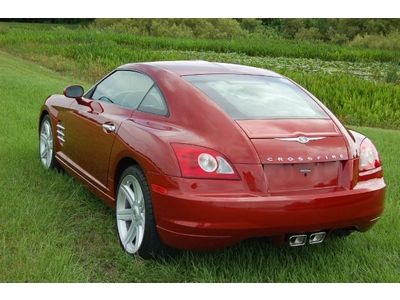

Low Miles, Perfect Carfax !!!, Florida Car on 2040-cars

Osprey, Florida, United States

Engine:3.2L 3200CC 195Cu. In. V6 GAS SOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Coupe

Fuel Type:GAS

Transmission:Unspecified

Warranty: Unspecified

Make: Chrysler

Model: Crossfire

Options: CD Player

Trim: Base Coupe 2-Door

Safety Features: Driver Airbag

Power Options: Power Windows

Drive Type: RWD

Mileage: 79,524

Number of Doors: 2

Sub Model: Coupe

Exterior Color: Red

Number of Cylinders: 6

Interior Color: Gray

Chrysler Crossfire for Sale

2006 chrysler crossfire limited convertible 2-door 3.2l

2006 chrysler crossfire limited convertible 2-door 3.2l 2005 chrysler crossfire convertible limited 2-door 3.2l

2005 chrysler crossfire convertible limited 2-door 3.2l Limited model.rare find.. truly collectible wonderful roadster. clean car fax .(US $18,800.00)

Limited model.rare find.. truly collectible wonderful roadster. clean car fax .(US $18,800.00) 2 door coupe srt6 lowmiles coupe automatic 3.2l v6 supercharged 330 hp 310 mopar

2 door coupe srt6 lowmiles coupe automatic 3.2l v6 supercharged 330 hp 310 mopar Clean carfax like new local trade automatic alloy wheels must see limited

Clean carfax like new local trade automatic alloy wheels must see limited Salvage repairable rebuildable project 05 crossfire easy fix low reserve 83k

Salvage repairable rebuildable project 05 crossfire easy fix low reserve 83k

Auto Services in Florida

Xtreme Auto Upholstery ★★★★★

Volvo Of Tampa ★★★★★

Value Tire Loxahatchee ★★★★★

Upholstery Solutions ★★★★★

Transmission Physician ★★★★★

Town & Country Golf Cars ★★★★★

Auto blog

Fiat Chrysler's Marchionne is done talking about alliances

Sat, Apr 15 2017AMSTERDAM (Reuters) - Fiat Chrysler Chief Executive Sergio Marchionne rowed back on his search for a merger on Friday, saying the car maker was not in a position to seek deals for now and would focus instead on following its business plan. Marchionne had repeatedly called for mergers in the car industry and a tie-up has long been seen as the ultimate aim of his relaunch of Fiat Chrysler, which he is due to leave in early 2019 after 15 years at the helm. He sought a merger with General Motors two years ago but was rebuffed. Only last month he said Volkswagen - the market leader in Europe - may agree to discuss a tie-up with FCA in reaction to rival PSA Group's acquisition of Opel. Marchionne told the annual general meeting in Amsterdam he still saw the need for car companies to merge to better shoulder the large investments needed, but said Fiat Chrysler was not talking to Volkswagen. "On the Volkswagen issue, on the question if there are ongoing discussions, the answer is no," he said. He added, without elaborating, that Fiat Chrysler was not at a stage where it could discuss any alliances. "The primary focus is the execution of the plan," he said. FCA has pledged to swing to a 5 billion euro net cash position by 2018, from net debt of 4.6 billion euros at the end of 2016 - an achievement that Marchionne has said would put it in a better position to strike a deal in the future. Volkswagen, which is still reeling from an emissions scandal that hurt its profits, initially spurned FCA's approach. However, CEO Matthias Mueller said last month the group had become more open on the issue of tie-ups and invited Marchionne to speak to him directly rather than with the press. Fiat Chrysler Chairman John Elkann underlined the message that finding a merger partner was not a priority. "I'm not interested in a big merger deal," he said. "Historically, deals are struck at times of difficulty ... we don't want to be in trouble." Elkann is the scion of Fiat's founder and top shareholder the Agnelli family. He has said in the past he was prepared to have the Agnelli's stake severely diluted in exchange for a minority holding in a larger auto group. "I believe the priority for FCA is to press ahead with this ambitious (business) plan despite the difficult environment," he said. FCA pledged in January to nearly halve net debt this year, as part of the 2018 plan. Doubts remain about its exposure to a peaking U.S.

2015 Chrysler 300 First Drive [w/video]

Mon, Dec 22 2014When Chrysler last updated its 300 in 2011, the fullsize sedan market was a very different place than it is today. Ford's redesigned Taurus was in showrooms, sure, but segment stalwarts like the Toyota Avalon and Chevrolet Impala were languishing at the tail end of their model cycles. And still, the second-generation 300 (not counting the "letter series" cars from the 1950s and '60s, of course) failed to recapitulate the booming success of the model reboot in 2004. Something in the combination of the down economy, higher gas prices and great product from front-wheel-drive entries in the class kept the 300 from the six-digit sales numbers it saw in the early 2000s. For the 2015 model year, Chrysler hopes that a more clearly defined purpose for its big sedan, combined with liberal dipping into the corporate tech toy box, will rekindle buyer interest. Considering the mild characters and front-driver dynamics of its mainstream competition, the promise of V8 power and rear-wheel drive should at least turn the heads of those looking for a car with a little edge. I grabbed the keys of the edgiest of the bunch, the sport-intended 300S, and found a big sedan that gives away some practicality to the rest of its segment mates. The trade-off for the dip in pragmatism is an uptick and driving fun and attitude that should make all the difference for the right buyer. Even though the hard-to-miss face of the 300 has come in for another nip and tuck, that attitude is still clearly on display, too. The grille of the 300 is some 33-percent larger than the outgoing model, though it's still far less brutal than the throwback styling of the 2005 "Baby Bentley" car, at least to my eyes. The cheese grater insert is metallic in most trims of the 300, though the 300S you see in my photo set gets the meaner blacked-out treatment. A quick scroll through our gallery will show you that the rest of the 300 has been similarly changed but not reinvented. Light clusters front and rear are revised, the rear clip has been re-forged with less busy styling, and the whole car has been de-chromed to a large extent (this 300S is wearing the least blingy outfit of the bunch). That rear spoiler is S-model specific. I held the existing 300 interior in fairly high regard, and this new car improves on that base.

Stellantis invests more than $100 million in California lithium project

Thu, Aug 17 2023Stellantis said it would invest more than $100 million in California's Controlled Thermal Resources, its latest bet on the direct lithium extraction (DLE) sector amid the global hunt for new sources of the electric vehicle battery metal. The investment by the Chrysler and Jeep parent announced on Thursday comes as the green energy transition and U.S. Inflation Reduction Act have fueled concerns that supplies of lithium and other materials may fall short of strong demand forecasts. DLE technologies vary, but each aims to mechanically filter lithium from salty brine deposits and thus avoid the need for open pit mines or large evaporation ponds, the two most common but environmentally challenging ways to extract the battery metal. Stellantis, which has said half of its fleet will be electric by 2030, also agreed to nearly triple the amount of lithium it will buy from Controlled Thermal, boosting a previous order to 65,000 metric tons annually for at least 10 years, starting in 2027. "This is a significant investment and goes a long way toward developing this key project," Controlled Thermal CEO Rod Colwell said in an interview. The company plans to spend more than $1 billion to separate lithium from superhot geothermal brines extracted from beneath California's Salton Sea after flashing steam off those brines to spin turbines that will produce electricity starting next year. That renewable power is expected to cut the amount of carbon emitted during lithium production. Rival Berkshire Hathaway has struggled to produce lithium from the same area given large concentrations of silica in the brine that can form glass when cooled, clogging pipes. Colwell said a $65 million facility recently installed by Controlled Thermal can remove that silica and other unwanted metals. DLE equipment licensed from Koch Industries would then remove the lithium. "We're very happy with the equipment," he said. "We're going to deliver. There's just no doubt about it." Stellantis CEO Carlos Tavares called the Controlled Thermal partnership "an important step in our care for our customers and our planet as we work to provide clean, safe and affordable mobility." Both companies declined to provide the specific investment amount. Controlled Thermal aims to obtain final permits by October and start construction of a commercial lithium plant soon thereafter, Colwell said. Goldman Sachs is leading the search for additional debt and equity financing, he added.