Vehicle Title:Clear

Engine:V6

Fuel Type:Gasoline

For Sale By:Private Seller

Transmission:Automatic

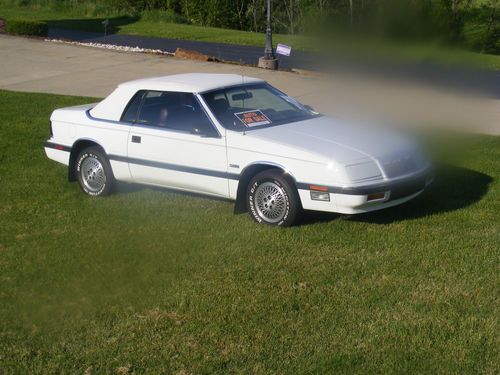

Model: LeBaron

Options: CD Player, Convertible

Mileage: 79,500

Power Options: Air Conditioning, Power Windows

Exterior Color: Silver

Interior Color: Gray

Timeless Chrysler LeBaron convertible in near perfect condition. Fantastically low kms - 79,500kms! Maintained annually and only owned by one owner. Interior is in fantastic condition and compliments nicely with the V6 engine.

Chrysler LeBaron for Sale

1986 chrysler lebaron base convertible 2-door 2.2l

1986 chrysler lebaron base convertible 2-door 2.2l Only 66k miles gtc convertible 2 dr runs drives great xtra clean must see coupe(US $4,995.00)

Only 66k miles gtc convertible 2 dr runs drives great xtra clean must see coupe(US $4,995.00) 1984 chrysler lebaron base convertible 2-door 2.2l

1984 chrysler lebaron base convertible 2-door 2.2l 1979 chrysler lebaron 2dr coupe w/ super six.

1979 chrysler lebaron 2dr coupe w/ super six. 1988 chrysler turbo convertible excellent no reserve 45000 actual miles

1988 chrysler turbo convertible excellent no reserve 45000 actual miles Chrysler: mark cross limited edition convertible

Chrysler: mark cross limited edition convertible

Auto blog

FCA's profit rises ahead of Peugeot merger

Thu, Feb 6 2020MILAN — Fiat Chrysler (FCA) posted a 7% rise in fourth-quarter profit on Thursday, boosted by strong business in North America and better results in Latin America as it heads into a merger with France's PSA. The Italian-American carmaker said adjusted earnings before interest and tax (EBIT) rose to 2.12 billion euros ($2.3 billion), in line with a 2.11 billion forecast in Reuters poll of analysts. That left its adjusted operating profit for the year at 6.67 billion euros ($7.34 billion), just shy of its target of over 6.7 billion euros. Its adjusted EBITDA margin came in at 6.2%, in line with its target of more than 6.1%. A trader said Fiat Chrysler results were "a touch above" expectations and the carmaker's shares in Milan were up 3.4% at 1300 GMT following the results. Fiat Chrysler and Peugeot maker PSA agreed in December to combine forces in a $50 billion deal to create the world's No. 4 carmaker, in response to slower global demand and the mounting cost of making cleaner cars amid tighter emissions rules. Chief Executive Mike Manley said last month that talks with PSA were progressing well and that he hoped to complete the deal by early 2021. FCA reiterated its plan to boost adjusted EBIT to above 7 billion euros ($7.7 billion) this year. In slides prepared for an analyst call, FCA said it was monitoring the global impact of coronavirus in China. FCA operates in the country through a loss-making joint venture with Guangzhou Automobile Group (GAC) and has a 0.35% share of the Chinese passenger car market. Reporting by Giulio Piovaccari; Additional reporting by Danilo Masoni; Editing by Stephen Jewkes, Jason Neely and David Clarke. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Dodge Demon's deliverer? FCA files for 'Angel' trademark

Thu, Aug 3 2017We've driven the Dodge Demon, and despite its satanic overtones and 840 freakin' horsepower under the hood, the car is actually quite well-behaved. At least it didn't bite our head off or drag us into any sort of inferno. Still, Dodge might be looking to balance its lineup with something with a bit more righteous, as FCA has filed for a trademark of the moniker "Angel."... According to the United States Patent and Trademark Office, FCA filed the application on July 17, 2017, and it applies to "Motor vehicles, namely, passenger automobiles, their structural parts, trim and badges." Essentially, that's all the information we have to go on at this point. It could mean that Dodge is planning to further capitalize on the Demon name by creating another variant, or a completely different car. But what's the opposite of the Demon? Could it be a more road-friendly version of the drag-focused Demon? (And wouldn't that just be a Hellcat Widebody with more power?) Maybe it's a performance hybrid, as FCA CEO Sergio Marchionne recently said that the automaker would electrify half its fleet by 2022. For now, we can merely speculate as to what the Angel would be. And you can, too. Get at it in the comments section, below. And while you're at it, what name do you think FCA should trademark next, and what sort of car would that be?Related Video: Related Gallery 2018 Dodge Challenger SRT Demon: First Drive View 37 Photos News Source: US Patent and Trademark Office via FCA Authority Auto News Chrysler Dodge Future Vehicles Performance FCA trademark dodge demon

Stocks down as automakers, Boeing lead China's hit list in trade spat

Wed, Apr 4 2018Shares in U.S. exporters of everything from planes to tractors fell on Wednesday after China retaliated against the Trump administration's tariff plans by proposing duties on key U.S. imports including soybeans, beef and chemicals. U.S. automakers' products are prominent on China's list of tariff targets, yet shares of automakers ended higher on Wednesday as Wall Street stocks changed course in the afternoon when investors' trade fears subsided. Tesla shares closed 7.3 percent higher at $286.94, Ford shares gained 1.6 percent to close at $11.33, and GM shares were up 3 percent at $38.03. Aircraft maker Boeing closed down 1 percent, weighing the most on the Dow Jones Industrial Average as documents from China's Ministry of Commerce and the U.S. manufacturer showed the move would affect some older Boeing narrowbody models. It was not immediately clear how much the tariffs would impact its newer aircraft. Boeing said it was assessing the situation while analysts from JP Morgan said the proposals from China looked to have been calibrated carefully to avoid a major impact on the planemaker. Fellow Dow component 3M lost as much as 2.4 percent. And farming equipment maker Deere lost nearly $10 per share at its lowest. The company urged the two countries to work toward a resolution to "limit uncertainty for farmers and avoid meaningful disruptions to agricultural trade." The speed with which the trade spat between Washington and Beijing is ratcheting up — the Chinese government took less than 11 hours to respond with its own measures — led to a sharp selloff in global stock markets and commodities. China was hitting back against U.S. President Donald Trump's plans to impose tariffs on $50 billion in Chinese goods with similar tariffs on U.S. goods even as Trump said the country is "not in a trade war with China." "Everybody knew they were going to retaliate. The question was how strong of a retaliation. Today's move clearly shows that they mean business," said Adam Sarhan, chief executive of 50 Park Investments in New York. China levied 25 percent additional tariffs on U.S. goods, but unlike Washington's list that covers many obscure industrial items, Beijing's covers 106 key U.S. imports including soybeans, planes, cars, whiskey and chemicals. Trump denied that the tit-for-tat moves amounted to a trade war between the world's two economic superpowers.