreement. "As a result of the combination of Groupe PSA and FCA, Stellantis will be in a position to achieve CO2 targets in Europe for 2021 without open passenger car pooling arrangements with other automakers," he added. Tesla's sales of environmental credits to rival automakers helped it to announce slightly better than expected first-quarter revenue this week. The next tightening of European regulations will soon be the subject of proposals from the European Commission. The 2030 target could be lowered to less than 43 grams/km. Related Video: Government/Legal Green Alfa Romeo Chrysler Dodge Fiat Jeep Maserati RAM Tesla Citroen Peugeot Emissions Stellantis