1977 New Yorker Brougham 70k Original Miles Beautiful on 2040-cars

Portland, Oregon, United States

Engine:440

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Interior Color: Burgundy

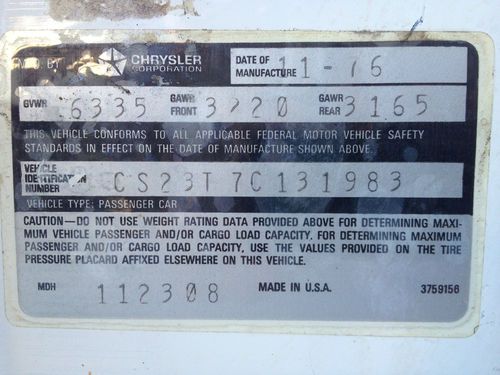

Make: Chrysler

Number of Cylinders: 8

Model: New Yorker

Trim: Brougham

Warranty: Vehicle does NOT have an existing warranty

Drive Type: AUTO

Options: Leather Seats

Mileage: 73,071

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: Brougham

Exterior Color: White

Chrysler New Yorker for Sale

Gorgeous - survivor 1966 chrysler new yorker town sedan 70k actual 440 v8 nice !

Gorgeous - survivor 1966 chrysler new yorker town sedan 70k actual 440 v8 nice ! 1990 chrysler new yorker fifth avenue sedan 4-door 3.3l

1990 chrysler new yorker fifth avenue sedan 4-door 3.3l 1953 chrysler new yorker deluxe 5.4l

1953 chrysler new yorker deluxe 5.4l 1954 chrysler new yorker deluxe 67212 original miles

1954 chrysler new yorker deluxe 67212 original miles No reserve auction! highest bidder wins! check out this rust-free new yorker!

No reserve auction! highest bidder wins! check out this rust-free new yorker! 1948 chrysler new yorker sedan body/project/parts car(US $1,200.00)

1948 chrysler new yorker sedan body/project/parts car(US $1,200.00)

Auto Services in Oregon

Woodburn Automotive Repair Center ★★★★★

Wholesale Auto Connection ★★★★★

Vina Auto Care ★★★★★

Towne Center Tire Factory ★★★★★

Tim Miller`s Rv Repair ★★★★★

Tietan Auto Body ★★★★★

Auto blog

Stellantis sees vehicle loan durations extended amid banking turmoil

Tue, Apr 4 2023Stellantis is seeing clients seeking longer-term financing and leasing deals for their vehicles as a consequence of higher global interest rates, the carmaker's head for the business said. Chief Affiliates Officer Philippe de Rovira said loans which normally had a three-year maturity were now increasingly moved to four years. "This allows customers to get a car for a monthly instalment that is similar to that they had before," he said. The world's third largest carmaker by sales on Tuesday announced it had completed a plan announced in late 2021 to reshuffle and simplify its leasing and financing operations in Europe. Under its terms, Stellantis created a 50-50 single long term multi-brand leasing company named Leasys with Credit Agricole Consumer Finance. It also set up local joint ventures in European countries for its new Stellantis Financial Services unit, formerly Banque PSA Finance, with BNP Paribas Personal Finance and Santander Consumer Finance. "These banks have always had better funding conditions than those we can have as an automaker," de Rovira said. Benefits of the plan included cutting the number of financing and leasing entities the group runs in each country and the number of IT systems it uses, with expected savings exceeding 30% in this particular area, he added. De Rovira said the group had a huge portfolio of orders it had not yet delivered due to supply chain shortages impacting production. "Demand is not our main issue. The issue is to deliver as fast as we can cars that are in our order portfolio, which is still at record levels," he said. The group aims to expand its corporate leased vehicle fleet to more than one million units in 2026 and to double net income from its so-called banking activities to 5.8 billion euros ($6.3 billion) by 2030. De Rovira said Stellantis was not seeing a downward trend in vehicle pricing. "Probably the significant price increases we have seen in 2021 and 2022 will not be repeated because the context is changing, but for the moment we don't see decreases, we see stabilisation". ($1 = 0.9188 euros) (Reporting by Giulio Piovaccari and Gilles Guillaume; Editing by Jan Harvey) Earnings/Financials Plants/Manufacturing Alfa Romeo Chrysler Dodge Jeep RAM

Automakers not currently promoting EVs are probably doomed

Mon, Feb 22 2016Okay, let's be honest. The sky isn't falling – gas prices are. In fact, some experts say that prices at the pump will remain depressed for the next decade. Consumers have flocked to SUVs and CUVs, reversing the upward trend in US fuel economy seen over the last several years. A sudden push into electric vehicles seems ridiculous when gas guzzlers are selling so well. Make hay while the sun shines, right? A quick glance at some facts and figures provides evidence that the automakers currently doubling down on internal combustion probably have some rocky years ahead of them. Fiat Chrysler Automobiles is a prime example of a volume manufacturer devoted to incremental gains for existing powertrains. Though FCA will kill off some of its more fuel-efficient models, part of its business plan involves replacing four- and five-speed transmissions with eight- and nine-speed units, yielding a fuel efficiency boost in the vicinity of ten percent over the next few years. Recent developments by battery startups have led some to suggest that efficiency and capacity could increase by over 100 percent in the same time. Research and development budgets paint a grim picture for old guard companies like Fiat Chrysler: In 2014, FCA spent about $1,026 per car sold on R&D, compared with about $24,783 per car sold for Tesla. To be fair, FCA can't be expected to match Tesla's efforts when its entry-level cars list for little more than half that much. But even more so than R&D, the area in which newcomers like Tesla have the industry licked is infrastructure. We often forget that our vehicles are mostly useless metal boxes without access to the network of fueling stations that keep them rolling. While EVs can always be plugged in at home, their proliferation depends on a similar network of charging stations that can allow for prolonged travel. Tesla already has 597 of its 480-volt Superchargers installed worldwide, and that figure will continue to rise. Porsche has also proposed a new 800-volt "Turbo Charging Station" to support the production version of its Mission E concept, and perhaps other VW Auto Group vehicles. As EVs grow in popularity, investment in these proprietary networks will pay off — who would buy a Chevy if the gas stations served only Ford owners? If anyone missed the importance of infrastructure, it's Toyota.

FCA's European boss quits after losing out as Marchionne's replacement

Mon, Jul 23 2018MILAN — Fiat Chrysler's European boss has quit, adding to the problems facing new CEO Mike Manley, who must deliver on promises to boost production of SUVs and catch up with rivals in electric cars. Jeep division head Manley was named on Saturday to succeed Chief Executive Sergio Marchionne, one of the auto industry's most tenacious and respected leaders, who fell seriously ill after suffering complications following surgery. It emerged on Monday that Alfredo Altavilla, head of Fiat Chrysler's business in the Europe, Middle East Africa had resigned, according to a source with knowledge of the matter. He had been a rival for the top job along with Manley and Chief Financial Officer Richard Palmer. It's another complication to new CEO Manley's task of executing his predecessor's plan to keep the world's seventh-largest carmaker competitive in the absence of a merger. Marchionne had been due to step down next April, so the market reaction was limited on Monday. The shares initially fell more than 5 percent, but then pared some losses and were down 2.4 percent by 0930 GMT. "The downside may be modest, at least in the next 12 months. But long-term concerns will build — Marchionne ran FCA in a command and control style, with constant firefighting measures," said Bernstein analyst Max Warburton. Fiat Chrysler Automobiles (FCA) said British-born Manley would pursue the strategy that Marchionne outlined last month. FCA has pledged to increase production of sport utility vehicles and invest in electric and hybrid cars to double operating profit by 2022. It also unveiled bold targets for Jeep, which has become FCA's ticket to creating a high-margin brand with global appeal. Reviving struggling brands Analysts said that choosing Manley, 54, under whose watch Jeep's sales surged fourfold, sent a clear message that FCA was staying on course and would keep the Jeep brand at the heart of its growth plan. "Manley knows that his primary focus is on execution and that, already, he has a strategy into which his team has bought," said George Galliers, an analyst at Evercore ISI. "There is no reason the 2022 plan cannot be executed." Under Manley, the company is expected to sharpen its focus on revamping individual brands, including ailing Fiat in Europe, Chrysler in the United States and Alfa Romeo, which has yet to turn a profit despite multibillion-euro investments.