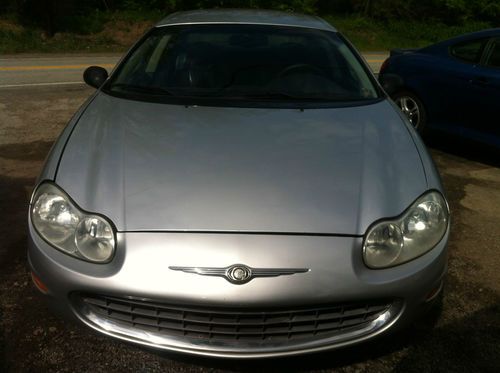

2002 Chrysler Concorde ! No Reserve ! No Resevre ! on 2040-cars

Ontario, California, United States

Transmission:Automatic

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Exterior Color: Tan

Model: Concorde

Interior Color: Tan

Trim: Sedan

Number of Cylinders: 6

Drive Type: Automatic

Mileage: 167,000

Sub Model: Concorde

Chrysler Concorde for Sale

2000 chrysler concorde lxi sedan 4-door 3.2l(US $1,600.00)

2000 chrysler concorde lxi sedan 4-door 3.2l(US $1,600.00) 1999 chrysler concorde lxi auto v6 low miles 71k! clean! no reserve!!

1999 chrysler concorde lxi auto v6 low miles 71k! clean! no reserve!! 1999 chrysler concorde

1999 chrysler concorde 1994 chrysler concorde v6 3.3l engine,97863 original miles,no reserve price,nice

1994 chrysler concorde v6 3.3l engine,97863 original miles,no reserve price,nice 1997 chrysler concorde 1 owner 65k warranty(US $3,499.00)

1997 chrysler concorde 1 owner 65k warranty(US $3,499.00) 2002 chrysler concorde lx sedan 4-door 2.7l(US $6,000.00)

2002 chrysler concorde lx sedan 4-door 2.7l(US $6,000.00)

Auto Services in California

Yuki Import Service ★★★★★

Your Car Specialists ★★★★★

Xpress Auto Service ★★★★★

Xpress Auto Leasing & Sales ★★★★★

Wynns Motors ★★★★★

Wright & Knight Service Center ★★★★★

Auto blog

2015 Chrysler 300 swaggers into LA Auto Show [w/video]

Thu, Nov 20 2014The Chrysler 300 has always exuded a certain brashness, but the chip-on-its-shoulder styling seemed to mellow a bit after its 2011 redesign. Now, the bad boy of the premium sedan segment is getting some of its angry attitude back for 2015, and the refreshed model debuted here at the Los Angeles Auto Show. The grille is larger, the fascia is updated and the lights are redesigned. That doesn't seem like much, but when taken collectively, they give the car a more menacing glare. The inside is freshened with a new seven-inch in-cluster display, better-quality materials and an updated suite of available Uconnect features, and there's a bevy of new active safety features available, too. The engine line continues with the 3.6-liter V6 and the 5.7-liter V8, though they are now both paired with Chrysler's eight-speed automatic. The sedan also received a Sport mode button, which changes the tuning for the steering, engine and transmission, while providing a rear bias for all-wheel drive models. Pricing starts at $31,395, just as it did for the 2014 model. The lineup also gets a new Platinum model with special wood, chrome and leather finishings, though the company also has said it will discontinue the 300's high-performance SRT variant for in the United States. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. New 2015 Chrysler 300: Return of the Big, Bold American Sedan with World-class Levels of Sophistication, Craftsmanship and Technology, Once Again Putting Boulevards and Interstates On Notice The new 2015 Chrysler 300 highlights six decades of ambitious American ingenuity through iconic design proportions inspired by historic 1955 and 2005 models – world-class quality, materials and refinement, best-in-class V-6 highway fuel economy, plus segment-exclusive innovations – all at the same $31,395 starting price as its predecessor.

Ferrari raises $893M, valued at $12B

Wed, Oct 21 2015Ferrari's stock is moving as quickly on the New York Stock Exchange as the brand's iconic sports cars do on the road. The company's incredibly popular initial public offering has already raised $893.1 million by virtue of 17.18 million shares sold for $52 apiece. If the deal's underwriters buy in as well, the figure would grow to $982.4 million. Plus, even after shouldering some of FCA's debt, the automaker carries an enterprise value of $12 billion, Bloomberg reports. Just as the company starts trading on the New York Stock Exchange, the share price is already racing upward, too. As of this writing, Ferrari stock, which is listed under the symbol RACE, is priced at $57.59. At its high so far today, the value reached as high as $60.95. While Ferrari is looking strong, the big winner in this success looks to be FCA because the company should raise $4 billion in the spin-off, according to Bloomberg. With nine percent of the sports car maker on the NYSE and one percent for the underwriters, another 80 percent will be distributed to FCA investors in 2016. When that's through, Exor, the holding company for the Agnelli/Elkann family, should have the largest stake at about 30 percent. Piero Ferrari holds the remaining 10 percent and has no intention to sell it. Related Video: FCA Announces Pricing of Initial Public Offering of Ferrari N.V. Common Shares Fiat Chrysler Automobiles N.V. (NYSE: FCAU/MI: FCA) ("FCA") and its subsidiary Ferrari N.V. ("Ferrari") announce today the pricing of Ferrari's initial public offering of 17,175,000 common shares at an offering price of $52 per share for a total offering size of $893.1 million ($982.4 million if the underwriters exercise the option described below in full). The shares are expected to begin trading on the New York Stock Exchange on Wednesday, October 21, 2015, under the symbol "RACE", and closing of the offering is expected to occur on October 26, 2015. In addition, the underwriters have a 30-day option to purchase an aggregate of up to 1,717,150 common shares of Ferrari from FCA. The offering is intended to be part of a series of transactions to separate Ferrari from FCA. Following completion of this offering, FCA expects to distribute its remaining ownership interest in Ferrari to FCA shareholders at the beginning of 2016. UBS Investment Bank is acting as Global Coordinator for the offering.

Five automakers now being investigated by NHTSA for airbag woes

Thu, 12 Jun 2014It appears that Toyota's renotification to owners of recalled vehicles from last year is just the tip of the iceberg for what could potentially be a much larger industry-wide recall. The National Highway Traffic Safety Administration is opening a preliminary evaluation investigation into roughly 1.1 million vehicles from Chrysler, Honda, Mazda, Nissan, Toyota and parts supplier Takata regarding faulty airbag inflators in several models.

NHTSA has received six reports - three directly, two from Takata and one from Toyota - of vehicles with ruptured airbag inflators from 2002-2006, which resulted in three injuries. So far, all six incidents have occurred in high humidity areas like Florida and Puerto Rico. According to Toyota's latest recall announcement, the inflators may have an improper propellant that could cause it to rupture in a crash and the bag to deploy abnormally.

This new investigation follows a previous recall from April 2013 of about 3.4 million vehicles worldwide for the airbag inflators from Takata. As Autoblog reported, Toyota jumpstarted the new situation when it found that the original list of serial numbers for the faulty part was incomplete and discovered more cars in need of replacement. Honda and Nissan told us that they were investigating whether further models would need called in again as well. Mazda told Autoblog: "Regarding the current Takata situation, we're working closely with NHTSA and investigating the situation, but nothing else to report at this time." Chrysler Group responded to us with the statement: "Chrysler Group engineers are conducting the appropriate analysis. The Company will cooperate fully with the National Highway Traffic Administration."