1972 Chrysler Imperial Lebaron Hardtop 4-door 7.2l on 2040-cars

Guymon, Oklahoma, United States

Engine:7.2L 7212CC 440Cu. In. V8 GAS OHV Naturally Aspirated

Vehicle Title:Clear

Body Type:Hardtop

Fuel Type:GAS

For Sale By:Private Seller

Mileage: 85,178

Make: Chrysler

Exterior Color: Blue

Model: Imperial

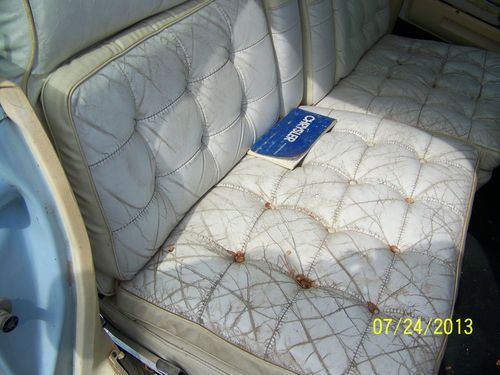

Interior Color: White

Trim: LeBaron Hardtop 4-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: U/K

Number of Cylinders: 8

Power Options: Power Windows

Disability Equipped: No

1972 Chrysler Imperial LeBaron, car starts and runs, I would still pull it on a trailer and not plan on driving it home, the kinda feel like they are sticking and they don't have much stopping power, the brake reservoir was empty when I started it and i just put some in it I didn't bleed them, Paint and bumpers are in great shape except the rust on the quarter panels, Crack in the windshield on passenger side, seats show cracking but no holes in them. Car needs to be picked up within 2 weeks after auction ends, Please do your research on getting it shipped before you bid as it is not cheap. If you have any questions I will do my best to answer them, thanks!!

Chrysler Imperial for Sale

1951 imperial club coupe--few built---rock solid----very rare(US $5,650.00)

1951 imperial club coupe--few built---rock solid----very rare(US $5,650.00) 1954 chrysler imperial

1954 chrysler imperial 1983 chrysler imperial no reserve!!!!!!

1983 chrysler imperial no reserve!!!!!! 1963 imperial lebaron hardtop barn find estate car

1963 imperial lebaron hardtop barn find estate car How rare and beautiful 1983 chrysler imperial really well mantained drives great

How rare and beautiful 1983 chrysler imperial really well mantained drives great 1981 chrysler imperial; featured at the w.p. chrysler museum (2012)

1981 chrysler imperial; featured at the w.p. chrysler museum (2012)

Auto Services in Oklahoma

Stillwater Safety Lane ★★★★★

Standard Machine ★★★★★

Russell`s Wheel Alignment & Brake Service, LLC ★★★★★

Roberts Len Enterprises Inc ★★★★★

Puckett`s Inc ★★★★★

Priest Brothers ★★★★★

Auto blog

Ferrari IPO could come any day now

Sun, Jul 12 2015According to Bloomberg, Fiat Chrysler Automotive Sergio Marchionne told reporters at the Toronto Global Forum that the Ferrari IPO could come any day now. "We are days away from filing the prospectus," said Marchionne, who declined to confirm whether rumors of involvement from UBS Group AG, JPMorgan Chase & Co and Goldman Sachs Group were accurate. In addition to an expected filing in New York, Marchionne hinted that a secondary filing could take place in Milan, Italy. Although the FCA Chief Executive didn't offer any expected sum for Ferrari, he had previously suggested that an IPO for the iconic Italian brand could be worth $1 billion, ringing the registers to the tune of 10 percent of the company's $11 billion valuation. According to Bloomberg, that potential sum is significantly higher than its own internal figures indicate after taking a poll of analysts who we assume must know a heck of a lot more about such things than we do. Considering how close we apparently are to the actual filing, though, we probably won't have to wait long to find out. Another hot topic any time Sergio is the subject of reporter questioning is a potential merger with General Motors or another large, full-line automaker. It seems there aren't any new revelations to reveal on the consolidation front, though Marchionne told reporters there were no plans to mount a hostile takeover of GM or any "other, less optimal" partners. Related Video: News Source: BloombergImage Credit: STR/AFP/Getty Earnings/Financials Chrysler Ferrari Fiat Sergio Marchionne FCA

Auto sales in March and first quarter down nearly across the board

Wed, Apr 3 2019Nearly every major automaker reported weak U.S. sales for March and the first quarter of 2019, citing a rough start to the year, but said a robust economy and strong labor market should encourage consumers to buy more vehicles as 2019 rolls on. GM, which no longer releases monthly sales figures, saw first-quarter sales fall 7 percent, with declines across all brands. Sales of Silverado pickup trucks fell nearly 16 percent and the high-margin Chevy Suburban large SUV dropped 25 percent. Ford also no longer releases monthly sales numbers, but is due to release its first-quarter sales figures on Thursday. According to industry data, Ford's sales fell 2 percent in the quarter and 5 percent in March. Ford representatives did not immediately respond to requests for comment. FCA reported a 7 percent fall in U.S. sales in March and a 3 percent drop for the first quarter. All of FCA's brands dropped in March, except for Ram, which saw a 15 percent increase in pickup truck sales. "The industry had a tough first quarter, but with spring finally starting to show its face and continued strong economic indicators ... we are confident that new vehicle sales demand will strengthen going forward," FCA's U.S. head of sales, Reid Bigland, said in a statement. Toyota reported a 3.5 percent fall in U.S. sales in March and 5 percent for the first quarter, hurt by declining demand for its Corolla sedans and Camry vehicles. "While some of our competitors are abandoning sedans, we remain optimistic about the future of the segment," Toyota said in a statement. Nissan posted a 5.3 percent drop in sales in March, and its first-quarter sales were down 11.6 percent. Honda and Hyundai bucked the trend. Honda's U.S. sales rose 4.3 percent in March and 2 percent in the quarter, while Hyundai's were up 1.7 percent and 2.1 percent, respectively. Passenger-car sales suffered throughout the January-March quarter compared with the same period in 2018 as Americans continued to abandon them in favor of larger, more comfortable pickup trucks and SUVs, which are far more profitable for automakers. The battle for market share in the particularly lucrative large-pickup truck market intensified in the quarter, as Fiat Chrysler Automobiles' Ram brand outsold the U.S.' No. 1 automaker General Motors' Chevrolet-brand trucks. The two automakers have both launched redesigned pickup trucks.

Ferrari officially files SEC paperwork to register future IPO

Thu, Jul 23 2015Late last year FCA announced plans to spin off Ferrari into a separate company, and after a long wait that process has finally become official. The Prancing Horse has now filed the necessary prospectus and other documents with the Securities and Exchange Commission to hold an initial public offering on The New York Stock Exchange. The paperwork doesn't mention a specific date for the Italian sportscar maker's IPO, but it's expected sometime in October. At this point, the documents also don't include some other vital data about the IPO. Ferrari lists neither the number of shares being offered nor their price. The company also doesn't have a stock symbol yet. UBS, BofA Merrill Lynch and Santander are acting as joint book runners for the deal. As part of the IPO, FCA initially intends to sell 10 percent of Ferrari's shares on the stock market. Another 10 percent of the company still belongs to Piero Ferrari. FCA is holding onto the remaining 80 percent in the short term for financial reasons but intends to distribute them to shareholders in early 2016. After the spin-off, about 24 percent of Ferrari would be owned by Exor, 10 percent by Piero Ferrari, and 66 percent by public shareholders, according to the SEC documents. FCA boss Sergio Marchionne believes that Ferrari could be worth over $11 billion. Although, his estimate might be slightly high. According to Reuters, Wall Street is actually putting the value somewhere between $5.5 billion and $11 billion. If you're thinking about investing in the company or just want to read the nitty-gritty about the brand's financial health, the entire SEC filing can be read here. Ferrari Files for Initial Public Offering LONDON, July 23, 2015 /PRNewswire/ -- Fiat Chrysler Automobiles N.V. ("FCA") announced today that its subsidiary, New Business Netherlands N.V. (to be renamed Ferrari N.V.), has filed a registration statement on Form F-1 with the U.S. Securities and Exchange Commission ("SEC") for a proposed initial public offering of common shares currently held by FCA. The number of common shares to be offered and the price range for the proposed offering have not yet been determined, although the proposed offering is not expected to exceed 10% of the outstanding common shares. In connection with the initial public offering, Ferrari intends to apply to list its common shares on the New York Stock Exchange.