1992 Chrysler Lebaron Lx Convertible 3.0l V6 Cold Air, Low Miles, Excellent on 2040-cars

Las Vegas, Nevada, United States

Body Type:Convertible

Engine:3.0L 2972CC 181Cu. In. V6 GAS SOHC Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Number of Cylinders: 6

Make: Chrysler

Model: LeBaron

Trim: LX Convertible 2-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: FWD

Options: Cruise Control, Power Windows, Power Mirrors, Power Seats, Leather Seats, CD Player, Convertible

Mileage: 101,000

Safety Features: Driver Airbag

Sub Model: LX

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Exterior Color: Champagne

Interior Color: Tan

Chrysler LeBaron for Sale

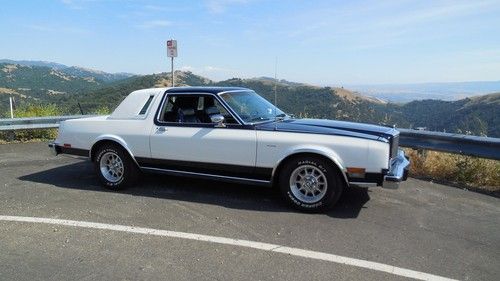

1980 chrysler lebaron medallion coupe 2-door 5.2l

1980 chrysler lebaron medallion coupe 2-door 5.2l 1989 maserati tc convertible rare plum turbo super nice actual miles no reserve

1989 maserati tc convertible rare plum turbo super nice actual miles no reserve 1986 chrysler lebaron base convertible 2-door 2.2l low miles nice

1986 chrysler lebaron base convertible 2-door 2.2l low miles nice 1983 chrysler lebaron convertible mark cross(US $4,500.00)

1983 chrysler lebaron convertible mark cross(US $4,500.00) 1984 chrysler lebaron convertible 26,000 original miles. one owner.

1984 chrysler lebaron convertible 26,000 original miles. one owner. 1989 chrysler lebaron convertible very low miles 2nd owner

1989 chrysler lebaron convertible very low miles 2nd owner

Auto Services in Nevada

Walkers Mobile Auto Repair ★★★★★

Vegas Speed ★★★★★

Vegas New Finish Technology ★★★★★

Swing Shift Auto ★★★★★

Safe Lube Plus ★★★★★

Purrfect Auto Service ★★★★★

Auto blog

Fiat Chrysler Automobiles recalls nearly 750k vehicles in two campaigns

Thu, 16 Oct 2014Fiat Chrysler Automobiles is recalling a total of 747,817 vehicles in the US in two separate campaigns recently added to the National Highway Traffic Safety Administration database.

The first one covers about 434,581 units of the Chrysler 300, Dodge Charger, Challenger, Durango, and Jeep Grand Cherokee from the 2011-2014 model years with electric hydraulic power steering, the 3.6-liter V6 engine and a 160 amp alternator, according to FCA. In the affected vehicles, it's possible for the alternator to fail without warning and possibly cause the car to stall. According to the documentation submitted to NHTSA, the automaker began investigating the problem in August 2014 and has found possible evidence of one crash caused by the failures but no known injuries.

Customers will begin receiving notification about the recall next month, and obviously the repairs will be done at no cost to them.

Chrysler Portal Concept introduces millennials to their automotive future at CES

Tue, Jan 3 2017"Created by millennials for millennials." That's how Chrysler describes its new Portal Concept, a fully electric minivan that's set to debut later today at CES in Las Vegas. Reading between the lines, apparently that means millennials want a one-box van with lots of glass and LED lighting elements... and that FCA is talking to the same millennials as Mercedes did back in 2015. From the few early images of the vehicle released ahead of its official debut, Chrysler's electric van looks like it could have come straight off a Syd Mead drawing. The Portal Concept rides on a 118.2-inch wheelbase, which makes it a little smaller than the Pacifica. There's just enough reality in its design that we can't completely dismiss its viability as an actual vehicle, but all of its disparate design ideas make the Portal look like an overwrought vision of a future that will probably never happen. That said, we'll reserve final judgment until we see it in person at CES. The Portal Concept gets intriguing once its massive double-sliding doors open up. There's a minimalist dash with a long, slender LCD at the top and another, more conventional touchscreen right in the center. Apparently, the screens can be repositioned as needed. There are 10 docking stations inside to charge and hold smartphones or tablets. FCA worked with Panasonic to develop the Portal's user experience, and the automaker hints that the supplier could become a long-term partner. Chrysler calls the interior of its Portal Concept a "third space," the other two being home and work. All the seats mount to rails that allow them to move fore and aft, fold flat, or be removed completely. The flat floor sits above a lithium ion battery pack rated at 100 kWh. That's enough capacity to allow a driving range of more than 250 miles. A 350-kW fast charger can replenish the pack to allow a 150-mile range in less than 20 minutes. A single electric motor powers the front wheels. As befitting a vehicle unveiled at CES, Chrysler says the Portal is capable of SAE Level Three autonomous driving, which means the occupants can turn driving duties over to the vehicle under certain conditions on the highway. As self-driving technology advances, Chrysler says the Portal could be upgraded. Facial recognition and voice biometric technologies allow the Portal to recognize individual users so it can tailor the driving environment to their needs and wishes.

Junkyard Gem: 1979 Chrysler Cordoba

Thu, Oct 20 2016The original Cordoba personal luxury coupe, which debuted for the 1975 model year, was a big hit for Chrysler. Through the 1979 model year, it was based on the successful Chrysler B-Body platform, making it a sibling to the Dukes of Hazzard Charger and Governor Moonbeam's Plymouth Satellite sedan. I see a surprising number of Cordobas showing up in the self-service wrecking yards I frequent in California and Colorado, and this two-tone '79 showed up in a San Francisco Bay Area yard a while back. You could get the 1979 Cordoba with typical 1970s fuzzy-velour seats, but this one has the iconic Corinthian Leather of Ricardo Montalban fame. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Yes, soft Corinthian Leather! This one has just about every possible option, if we are to go by the information in the brochure. The vinyl landau roof and two-tone paint were for serious buyers only. This V8 is either a 318 or a 360, and we won't discuss the depressing power figures that you get with engines of the late 1970s. Worth restoring? Not in this kind of condition. Source of parts for other, more valuable B-bodies? Yes. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Featured Gallery Junked 1979 Chrysler Cordoba View 17 Photos Auto News Chrysler