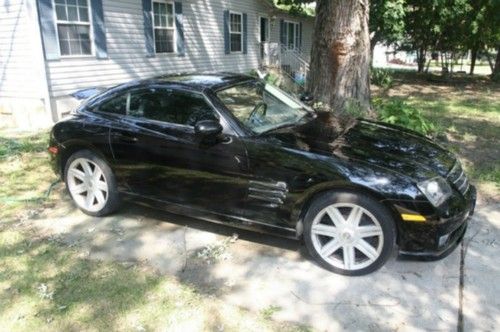

2005 Chrysler Crossfire Roadster Limited on 2040-cars

Stafford, Texas, United States

Transmission:Unspecified

Body Type:Convertible

Vehicle Title:Clear

Fuel Type:GAS

CapType: <NONE>

Make: Chrysler

FuelType: Gasoline

Model: Crossfire

Listing Type: Pre-Owned

Trim: Limited Convertible 2-Door

Sub Title: 2005 CHRYSLER Crossfire Roadster Limited

Certification: None

Drive Type: RWD

Mileage: 101,994

BodyType: Coupe

Sub Model: Roadster

Cylinders: 6 - Cyl.

Exterior Color: Yellow

DriveTrain: REAR WHEEL DRIVE

Number of Doors: 2

Warranty: Unspecified

Number of Cylinders: 6

Vehicle Inspection: Vehicle has been Inspected

Chrysler Crossfire for Sale

2005 chrysler crossfire limited convertible 2-door 3.2l

2005 chrysler crossfire limited convertible 2-door 3.2l 2005 chrysler crossfire ltd roadster htd seats 18's 48k texas direct auto(US $13,980.00)

2005 chrysler crossfire ltd roadster htd seats 18's 48k texas direct auto(US $13,980.00) 2004 chrysler crossfire automatic heated leather 49k mi texas direct auto(US $12,980.00)

2004 chrysler crossfire automatic heated leather 49k mi texas direct auto(US $12,980.00) Florida limited convertible two tone leather auto carfax certified 67k new tires(US $13,977.00)

Florida limited convertible two tone leather auto carfax certified 67k new tires(US $13,977.00) 2007 chrysler crossfire coupe 46k miles!

2007 chrysler crossfire coupe 46k miles! 2005 chrysler crossfire coupe limited automatic low miles(US $15,977.00)

2005 chrysler crossfire coupe limited automatic low miles(US $15,977.00)

Auto Services in Texas

Zeke`s Inspections Plus ★★★★★

Value Import ★★★★★

USA Car Care ★★★★★

USA Auto ★★★★★

Uresti Jesse Camper Sales ★★★★★

Universal Village Auto Inc ★★★★★

Auto blog

Stellantis is official: FCA and PSA merger finally sealed

Sat, Jan 16 2021MILAN — Fiat Chrysler and PSA sealed their long-awaited merger on Saturday to create Stellantis, the world's fourth-largest auto group with deep enough pockets to fund the shift to electric driving and take on bigger rivals Toyota and Volkswagen. It took over a year for the Italian-American and French automakers to finalize the $52 billion deal, during which the global economy was upended by the COVID-19 pandemic. They first announced plans to merge in October 2019, to create a group with annual sales of around 8.1 million vehicles. "The merger between Peugeot S.A. and Fiat Chrysler Automobiles N.V. that will lead the path to the creation of Stellantis N.V. became effective today," the two automakers said in a statement. Shares in Stellantis, which will be headed by current PSA Chief Executive Carlos Tavares, will start trading in Milan and Paris on Monday, and in New York on Tuesday. Now analysts and investors are turning their focus to how Tavares plans to address the huge challenges facing the group – from excess production capacity to a woeful performance in China. Tavares will hold his first press conference as Stellantis CEO on Tuesday, after ringing NYSE's bell with Chairman John Elkann. FCA and PSA have said Stellantis can cut annual costs by over 5 billion euros ($6.1 billion) without plant closures, and investors will be keen for more details on how it will do this. Marco Santino, a partner at consultants Oliver Wyman, said he expected Tavares to disclose the outlines of his action plan soon, but without divulging too many details at first. "He has proven to be the kind of person who prefers action to words, so I don't think he will make loud statements or try to over-sell targets," he said. Like all global automakers, Stellantis needs to invest billions in the years ahead to transform its vehicle range for the electric era. But other pressing tasks loom, including reviving the group's lagging fortunes in China, rationalizing its huge global empire and addressing massive overcapacity. "It will be a step by step process, also to allow the market to better appreciate every single move. I don't think we will have all the details before one year," Santino said.

Analysts wary over FCA lawsuit but say emissions not as bad as VW

Wed, May 24 2017MILAN - Any potential fines Fiat Chrysler (FCA) may need to pay to settle a US civil lawsuit over diesel emissions will unlikely top $1 billion, analysts said, adding the case appeared less serious than at larger rival Volkswagen. The US government filed a civil lawsuit on Tuesday accusing FCA of illegally using software to bypass emission controls in 104,000 vehicles sold since 2014, which it said led to higher than allowable levels of nitrogen oxide (NOx) that are blamed for respiratory illnesses. FCA's shares dropped 16 percent in January when the U.S. Environmental Protection Agency (EPA) first raised the accusations, adding the carmaker could face a maximum fine of about $4.6 billion. The stock has been under pressure since. Volkswagen agreed to spend up to $25 billion in the United States to address claims from owners, environmental regulators, U.S. states and dealers. FCA, which sits on net debt of 5.1 billion euros ($5.70 billion), lacks VW's cash pile but analysts said its case looked much less severe. While VW admitted to intentionally cheating, Fiat Chrysler denies any wrongdoing. Authorities will have to prove that FCA's software constitutes a so-called "defeat device" and that it was fitted in the vehicles purposefully to bypass emission controls. Even if found guilty, the number of FCA vehicles targeted by the lawsuit is less than a fifth of those in the VW case. Applying calculations used in the German settlement, analysts estimate potential civil and criminal charges for Fiat Chrysler of around $800 million at most. Barclays has already cut its target price on the stock to take such a figure into account. Analysts also noted that FCA's vehicles are equipped with selective catalytic reduction (SCR) systems for cutting NOx emissions, so it is likely that any problem could be fixed through a software update. "Should this be the case, we estimate a total cost per vehicle of not more than around $100, i.e. around $10 million in aggregate," Evercore ISI analyst George Galliers said in a note. The estimates exclude any additional investments FCA may be asked to make in zero emissions vehicles infrastructure and awareness as was the case with VW. FCA said last week it would update the software in the vehicles in question, hoping it would alleviate the regulators' concern, but analysts said it may have been too little too late. The carmaker is also facing accusations over its diesel emissions in Europe.

Chrysler Town & Country plug-in hybrid minivan coming in 2015

Mon, 06 Oct 2014Among the multitude of models that Fiat Chrysler Automobiles announced as part of its five-year production plan in May was a plug-in hybrid version of the Town & Country minivan for sometime in 2016. However, according to the latest pronouncement from company CEO Sergio Marchionne, that timetable may have been moved forward quite a bit.

Marchionne told Automotive News at the Paris Motor Show that the PHEV minivan would now be launching in late 2015. That strategy does seem a bit confusing, though, because the next-gen platform for the T&C isn't supposed to hit the road until sometime in 2016, according to the plan. So it's not clear whether the boss means the PHEV rides on the current chassis or if the new model is going on sale early.

The technology underpinning the new plug-in hybrid has been shrouded in mystery. However, during the five-year plan meeting, FCA claimed the model could earn fuel economy figures around 75 mpge. Chrysler previously tested a 25-unit fleet of them as part of a demonstration test in Auburn Hills, MI, in 2012, but that didn't go so well.