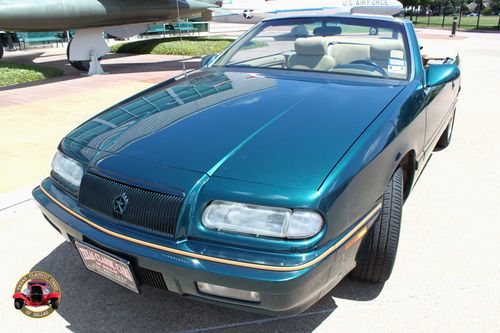

Chrysler Lebaron Mark Cross T&c Convertible Le Baron - 1984 on 2040-cars

Moberly, Missouri, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:2.6 Liter

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 4

Make: Chrysler

Model: LeBaron

Trim: Wood Grain

Options: Computer System, Cassette Player, Leather Seats, Convertible

Drive Type: Front WD

Power Options: Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 72,000

Sub Model: Mark Cross

Exterior Color: White

Warranty: Vehicle does NOT have an existing warranty

Interior Color: Brown

Chrysler LeBaron for Sale

1987 chrysler lebaron base convertible 2-door 2.2l "prestine condition"(US $7,000.00)

1987 chrysler lebaron base convertible 2-door 2.2l "prestine condition"(US $7,000.00) Chrysler lebaron convertible 1983 26,900 orig miles excellent condition 4 cylind(US $6,000.00)

Chrysler lebaron convertible 1983 26,900 orig miles excellent condition 4 cylind(US $6,000.00) 1982 chrysler lebaron convertible mark cross edition white w tan interior(US $9,650.00)

1982 chrysler lebaron convertible mark cross edition white w tan interior(US $9,650.00) 1993 chrysler lebaron convertible / one family owned

1993 chrysler lebaron convertible / one family owned Runs fine, great body, low reserve, call me....

Runs fine, great body, low reserve, call me.... 1984 chrysler lebaron base convertible 2-door 2.2l(US $2,900.00)

1984 chrysler lebaron base convertible 2-door 2.2l(US $2,900.00)

Auto Services in Missouri

Wodohodsky Auto Body ★★★★★

West County Nissan ★★★★★

Wayne`s Auto Body ★★★★★

Superior Collision Repair ★★★★★

Superior Auto Service ★★★★★

Springfield Transmission Inc ★★★★★

Auto blog

Mopar boss promoted at FCA, still runs Mopar

Thu, May 21 2015Fiat Chrysler Automobiles is appointing Pietro Gorlier as its new chief operating officer for components. The change in title is effective June 30 and means that he reports directly to Sergio Marchionne. He already runs Mopar globally. Gorlier is replacing Eugenio Razelli, who is leaving the automaker. Even with the new position, Gorlier continues to be the boss at Mopar and retains his seat on FCA's global executive council, which is the company's top decision-making group. This is essentially one more step up the ladder for the Turin-born executive. Gorlier became CEO of Mopar service, parts, and customer care for FCA US in 2009 and took over that role worldwide in 2011. FCA announces new appointment Fiat Chrysler Automobiles N.V. (NYSE: FCAU / MI: FCA) announced today that effective June 30, 2015, Pietro Gorlier is appointed Chief Operating Officer Components reporting directly to the Chief Executive Officer Sergio Marchionne. Mr. Gorlier will also retain his current responsibilities as Head of Parts & Service (MOPAR) and member of the Group Executive Council. Mr. Gorlier will succeed Eugenio Razelli, who elected to leave the Group after several years of dedicated service. "We extend our sincere appreciation to Eugenio for his leadership and contribution to the organization" said Sergio Marchionne. Pietro Gorlier is Head of Parts & Service (MOPAR) and a member of the Group Executive Council (GEC) since September 1, 2011. He joined the Group in 1989 in Iveco and held various positions in Logistics, After Sales, and Customer Care before joining the automobile business in 2006 in Network Development. He holds a Master of Economics from the University of Turin. London, 18 May 2015 Related Video: News Source: FCA Hirings/Firings/Layoffs Chrysler Fiat FCA fiat chrysler automobiles fca us

Toyota Sienna vs Chrysler Pacifica Hybrid | Minivan comparison test

Mon, Mar 29 2021Shopping for a new car can be difficult due to the sheer number of choices. Which brand do you start with, which do you skip and are you missing something worthwhile? Thankfully, minivans are much simpler. There are effectively only four choices, they're all pretty good and they're even different enough to make choosing the right one for you a bit easier. This comparison features the two most recently updated minivans: the Toyota Sienna versus the Chrysler Pacifica Hybrid. Besides their common newness, they stand out in another fundamental way: they're both hybrids. Now, they're very different hybrids – the Toyota comes standard with a traditional gasoline-electric system like that of a Prius, whereas the Pacifica is offered with an optional plug-in hybrid system that provides an estimated 32 miles of all-electric range before effectively turning into a traditional hybrid – but in both cases, fuel economy is the priority. With the rare exception, the minivan segment has exclusively used V6 engines, which provide sufficient power to move hefty loads of people and stuff. The Chrysler Pacifica comes standard with a V6, while a V6 is the sole powertrain option for the Honda Odyssey and new 2022 Kia Carnival. The fuel economy difference between those and our hybrid competitors is staggering: The new Sienna gets an EPA-estimated 36 mpg combined while the Odyssey and V6 Pacifica get 22 mpg. That equates to saving an estimated $750 every year on gas, according to the EPA. And the Pacifica Hybrid could potentially save you even more as long as you routinely utilize its electric range. This frugality alone could send the Sienna and Pacifica Hybrid to the top of many shopping lists, but as we've seen in previous tests, they offer more than enough in other respects to warrant top consideration. But which is better, Sienna or Pacifica? Well, we knew this was going to be close, and we were right. After averaging the scores from 16 categories, the difference between first and second was a mere 0.06 out of 10. When we added extra weight to key minivan-buying attributes (second-row space/versatility, safety features and functionality, infotainment, interior storage, cargo space/versatility, value and fuel economy), the gap was only 1 point out of a possible 230. We then triple checked and conducted a recount, but the order remained. In the end, there are no losers here.

eBay Find of the Day: 1979 Chrysler ETV-1 electric car prototype

Mon, 27 Jan 2014Electric cars may be reaching their time in the sun with successes like the Tesla Model S, but the basic concept goes back to practically beginning of motoring. EVs also saw a brief renaissance in the 1970s when automakers were trying find a way around rising fuel prices. This 1979 Chrysler ETV-1 concept for sale on eBay Motors is a great example from that era.

Built in 1979, designers hoped the ETV-1 would preview what an electric car would look like in 1985. The base price was slated to start at $6,400, or the rough equivalent of $20,536, which seems like an optimistic price. General Electric created the ETV-1's powertrain, and Chrysler was in charge of styling. At the time, the Department of Energy called it "the first advanced four-passenger subcompact experimental electric car."

While it seems ancient compared to today's EVs, the ETV-1 featured regenerative braking and a computer-controlled electric motor. Chrysler reported a 100-mile range at 45 miles per hour with two passengers in the car. The range fell to 75 miles with four passengers. Acceleration was not brisk with Chrysler claiming the run to 30 mph in 9 seconds. Power was stored in 18 lead-acid batteries, and a full charge took 10 hours from a home outlet.