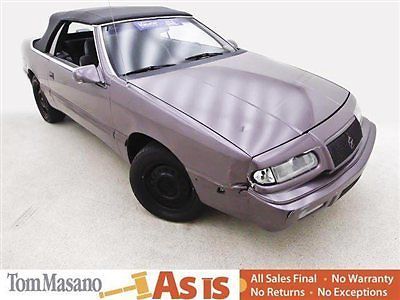

1987 Chrysler Lebaron Convertible 59k Low Miles Automatic 4 Cylinder No Reserve on 2040-cars

Orange, California, United States

Chrysler LeBaron for Sale

1985 chrysler lebaron base convertible 2-door 2.2l

1985 chrysler lebaron base convertible 2-door 2.2l 1977 chrysler lebaron medallion coupe 2-door 5.2l(US $4,000.00)

1977 chrysler lebaron medallion coupe 2-door 5.2l(US $4,000.00) 1983 mark cross black brown leather automatic convertible fwd

1983 mark cross black brown leather automatic convertible fwd 1995 chrysler lebaron gtc convertible (f9632b) ~ absolute sale ~ no reserve ~

1995 chrysler lebaron gtc convertible (f9632b) ~ absolute sale ~ no reserve ~ 1989 chrsyler lebaron convertible turbo

1989 chrsyler lebaron convertible turbo 1978 lebaron 2 door coup(US $6,000.00)

1978 lebaron 2 door coup(US $6,000.00)

Auto Services in California

Yes Auto Glass ★★★★★

Yarbrough Brothers Towing ★★★★★

Xtreme Liners Spray-on Bedliners ★★★★★

Wolf`s Foreign Car Service Inc ★★★★★

White Oaks Auto Repair ★★★★★

Warner Transmissions ★★★★★

Auto blog

Former UAW official gets 15 months in labor corruption case

Tue, Aug 6 2019DETROIT (Reuters) - A federal judge in Detroit on Monday sentenced the former United Auto Workers union vice president in charge of relations with Fiat Chrysler to 15 months in federal prison for misusing funds intended for worker training to pay for luxury travel, golf, liquor and parties for himself and other union officials. Norwood Jewell, 61, who led the UAW's national contract negotiations with Fiat Chrysler in 2015, is the highest ranking UAW official to be sentenced in connection with a wide-ranging federal investigation of corruption within the union that represents U.S. factory workers at Fiat Chrysler Automobiles, General Motors and Ford. Jewell pleaded guilty in April to a single charge of violating the Labor Relations Management Act. At the time, prosecutors proposed a prison sentence of 12 to 18 months. U.S. District Judge Paul Borman rejected Jewell's request to avoid prison and serve his sentence under house arrest. "He betrayed his position," Borman said from the bench. Jewell is the eighth former UAW or Fiat Chrysler official sentenced as part of the federal criminal investigation of UAW finances. Federal prosecutors are continuing to investigate the misuse of company and union funds at the Detroit automakers. Fiat Chrysler Chief Executive Mike Manley, during a meeting with reporters last week, declined to discuss whether the company is in talks with federal authorities or whether he has been interviewed by investigators. Federal prosecutors have said Fiat Chrysler officials conspired in the misuse of $4.5 million in training center funds. Fiat Chrysler's former vice president of labor relations, Alphons Iacobelli, pleaded guilty in January 2018 to charges of violating the Labor Management Relations Act and filing false tax returns. Prosecutors charged Iacobelli with making hundreds of thousands of dollars in improper payments to charities controlled by UAW officials, and agreeing to pay off the mortgage of a now-deceased UAW vice president, General Holiefield. Prosecutors said Jewell accepted over $90,000 in illegal payments from Fiat Chrysler for his own benefit and to pay for travel, golf outings, parties and other entertainment for senior UAW leaders. "The parties included thousands of dollars in Fiat Chrysler money spent on 20 boxes of cigars, ultra-premium liquor, personalized bottles of wine, and women paid to light the cigars of senior UAW leaders," federal prosecutors said in a statement on Monday.

2015 Dodge Charger SRT Hellcat revealed [UPDATE]

Wed, 13 Aug 2014Almost immediately after we drove the 2015 Dodge Challenger SRT Hellcat, we began wondering: what's next? Pumping 707 horsepower into the Challenger seemed so crazy - and so intoxicating - we just assumed that Dodge would try that trick again.

Rumors swirled about a Charger Hellcat. Frankly it makes even more sense than the Challenger version. The Charger is a bigger car, and Dodge has never been shy about dropping monster engines under its hood. Hell (cat), we've seen Charger mules running around town that appeared to be the super sedan.

And finally, it's here. The 2015 Dodge Charger SRT Hellcat was revealed today at a preview event near Detroit, and it will be a centerpiece of the Chrysler display this weekend at the Woodward Dream Cruise.

The UAW's 'record contract' hinges on pensions, battery plants

Thu, Oct 12 2023DETROIT - After nearly four weeks of disruptive strikes and hard bargaining, the United Auto Workers and the Detroit Three automakers have edged closer to a deal that could offer record-setting wage gains for nearly 150,000 U.S. workers. General Motors, Ford Motor and Chrysler parent Stellantis have all agreed to raise base wages by between 20% and 23% over a four-year deal, according to union and company statements. Ford and Stellantis have agreed to reinstate cost-of-living adjustments, or COLA. The companies have offered to boost pay for temporary workers and give them a faster path to full-time, full-wage status. All three have proposed slashing the time it takes a new hire to get to the top UAW pay rate. The progress in contract talks follows the first-ever simultaneous strike by the UAW against Detroit's Big Three automakers. The union began the strike on Sept. 15 in hopes of forcing a better deal from each major automaker. But coming close to a deal is not the same thing as reaching a deal. Big obstacles remain on at least two major UAW demands: restoring the retirement security provided by pre-2007 defined benefit pension plans, and covering present and future joint- venture electric vehicle battery plants under the union's master contracts with the automakers. On retirement, none of the automakers has agreed to restore pre-2007 defined-benefit pension plans for workers hired after 2007. Doing so could force the automakers to again burden their balance sheets with multibillion-dollar liabilities. GM and the former Chrysler unloaded most of those liabilities in their 2009 bankruptcies. The union and automakers have explored an approach to providing more income security by offering annuities as an investment option in their company-sponsored 401(k) savings plans, people familiar with the discussions said. Stellantis referred to an annuity option as part of a more generous 401(k) proposal on Sept. 22. Annuities or similar instruments could give UAW retirees assurance of fixed, predictable payouts less dependent on stock market ups and downs, experts said. Recent changes in federal law have removed obstacles to including annuities as a feature of corporate 401(k) plans, said Olivia Mitchell, a professor at the University of Pennsylvania Wharton School and an expert on pensions and retirement. "Retirees want a way to be assured they won't run out of money," Mitchell said.