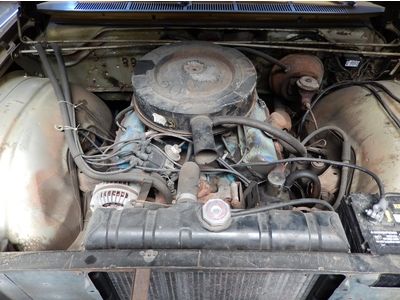

1966 Chrysler Newport Convertible Runs And Drives No Brakes Needs Restoration !! on 2040-cars

Ontario, California, United States

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Unspecified

Make: Chrysler

Model: Newport

Mileage: 100,000

Exterior Color: Other

Warranty: Vehicle does NOT have an existing warranty

Chrysler Newport for Sale

1950 chrysler windsor newport 2 door hardtop only 31,434 miles!!!(US $14,500.00)

1950 chrysler windsor newport 2 door hardtop only 31,434 miles!!!(US $14,500.00) Beautiful 1969 chrysler newport convertible

Beautiful 1969 chrysler newport convertible 1968 silver daily driver runs great body & interior nice!

1968 silver daily driver runs great body & interior nice! 1976 chrysler newport original 19,000 mile car(US $7,500.00)

1976 chrysler newport original 19,000 mile car(US $7,500.00) 1979 chrysler newport - one owner, low miles - no reserve

1979 chrysler newport - one owner, low miles - no reserve 1962 chrysler newport convertible-- complete!

1962 chrysler newport convertible-- complete!

Auto Services in California

Yes Auto Glass ★★★★★

Yarbrough Brothers Towing ★★★★★

Xtreme Liners Spray-on Bedliners ★★★★★

Wolf`s Foreign Car Service Inc ★★★★★

White Oaks Auto Repair ★★★★★

Warner Transmissions ★★★★★

Auto blog

Ferrari families have 'agreement' to prevent takeover

Thu, Oct 22 2015With its initial public offering already a massive success, Ferrari is now officially a publicly traded company on the New York Stock Exchange. While anyone can buy those shares, don't expect investors to take control away from some of the top owners of the Prancing Horse anytime soon. To maintain their power, Enzo Ferrari's son, Piero, and Exor chairman John Elkann will sign a deal guaranteeing themselves nearly half of the automaker's voting rights, Bloomberg reports. As part of this arrangement, shareholders that agree to hang onto Ferrari stock for at least three years would receive additional voting rights in the company, and that would give Piero and Elkann a combined 48.7 percent of the automaker by banding together. While not quite complete control, the move should be enough to prevent a takeover of the business. "We have an agreement among the families to protect our interests in Ferrari," Piero said to Bloomberg. This agreement won't really become a concern until next year because only 10 percent of Ferrari will be traded for now. FCA will distribute another 80 percent to its shareholders in early 2016, and Elkann's Exor will be getting the largest portion of the Prancing Horse in the spin-off. Meanwhile, Piero holds the remaining 10 percent but has absolutely no intention to sell his stake in his father's business. The newly public Ferrari will push to grow volume with a goal of moving 9,000 vehicles annually by 2019. To reach that 30-percent boost, expect to see a new model every year, and some of them might use a new, modular platform that's reportedly under development. Related Video:

Chrysler stays IPO until 2014

Mon, 25 Nov 2013There will not be a Chrysler IPO in 2013. Fiat, according to a report from Forbes, has announced that it will not be able to make the American brand's initial public offering before the end of the year, saying that the short, five-week window that makes up the rest of 2013 is "not practicable."

Not surprisingly, the issue with the Chrysler IPO is the same as it's always been - a disagreement between parent company Fiat, which owns 58.5 percent of the Chrysler Group and a UAW healthcare trust, which owns 41.5 percent. Fiat wants to buy out the UAW VEBA healthcare trust, which is responsible for shouldering retiree healthcare costs, but the two sides are hung up on an actual price tag for the remaining two-fifths of the company.

The original idea saw an IPO as a way of setting a fair market price for the remaining shares, although it's not entirely clear what broke down and led to a delay of the IPO plan. As Forbes points out, by waiting until 2014, Chrysler could be risking a cool-off in the IPO market, which could mean less money in its pocket when the automaker finally goes public.

Dongfeng and PSA extend Chinese joint venture

Thu, Dec 19 2019BEIJING/PARIS — China's Dongfeng and Peugeot maker PSA are extending their business cooperation, despite the Chinese company reducing its stake in PSA to help smooth the French carmaker's merger with Fiat Chrysler Automobiles (FCA). Dongfeng said on Thursday it had agreed with PSA to extend the duration of their joint venture Dongfeng Peugeot Citroen Automobiles (DPCA). Under the deal, the venture could get the rights to PSA's new brands in China and will benefit from new technologies and intellectual properties, the Chinese company said. PSA was not immediately available for comment. The announcement comes a day after the companies said Dongfeng would reduce its 12.2% stake in PSA by selling 30.7 million shares to the French company. Analysts said the move could smooth U.S. regulatory approval for PSA's roughly $50 billion (GBP38.97 billion) merger with Italian-American carmaker FCA. The sale of Dongfeng's shares in PSA, worth around 680 million euros ($757 million), will leave the Chinese group holding around 4.5% of the merged PSA-FCA, which is set to become the world's fourth-biggest carmaker by sales volumes. "As the cooperation between Dongfeng and PSA deepens, we expect the joint venture to continue making good progress in China," a Dongfeng representative said. On a conference call, Dongfeng said DPCA would have exclusive rights to PSA's Opel cars should the partners agree to bring the brand to China, and enjoy lower prices on car parts imported from PSA. Earlier this year, a document seen by Reuters showed Dongfeng and PSA plan to cut jobs at Wuhan-based DPCA and reduce its number of car plants to try to make the venture more profitable. Chrysler Dodge Fiat Jeep RAM Citroen Peugeot China FCA PSA Dongfeng