2005 Chrysler Crossfire Limited Convertible 2-door 3.2l All New Tires! 24-27mpg on 2040-cars

Gig Harbor, Washington, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:V-6

Fuel Type:GAS

For Sale By:253.219.6225

Make: Chrysler

Model: Crossfire

Trim: Limited Convertible 2-Door

Options: Leather Seats, CD Player, Convertible

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: RWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 37,896

Exterior Color: Red

Interior Color: Gray

Number of Doors: 2

Number of Cylinders: 6

On Oct-27-12 at 07:28:37 PDT, seller added the following information:

Please note: this is not covered with any warranty... All sales are final.

Chrysler Crossfire for Sale

2005 chrysler crossfire roadster limited htd pwr leather seats 3.2l v6 automatic(US $14,850.00)

2005 chrysler crossfire roadster limited htd pwr leather seats 3.2l v6 automatic(US $14,850.00) 2006 chrysler crossfire limited coupe 2-door 3.2l

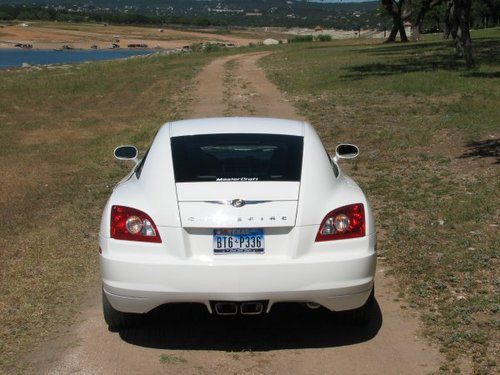

2006 chrysler crossfire limited coupe 2-door 3.2l 2004 chrysler crossfire coupe 6 spd power spoiler 35k texas direct auto(US $11,780.00)

2004 chrysler crossfire coupe 6 spd power spoiler 35k texas direct auto(US $11,780.00) 2008 chrysler crossfire ltd htd leather spoiler 39k mi texas direct auto(US $15,980.00)

2008 chrysler crossfire ltd htd leather spoiler 39k mi texas direct auto(US $15,980.00) 2006 chrysler crossfire limited coupe 2-door 3.2l(US $15,200.00)

2006 chrysler crossfire limited coupe 2-door 3.2l(US $15,200.00) 2006 chrysler crossfire ltd htd leather pwr spoiler 38k texas direct auto(US $15,480.00)

2006 chrysler crossfire ltd htd leather pwr spoiler 38k texas direct auto(US $15,480.00)

Auto Services in Washington

Wild West Cars & Trucks ★★★★★

Walker`s Renton Mazda ★★★★★

Volkswagen Repair ★★★★★

Valley Automotive Specialties ★★★★★

Tveten`s Auto Clinic ★★★★★

Stillbuilt Automotive ★★★★★

Auto blog

2013.5 Chrysler 200 S Special Edition is a Sebring swan song

Wed, 27 Mar 2013

The world is set to get an all-new Chrysler 200 next year, thereby finally putting the bones of the long-serving Sebring to rest. To tide us all over until then, the automaker has released the 2013.5 200 S Special Edition. As a collaboration between Chrysler and the Imported from Detroit clothing line, the sedan features plenty of aesthetic tweaks to give it a bit more attitude. Those include tinted headlamp and taillamp housings, body-color door sills and 18-inch gloss black wheels. There's also a revised front fascia with a black mesh grille, while the tail end gets a decklid spoiler and a revised valance.

Indoors, the seats are clad in black, water-resistant fabric courtesy of Carhartt. Expect to see the 2013.5 200 S Special Edition in dealers soon with a price tag of $28,870. While there are plenty of questions to be asked here, one is more nagging than the others. Why bother buying the special edition when an all-new model is mere months away? It's an age-old question, but it still bears asking. Check out the full press release below for more information.

Car Club USA: Chrysler Power Classic

Wed, Jul 22 2015Car Club USA heads to the Buckeye State for some high-octane drag racing at the Chrysler Power Classic. And for these amateur drag racers, nothing but Mopar muscle will do. "I would say Mopar is kind of a way of life," says Larry Augenstine. "Some people get addicted to lemonade, or beer, [or] drugs. Well, I'm Mopars." Larry drives a 1968 Plymouth Barracuda with a 426 Hemi motor that once belonged to local racing legend Ray Christian. He's joined at the track by Mark Ipsen of the Midwest Nostalgia Pro Stock Association. Mark runs a 1979 AMC Concord with a modified 401 block V8 that he claims has dynoed at just under 1,000 horsepower. The biggest threat to any day on track is Mother Nature, who cast a threatening shadow over National Trail Raceway for much of the event. When the clouds and rain subsided, our cameras captured the grounds crew in action with blowers, torches, and a sticky compound that's sprayed the entire length of the track. Can Larry, Mark, and the rest of these Mopar fanatics make the most of the few runs they'll get? Stay tuned to find out. Each Car Club USA episode features a different car club or event from across the US, where passionate owner communities gather to share automotive experiences and embark on incredible adventures. From Main Street cruises to off-road trails, catch all the latest car club activity on Autoblog. Chrysler Racing Vehicles Performance Car Club USA Videos Original Video autoblog black

Next Jeep Wrangler to get hybrid option?

Wed, Jan 21 2015This may the year a Jeep hybrid is officially announced. Really. The Chrysler division may finally be making plans for its first gas-electric powertrain to help boost the group's fuel economy, says UK's Auto Express, citing Mike Manley, CEO of FCA's Jeep division. The guinea pig of sorts may be the Wrangler, which moved almost a quarter-million units in the US last year. The Wrangler could get a hybrid drivetrain by the 2017 model year, as Jeep executives look to maintain the model's feel and torque while boosting its fuel economy. The Wrangler gets a pretty paltry 18 miles per gallon combined out of its six-cylinder mill, so the bar's set pretty low. Of course, we've heard this talk before. In late 2013, Chrysler Asia-Pacific product planning manager Steve Bartoli told Australia's Drive that a Jeep hybrid was pretty much inevitable, though not much has been mentioned since. FCA could use all the help it can get in the fuel economy department. The group brought up the rear among automakers when it came to fuel efficiency, the US Environmental Protection Agency (EPA) said in its EPA Trends report released last October. The FCA models combined for a 21.1 miles per gallon average for the 2014 model year, compared to the 24.2 mpg overall industry average. The group's only electric vehicle in the US is the low-volume Fiat 500e, though the company may start selling a plug-in hybrid version of its Chrysler Town & Country by the end of the year. Featured Gallery 2014 Jeep Wrangler Polar Edition View 9 Photos News Source: Auto Express Green Chrysler Jeep Fuel Efficiency Hybrid