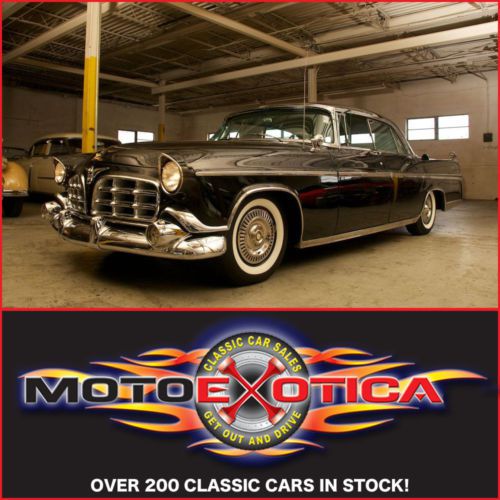

1956 Chrysler Imperial Southampton - P/s - P/b - Rear A/c - 348 Ci V8 - Lqqk!!!! on 2040-cars

Saint Louis, Missouri, United States

Chrysler Imperial for Sale

1956 chrysler imperial 2 door 331 ci spitfire v8

1956 chrysler imperial 2 door 331 ci spitfire v8 1965 chrysler imperial 2dr coupe. beautiful condition!(US $6,499.00)

1965 chrysler imperial 2dr coupe. beautiful condition!(US $6,499.00) 1956 chrysler imperial park avenue no post hemi, rare

1956 chrysler imperial park avenue no post hemi, rare 1964 chrysler imperial convertible

1964 chrysler imperial convertible 1961 chrysler imperial crown southhampton 4dr. hardtop

1961 chrysler imperial crown southhampton 4dr. hardtop 1968 chrysler imperial crown coupe, hot street rod, pro touring look! hardtop!

1968 chrysler imperial crown coupe, hot street rod, pro touring look! hardtop!

Auto Services in Missouri

West County Auto Body Repair ★★★★★

Villars Automotive Center ★★★★★

Tuff Toy Sales ★★★★★

T & K Automotive ★★★★★

Stock`s Underhood Specialist ★★★★★

Schorr`s Transmission, Auto & Truck Service ★★★★★

Auto blog

2018 wrap-up, Ford Ranger and Mercedes A-Class | Autoblog Podcast #566

Fri, Dec 21 2018In the final Autoblog Podcast of 2018, Editor-in-Chief Greg Migliore is joined by Senior Editor Alex Kierstein and Associate Editor Reese Counts. They kick off the conversation by talking about a couple of hot new vehicles: the Ford Ranger and Mercedes-Benz A 220 4Matic. Then they round up the biggest stories of 2018 before helping a listener choose a new car in the "Spend My Money" segment. Thanks for listening, and happy holidays. The Autoblog Podcast will be back next year. Autoblog Podcast #566 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Driving the 2019 Ford Ranger Driving the 2019 Mercedes-Benz A-Class 2018 news roundup The ups and downs of Tesla and Elon Musk Losing Sergio Marchionne and the arrest of Carlos Ghosn Lots of layoffs Trump and tariffs Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

Chrysler and Google launch virtual 200 factory tour [w/video]

Tue, 23 Sep 2014Google is no stranger to showing off some of the most interesting automotive destinations in the world, like the museums for Lamborghini and Ducati, or even a Tesla showroom. However, it's taking that technology even further with a new, in-depth look of the Sterling Heights Assembly Plant where the Chrysler 200 is made. Unlike these earlier online excursions, the new Chrysler factory tour is a fully guided experience that includes several 360-degree videos explaining many parts of the production process.

"Just as we pioneered a completely new Chrysler 200, we are pioneering a new way for consumers to research a vehicle. The Factory Tour is an opportunity for us to prove to consumers that the all-new 2015 Chrysler 200 is not one ever built before," said Olivier Francois, Chrysler's chief marketing officer, in the company's release.

Chrysler was already pretty proud of its nearly $1 billion in recent updates to the Sterling Heights factory having released a look at the 200's assembly process earlier this year. However, the new Google tour goes far deeper by including 12 videos, and between highlighted stops, viewers can swing the camera all over to get a full view of the action. The whole thing is an intriguing way to show the way a modern car gets built.

Fiat Chrysler shares get a boost after revised Stellantis merger deal with PSA

Tue, Sep 15 2020MILAN — Shares in Fiat Chrysler (FCA) rose sharply in Milan on Tuesday after the car maker and French partner PSA revised the terms of their merger deal, with FCA's shareholders getting a smaller cash payout but a stake in another business. FCA and PSA, which last year agreed to merge to give birth to Stellantis, the world's fourth largest car manufacturer, said late on Monday they had amended the accord to conserve cash and better face the COVID-19 challenge to the auto sector. Milan-listed shares in Fiat Chrysler rose almost 8% by 1000 GMT, while PSA gained 1.5%. Under the revised terms, FCA will cut from 5.5 billion euros ($6.5 billion) to 2.9 billion euros the cash portion of a special dividend its shareholders are set to receive on conclusion of the merger. However, PSA will for its part delay the planned spinoff of its 46% stake in car parts maker Faurecia until after the deal is finalized. That means all Stellantis shareholders — and not just the current PSA investors - will get shares in a company which has a market value of 5.8 billion euros. Based on Stellantis' 50-50 ownership structure, FCA and PSA respective shareholders will each receive a 23% stake in Faurecia. Analysts welcomed the 2.6 billion euros in additional liquidity for Stellantis' balance sheet as well as the increase in projected synergies to more than 5 billion euros from 3.7 billion. There was also further reassurance as the two companies confirmed they expected the deal to close by the end of the first quarter of 2021. "All told, the two players emerge as winners," broker ODDO BHF said in a note. "Of the two, FCA might be a bit more of a winner in the short term given the structure of the deal and the numerous payouts to shareholders to come in the quarters ahead (potentially close to 5 billion euros versus the current capitalization of around 16 billion euros)." The special dividend for FCA shareholders had proved contentious after Italy offered state guarantees for a 6.3 billion euro loan to the company's Italian business. "These announcements should, at last, end the debate over the financial terms of the merger, which had become a big topic and was still penalizing the two groups' share performances," ODDO BHF said. PSA and FCA said they would consider paying out 500 million euros to shareholders in each firm before closing or else a 1 billion euro payout to Stellantis shareholders afterwards, depending on market conditions and company performance and outlook.