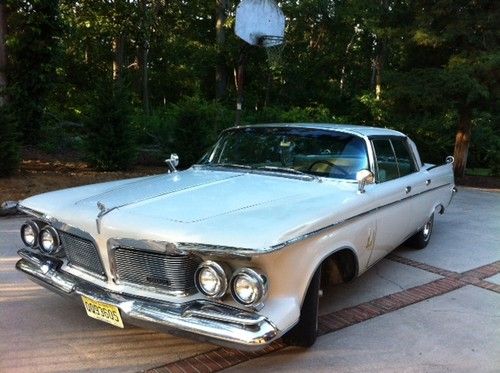

1963 Imperial Lebaron Hardtop Barn Find Estate Car on 2040-cars

Eugene, Oregon, United States

Body Type:Sedan

Vehicle Title:Clear

Engine:413

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chrysler

Model: Imperial

Warranty: Vehicle does NOT have an existing warranty

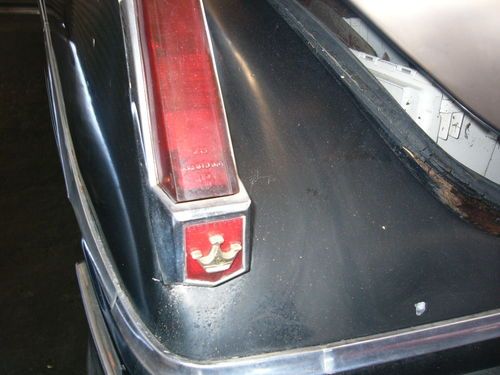

Trim: crown

Power Options: Air Conditioning, Cruise Control, Power Windows

Mileage: 12,038

Exterior Color: Black

Interior Color: Gray

Disability Equipped: No

Number of Cylinders: 8

Chrysler Imperial for Sale

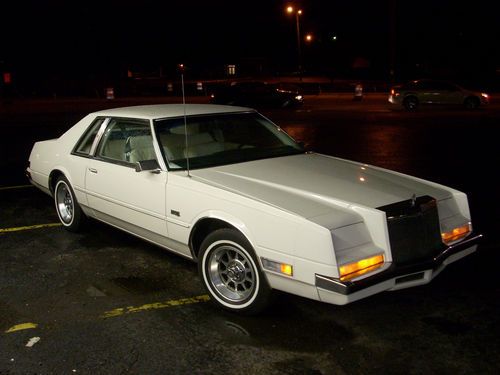

How rare and beautiful 1983 chrysler imperial really well mantained drives great

How rare and beautiful 1983 chrysler imperial really well mantained drives great 1981 chrysler imperial; featured at the w.p. chrysler museum (2012)

1981 chrysler imperial; featured at the w.p. chrysler museum (2012) 1962 chrysler imperial crown convertible(US $15,000.00)

1962 chrysler imperial crown convertible(US $15,000.00) 1962 imperial crown 4 dr sedan great ride!!

1962 imperial crown 4 dr sedan great ride!! 1965 chrysler imperial crown 4 door

1965 chrysler imperial crown 4 door 1964 chrysler imperial base convertible no reserve

1964 chrysler imperial base convertible no reserve

Auto Services in Oregon

Tire Factory Of Mc Minnville ★★★★★

Speed`s Auto Service ★★★★★

Sonny`s Auto Service ★★★★★

Roberson Chrysler Jeep ★★★★★

Rabe`s Auto Upholstery ★★★★★

Pro Auto Wholesale ★★★★★

Auto blog

Fiat shareholders green-light Chrysler merger, end of an Italian era

Fri, 01 Aug 2014Fiat has just taken a major step away from its Italian heritage, as shareholders officially approved the company's merger with Chrysler. That move will lead to the formation of Fiat Chrysler Automobiles NV, a Dutch company based in Great Britain and listed on the New York Stock Exchange, according to Automotive News Europe.

The company captured the two-thirds majority at a special shareholders meeting, although there are still a few situations that could defeat the movement. According to ANE, roughly eight percent of shareholders opposed the merger, which is a group large enough to defeat the plan, should they all exercise their exit rights outlined in the merger conditions.

Meanwhile, Fiat Chairman John Elkann (pictured above, right, with CEO Sergio Marchionne and Ferrari Chairman Luca Cordero di Montezemolo), the great-great-grandson of Fiat founder Giovanni Agnelli, reaffirmed his family's commitment to the company beyond the merger. Exor, the Agnelli family's holding company, still maintains a 30-percent stake in Fiat.

2017 Chrysler Model Year Preview and Updates

Wed, Feb 15 2017FCA's now-iconic minivan is all-new. The 'Town & Country' tag is out, a resurrected CHRYSLER PACIFICA tag is in, and both the design and content are transformational – at least in the context of a minivan available in North America. And for those looking to both capacity and efficiency, Chrysler now offers a plug-in Pacifica hybrid with 30+ miles of all-electric range. While all Pacifica trims represent good value, with federal tax credits the Pacifica Plug-In is great value. 200: In 2017 Chrysler offers a 200 with both a new Dark Appearance package and an Alloy Edition. The 'Alloy' offers a sport-tuned suspension in combination with an all-wheel-drive system featuring a 'sport' mode for better all-season traction. And then, of course, Chrysler discontinued the 200, citing a lack of all-season sales traction. 300: The venerable (translation: 'old') 300 continues the long run with fourth-generation Uconnect, along with the addition of both Apple CarPlay and Android Auto. Beyond that, it's a new year with new colors, trims and packaging. And while the platform may be showing its age, it remains a compelling option for those wanting upmarket content at a reasonably accessible ($30K to $40K) price point.

2015 Chrysler 200 production gets underway [w/videos]

Mon, 17 Mar 2014Chrysler announced recently that it has added some 800 new jobs at its Sterling Heights Assembly Plant (SHAP) to support the production of its all-new 2015 Chrysler 200 sedan. Total employment at the Sterling Heights, MI plant grows to almost 2,800 with the hires, an impressive figure for a plant that was slated for closure in 2010.

Speaking to a crowd of employees and community leaders, Fiat-Chrysler CEO Sergio Marchionne was on hand to celebrate the kick-off of 200 production last week. "We're making a big bet on its success," said Marchionne of the sedan, "we've invested nearly a billion dollars in this facility."

That billion-dollar bill has been used to construct a spanking new paint shop, install a new body shop and install "machinery, tooling and material-handling equipment" according to the Chrysler press release. The company says that SHAP now runs to nearly five million square feet of manufacturing space - loads of room for all the new employees to do their thing - and that the facility can handle multiple vehicles on two unique architectures.