1954 Chrysler Imperial on 2040-cars

Lake Havasu City, Arizona, United States

Body Type:2 Door

Vehicle Title:Clear

Engine:331 cu in Hemi

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chrysler

Model: Imperial

Mileage: 33,383

Exterior Color: Brown

Warranty: Vehicle does NOT have an existing warranty

Interior Color: Tan

Trim: 2 Door

Number of Cylinders: 8

Drive Type: RWD

Chrysler Imperial for Sale

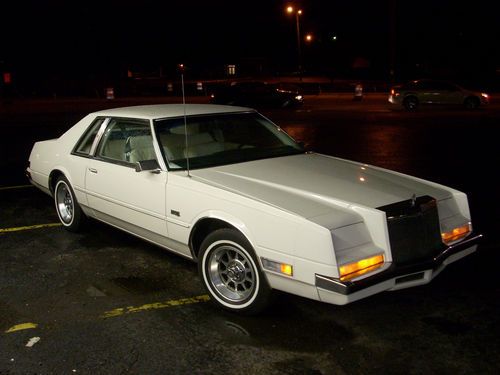

1983 chrysler imperial no reserve!!!!!!

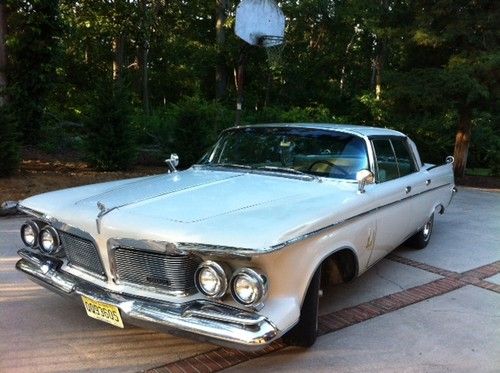

1983 chrysler imperial no reserve!!!!!! 1963 imperial lebaron hardtop barn find estate car

1963 imperial lebaron hardtop barn find estate car How rare and beautiful 1983 chrysler imperial really well mantained drives great

How rare and beautiful 1983 chrysler imperial really well mantained drives great 1981 chrysler imperial; featured at the w.p. chrysler museum (2012)

1981 chrysler imperial; featured at the w.p. chrysler museum (2012) 1962 chrysler imperial crown convertible(US $15,000.00)

1962 chrysler imperial crown convertible(US $15,000.00) 1962 imperial crown 4 dr sedan great ride!!

1962 imperial crown 4 dr sedan great ride!!

Auto Services in Arizona

Tri-City Towing ★★★★★

T & R upholstery & Body Works ★★★★★

Super Discount Transmissions ★★★★★

Stamps Auto ★★★★★

Solar Ray Auto Glass Repair ★★★★★

Sierra Toyota ★★★★★

Auto blog

Automakers, dealers are rushing cars to Houston after Harvey

Thu, Aug 31 2017DETROIT — Houston-area car retailers and automakers are rushing to reopen dealerships and beef up inventory to replace many hundreds of thousands of vehicles damaged in flooding from Hurricane Harvey. Pete DeLongchamps, vice president for manufacturer relations at Group 1 Automotive, the third-largest U.S. auto dealer group, said the company prepared for the storm with a plan designed after Hurricane Katrina in 2005. This included moving moved inventory to higher ground and cleaning roof drains to avoid cave-ins. Group 1 thus lost a "relatively small percentage" of inventory and reopened its roughly 25 dealerships in the Houston and Beaumont area by Thursday. "Things have been moving fast and furious with a large number of tow-ins already," DeLongchamps said. "Our customers have lost a lot of vehicles, we need to help them replace." Harvey brought record flooding to Houston and killed at least 35 people. The storm is expected to briefly depress already slowing U.S. auto sales but could eventually help boost demand as damaged cars are replaced. Automakers report U.S. August sales on Friday. Estimates for the number of Harvey-damaged vehicles needing replacement range up to 500,000. By Thursday, AutoNation, the largest U.S. auto retail chain, had reopened its 17 Houston stores and is moving cars and trucks from other regions, company spokesman Marc Cannon said. The company plans to move 500 to 1,000 used cars to an AutoNation USA used car store and stage a sale Sept. 21-23, when many would-be buyers should have insurance checks to replace destroyed vehicles, Cannon said. AutoNation is still assessing how many vehicles it lost, but it too moved vehicles to higher ground ahead of the storm. General Motors spokesman Jim Cain said the number of damaged vehicles at dealerships "is relatively modest." "But there are still several dealerships that are inaccessible, so the number will increase," he said. GM will move new and used vehicles to Houston, "but it won't be done until the infrastructure and our dealers are ready." Ford is still assessing damage and inventory needs, a spokeswoman said. CarMax, the biggest U.S. used car dealer, will reopen its six Houston area stores on Labor Day, spokeswoman Claire Hunter said. "We are mobilizing additional inventory to the region as we speak," Hunter said. Paul Lips, chief operating officer at ADESA, a unit of KAR Auction Services Inc., which with Manheim dominates the U.S.

Weekly Recap: FCA hit with record fine as NHTSA crackdown continues

Sat, Aug 1 2015The National Highway Traffic Safety Administration slapped Fiat Chrysler Automobiles with a record fine this week that could reach $105 million. The punishment comes after NHTSA found problems with the automaker's execution of 23 recalls that affect more than 11 million vehicles. The consent agreement, announced Sunday, calls for FCA to pay a $70-million cash fine and requires the company to spend at least $20 million over a three-year period on industry outreach programs and to beef up old recall campaigns. Failure to comply will result in another $15-million fine. FCA also agreed to federal oversight, which includes an independent monitor to oversee the company's recalls. The $70-million cash fine equals a penalty NHTSA levied on Honda in January. "Fiat Chrysler's pattern of poor performance put millions of its customers and the driving public at risk," NHTSA administrator Mark Rosekind said in a statement. "This action will provide relief to owners of defective vehicles, will help improve recall performance throughout the auto industry, and gives Fiat Chrysler the opportunity to embrace a proactive safety culture." FCA called the deal a "consensual resolution," but admitted that it "failed to timely provide an effective remedy" during certain recalls. "We are intent on rebuilding our relationship with NHTSA and we embrace the role of public safety advocate," the company said in a statement. The announcement kicked off a busy week for the automaker. NHTSA agreed FCA did not need to recall 4.7 million vehicles after an investigation failed to find defects with a power module used in some Jeep, Dodge, and Ram vehicles. A Georgia judge also reduced a civil verdict involving a death in a Jeep Grand Cherokee crash. Amid all of that, the company reported net profit of about 333 million euros, or $364 million in the second quarter on Thursday. OTHER NEWS & NOTES FCA ramps up Hellcat production Despite a decidedly legal and financial week for FCA, there was still time for the performance side of the business to briefly grab the spotlight. The automaker is more than doubling its production of the Dodge Challenger and Charger SRT Hellcats in response to strong demand. The order bank opens the second week of August and production begins in September. FCA will finish up its scheduled 2015 model-year Hellcat builds, and cancel any "unscheduled" versions, though customers will get discounted pricing for 2016.

Ferrari raises $893M, valued at $12B

Wed, Oct 21 2015Ferrari's stock is moving as quickly on the New York Stock Exchange as the brand's iconic sports cars do on the road. The company's incredibly popular initial public offering has already raised $893.1 million by virtue of 17.18 million shares sold for $52 apiece. If the deal's underwriters buy in as well, the figure would grow to $982.4 million. Plus, even after shouldering some of FCA's debt, the automaker carries an enterprise value of $12 billion, Bloomberg reports. Just as the company starts trading on the New York Stock Exchange, the share price is already racing upward, too. As of this writing, Ferrari stock, which is listed under the symbol RACE, is priced at $57.59. At its high so far today, the value reached as high as $60.95. While Ferrari is looking strong, the big winner in this success looks to be FCA because the company should raise $4 billion in the spin-off, according to Bloomberg. With nine percent of the sports car maker on the NYSE and one percent for the underwriters, another 80 percent will be distributed to FCA investors in 2016. When that's through, Exor, the holding company for the Agnelli/Elkann family, should have the largest stake at about 30 percent. Piero Ferrari holds the remaining 10 percent and has no intention to sell it. Related Video: FCA Announces Pricing of Initial Public Offering of Ferrari N.V. Common Shares Fiat Chrysler Automobiles N.V. (NYSE: FCAU/MI: FCA) ("FCA") and its subsidiary Ferrari N.V. ("Ferrari") announce today the pricing of Ferrari's initial public offering of 17,175,000 common shares at an offering price of $52 per share for a total offering size of $893.1 million ($982.4 million if the underwriters exercise the option described below in full). The shares are expected to begin trading on the New York Stock Exchange on Wednesday, October 21, 2015, under the symbol "RACE", and closing of the offering is expected to occur on October 26, 2015. In addition, the underwriters have a 30-day option to purchase an aggregate of up to 1,717,150 common shares of Ferrari from FCA. The offering is intended to be part of a series of transactions to separate Ferrari from FCA. Following completion of this offering, FCA expects to distribute its remaining ownership interest in Ferrari to FCA shareholders at the beginning of 2016. UBS Investment Bank is acting as Global Coordinator for the offering.