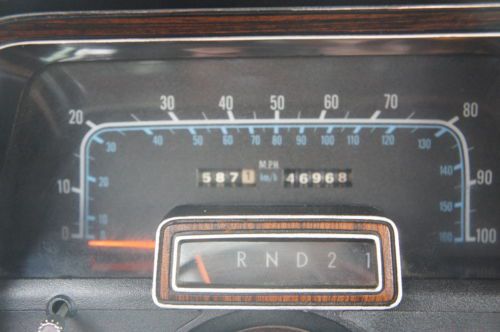

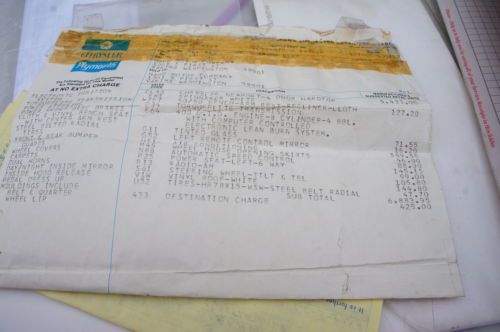

1977 Chrysler Newport Custom 400 Super Clean 43k Miles Not New Yorker on 2040-cars

Tacoma, Washington, United States

Chrysler Newport for Sale

1973 chrysler newport custom *original survivor*

1973 chrysler newport custom *original survivor* 1962 chrysler 300 2 door hardtop original condition(US $10,500.00)

1962 chrysler 300 2 door hardtop original condition(US $10,500.00) 1951 chrysler windsor deluxe 4.1l 2 door hardtop survivor(US $7,500.00)

1951 chrysler windsor deluxe 4.1l 2 door hardtop survivor(US $7,500.00) 1964 chrysler newport

1964 chrysler newport Completly restored 1970 crystler newport convertible with 440 tnt(US $18,500.00)

Completly restored 1970 crystler newport convertible with 440 tnt(US $18,500.00) No reserve 64 chrysler newport 41k actual mi beautiful amazing original survivor

No reserve 64 chrysler newport 41k actual mi beautiful amazing original survivor

Auto Services in Washington

Wrench-N-Time Quality Auto ★★★★★

Wesco Autobody Supply Inc ★★★★★

Tiny`s Tire Factory ★★★★★

Taylors Mobile RV & Auto Service ★★★★★

Tayag`s Auto Repair ★★★★★

Specialty Motors ★★★★★

Auto blog

Detroit automakers mulling helping DIA avoid bankruptcy looting

Tue, 13 May 2014It's not really a secret that the city of Detroit is in lots and lots of trouble. Even with an emergency manager working to guide it through bankruptcy, a number of the city's institutions remain in very serious danger. One of the most notable is the Detroit Institute of Arts, a 658,000-square-foot behemoth of art that counts works from Van Gogh, Picasso, Gauguin and Rembrandt (not to mention a version of Rodin's iconic "The Thinker," shown above) as part of its permanent collection.

Throughout the bankruptcy, the DIA has been under threat, with art enthusiasts, historians and fans of the museum concerned that its expansive collection - valued between $454 and $867 million by Christie's - could be sold by the city to help square its $18.5-billion debt.

Now, though, Detroit's hometown automakers could be set to step up and help save the renowned museum. According to a report from The Detroit News, the charitable arms of General Motors, Ford and Chrysler could be set to donate $25 million as part of a DIA-initiated campaign, called the "grand bargain." As part of the deal, the DIA would seek $100 million in corporate donations as part of a larger attempt at putting together an $816-million package that would be paid to city pension funds over 20 years. Such a move would protect the city's art collection from being sold off.

Fiat Chrysler taps Amazon, Shell execs to fill roles

Fri, Dec 7 2018MILAN — Fiat Chrysler Automobiles is tapping executives from Amazon and Shell Oil Company with previous automotive industry experience to fill its ranks. CEO Mike Manley said in a letter to employees Thursday that Mark Stewart would join FCA as chief operating officer of North America from Amazon, "a company known for its culture of innovation, and obsession with delivering incredible value to customers." At Amazon, Stewart led teams focused on advanced robotics, artificial intelligence and automation methods. He previously was COO of ZF TRW automotive components supplier. Niel Golightly was named head of global communications. He was most recently Shell's vice president for external relations in North and South America, with a focus on reputation, brand and stakeholder engagement beyond communication strategies. He previously held roles at Ford Motor Company. Related Video: Image Credit: REUTERS/Rebecca Cook Hirings/Firings/Layoffs Alfa Romeo Chrysler Dodge Fiat Jeep RAM FCA Amazon shell Mike Manley

FCA and Peugeot reportedly agree on merger

Wed, Oct 30 2019Citing a Wall Street Journal report, the Detroit Free Press says "Fiat Chrysler and PSA Groupe have agreed to merge." The Journal reported on talks between the two car companies only yesterday. It's said that Peugeot's board met yesterday to approve the deal, FCA's board met today, and an announcement could come as soon as tomorrow, Thursday. Both automakers have released statements, but neither company has released any information beyond admitting to ongoing talks. If the merger happens, the combined entity would become the world's fourth-largest carmaker with a $50 billion valuation, slotting in behind Toyota, the Volkswagen Group, and the Renault Nissan Mitsubishi alliance. Among the merger options possible, "an all-stock merger of equals" is the one analysts and Moody's seem to give the best grade. The reported merger would come about four months after FCA walked away from merger talks with Renault. FCA said the French government scuppered those talks over the role of Nissan in a reformed entity, but there were also brewing issues with French unions, and ongoing turmoil among Renault and Nissan leadership thanks to continuing fallout from ex-CEO Carlos Ghosn's arrest last year. FCA makes most of its revenue in the U.S. and rules Italy, while Peugeot is the second-best-selling automaker in Europe with its own brand in France and Opel in Germany. The two companies already have a partnership in Europe making vans, one that FCA CEO Mike Manley has spoken highly of. Among the list of obvious benefits in a potential merger, FCA would get access to Peugeot's small, modern platforms, $10.2 billion in cash, and electrified and hybrid architecture developments, the latter especially important to FCA as those are fields where it lags. Peugeot would get much easier access to the U.S. market, and the money-printing brands Jeep and Ram. A merged carmaker would have combined sales of nearly 9 million a year, based on 2018 results. By comparison, both Volkswagen and Toyota sell over 10 million cars a year, while the Renault-Nissan-Mitsubishi alliance almost 11 million. Peugeot CEO Carlos Tavares has proved he knows how to do turnarounds and mergers. After leaving a position as Carlos Ghosn's right-hand man in 2012, Tavares took over Peugeot in 2014, navigated a bailout from the French government and China's Dongfeng Motors in 2015, and turned PSA into a regional powerhouse.