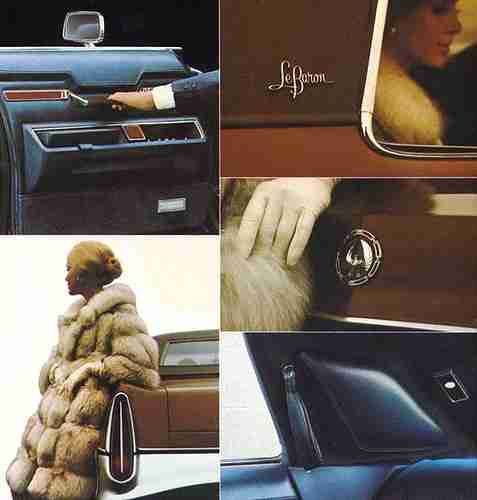

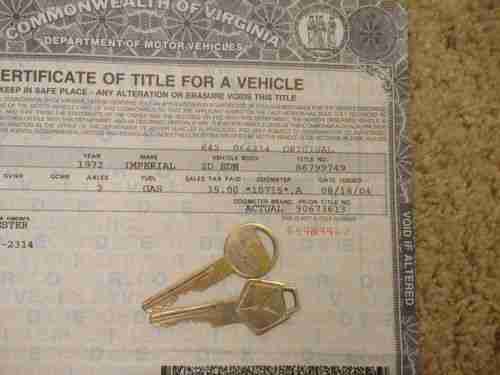

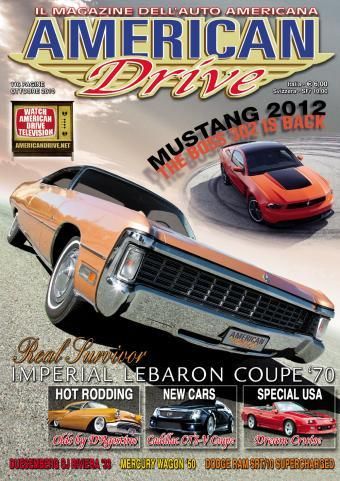

Imperial Lebaron 2-door 1 Of 2,322 Made,10,753 Actual Miles! Fury,monaco,charger on 2040-cars

Williamsburg, Virginia, United States

Vehicle Title:Clear

Engine:7.2L 440Cu. In. V8 GAS Naturally Aspirated

Fuel Type:GAS

Mileage: 10,753

Make: Chrysler

Number of Cylinders: 8

Model: Imperial

Trim: LeBaron Hardtop 2-Door

Drive Type: U/K

Chrysler Imperial for Sale

1967 chrysler imperial crown 7.2l(US $7,450.00)

1967 chrysler imperial crown 7.2l(US $7,450.00) 1981 chrysler imperial (with rare factory moonroof )

1981 chrysler imperial (with rare factory moonroof ) 1963 chrysler crown imperial southamptom hardtop coupe not ford or chevrolet

1963 chrysler crown imperial southamptom hardtop coupe not ford or chevrolet Chrysler imperial lebaron coupe. real survivor! incredible 25000 original miles!(US $29,900.00)

Chrysler imperial lebaron coupe. real survivor! incredible 25000 original miles!(US $29,900.00) 1951 chrysler imperial crown 5.4l no reserve(US $9,000.00)

1951 chrysler imperial crown 5.4l no reserve(US $9,000.00) Crown coupe(US $4,000.00)

Crown coupe(US $4,000.00)

Auto Services in Virginia

Winkler Automotive Service Center ★★★★★

Williamsons Body Shop & Wrecker Service ★★★★★

Wells Auto Sales ★★★★★

Variety Motors ★★★★★

Valley Collision Repair Inc ★★★★★

Tidewater Import Auto Repair LLC ★★★★★

Auto blog

Junkyard Gem: 1982 Chrysler LeBaron Convertible

Sat, Mar 28 2020Things looked very grim at Chrysler during the late 1970s, as Oil Crisis-shocked car shoppers avoided buying thirsty land yachts and ancient-technology compacts in droves. The Carter administration grudgingly bailed out the company with loan guarantees in 1979 (leaving "small enough to fail" American Motors to seek help from the French government) and Chrysler needed a huge sales hit in a big hurry. Under the leadership of Lee Iacocca (freshly canned by Henry Ford II), Chrysler developed the modern, front-wheel-drive K Cars and the company was saved. The very first K Cars hit the road for the 1981 model year, and I'm always on the lookout for those historic early Ks when I'm searching for interesting bits of automotive history in junkyards. The '81 and '82s have become nearly impossible to find, but this once-plush LeBaron convertible appeared in a Northern California yard last month. While a bafflingly complex family tree of K-derived vehicles grew up in Chrysler showrooms through 1995 (including the hot-selling Caravan/Voyager/Town and Country minivans), the only "true" US-market K-Cars are the Dodge Aries, Dodge 400/600 coupe, Plymouth Reliant and Chrysler LeBaron. 1982 was the first model year for the K LeBaron and this car was built in March of that year, so we're looking at one of the very early successors to the Dodge Diplomat-based LeBarons of the 1970s. Chrysler developed a homegrown 2.2-liter, overhead-cam straight-four engine that proved very successful, and a 94-horsepower version of that engine was the base powerplant for the 1982 LeBaron. This car appears to have just about every option available that year, so of course the original buyer went for the 2.6-liter Mitsubishi Astron straight-four. With hemispherical combustion chambers, the 2.6 could be called a Hemi (a few Ks even got "2.6 HEMI" badging); horsepower came to just 93 in 1982, but the 132 pound-feet of torque beat out the 117 lb-ft of the Chrysler 2.2 that year. Silver-faced gauges and complicated radio controls were all the rage during the Late Malaise Era, and this car has both. Note the Chronometer next to the HVAC controls, a digital design with green vacuum-fluorescent display lifted from the previous-generation rear-wheel-drive LeBaron. The non-cloth bits of the convertible-top mechanism look decent enough, so perhaps some junkyard-shopping LeBaron owner will rescue them.

SRT Viper plant idled over slow sales [UPDATE]

Wed, Mar 19 2014The SRT Viper is taking an extended production break later this spring while the factory copes with low demand and gears up for the 2015 model year. Chrysler will idle the Conner Avenue Assembly Plant from April 14 to June 23, and 91 employees there will be laid off during that time. Sales have been slow so far this year, with just 91 Vipers sold in the first two months of 2014 (591 were sold all last year), according to The Detroit News. According to Chrysler, this is all part of the plan for the Viper. The automaker says that the Connor Avenue factory was meant to fluctuate in this way because it only builds one vehicle, and the sports coupe was never meant to be a mass-production vehicle. The company claims that idling the plant will allow it to manage showroom inventories. "Customer and dealer demand for the SRT Viper continues at expected levels," said Chrysler spokesperson Dianna Gutierrez to The Detroit News. SRT hasn't revealed what changes are planned for the 2015 model. This isn't the first time we've heard of the Viper's weak demand. As of October 2013, SRT had hoped to build around 2,000 examples, but only about 1,000 had been made. At that point, officials then revealed production would likely be scaled back. We've contacted the Chrysler for further information, and we'll update this post if and when we hear back. UPDATE: Chrysler has passed along this official statement regarding the plant idling: Chrysler Group confirms that its Conner Avenue Assembly Plant will be down, beginning the week of April 14. Production will resume the week of June 23. Ninety-one UAW-represented employees will be laid off during this time. The SRT Viper is a hand-crafted American exotic car that is designed for a specific consumer that values performance, style and exclusivity. It has never been intended to be a mass-production vehicle as less than 29,000 vehicles have been produced in the past 20 years. The ability to increase and decrease production at the Conner Avenue Assembly Plant allows the company to continue to meet our customers' desire to keep these special cars exclusive. We will be able to take advantage of this transition to manage dealer inventories.

Bailout dealership cuts did their job as profits surge

Tue, 01 Oct 2013Almost five years after US taxpayers bailed out General Motors and Chrysler, a large majority of their slimmed-down dealership networks are posting soaring profits, Bloomberg reports, and contributing to the US auto industry on track this year to deliver 15.4 million vehicles, the most since 16.15 million were delivered in 2007.

Consider another important figure: Bloomberg says that more than 90 percent of GM dealerships are profitable, compared to about half of them in 2008 and 2009. At the start of 2013, GM had 4,355 US dealerships and Chrysler had about 2,600. Compare that with just a few years ago, when GM had 6,246 dealers in 2008, while Chrysler had 3,200 in 2009.

As part of their bankruptcy restructuring, both GM and Chrysler decided that their retail networks contained far too many dealerships and insisted that they be slimmed down. The resultant dealership terminations followed by a rebounding auto market - in part due to better new GM and Chrysler vehicles - have increased the number of sales per dealership to record levels. Many dealers are taking advantage of increasing profits and investing in facility renovations and updates, such as Chrysler dealership owner David Kelleher. He's spending $2 million to expand his store.