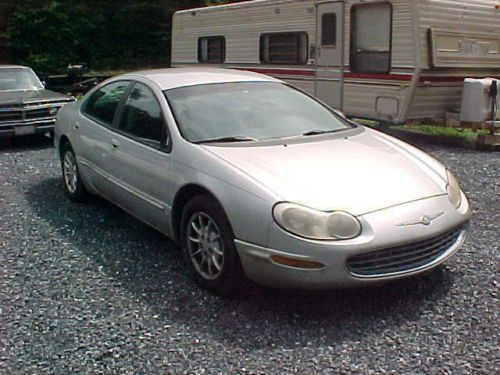

1999 Chrysler Concorde Lx on 2040-cars

5200 Dixie Hwy, Fairfield, Ohio, United States

Engine:Gas V6 2.7L/165

Transmission:4-Speed Automatic w/OD, Electronic

VIN (Vehicle Identification Number): 2C3HD46R2XH806937

Stock Num: FP061416

Make: Chrysler

Model: Concorde LX

Year: 1999

Exterior Color: Stone White

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 68035

Internet special. Price reflects discount for cash buyers. Traditional and special financing is available for qualified buyers. Please contact us first for availability as our cars go fast at near wholesale prices. Prices are subject to change. Sales Tax, Title, License Fee, Registration Fee, Dealer Documentary Fee, Finance Charges, Emission Testing Fees and Compliance Fees are additional to the advertised price. All options and conditions of the vehicles must be verified with the dealer, any descriptions or options that are listed maybe incorrect due to automatic data transfer. Options Installed Air Conditioning,AM/FM Radio,Cassette Player,Child Safety Door Locks,Cruise Control,Driver Airbag,Driver Multi-Adjustable Power Seat,Locking Differential,Passenger Airbag,Power Door Locks,Power Windows,Rear Window Defogger,Steering Wheel Mounted Controls,Tachometer,Tilt Steering,Tilt Steering Column,Vehicle Anti-Theft,GAS,

Chrysler Concorde for Sale

1997 chrysler concorde lxi(US $5,944.00)

1997 chrysler concorde lxi(US $5,944.00) 2003 chrysler concorde lxi(US $4,500.00)

2003 chrysler concorde lxi(US $4,500.00) 2004 chrysler concorde lxi(US $2,695.00)

2004 chrysler concorde lxi(US $2,695.00) 2001 chrysler concorde lx sedan 4-door 3.2l

2001 chrysler concorde lx sedan 4-door 3.2l 2000 chrysler concorde lxi sedan 4-door 3.2l(US $2,800.00)

2000 chrysler concorde lxi sedan 4-door 3.2l(US $2,800.00) Mopar 2000 chrysler concorde 4dr all power 92100 miles

Mopar 2000 chrysler concorde 4dr all power 92100 miles

Auto Services in Ohio

Yocham Auto Repair ★★★★★

Williams Auto Parts Inc ★★★★★

West Chester Autobody ★★★★★

Valvoline Instant Oil Change ★★★★★

Valvoline Instant Oil Change ★★★★★

Sweeting Auto & Tire ★★★★★

Auto blog

2019 Chrysler Pacifica Hybrid minivan gets sinister S package

Fri, Jun 22 2018If you prefer shuttling your kids and their juice boxes to soccer practices and piano recitals with a smaller carbon footprint, but you wanna look gangsta doing it, then has Chrysler got a minivan for you. Starting in July, the automaker will offer the murdered-out S Appearance Package on the Pacifica Hybrid, too, following its "wildly successful" debut in the gasoline combustion version last fall. The details appear to be mostly the same as on the gas versions. Buyers will get lots of exterior gloss black accents, including grille surrounds, eyebrow headlamp accents, and window and rear valance moldings. The front and rear Chrysler wing badges are likewise done in black, but the Hybrid version comes with a special teal insert to highlight its green bonafides. The "Pacifica," "S" and "eHybrid" badges also get the "Black Noise" finish. A black roof rack and 18-inch wheels with "Black Noise" finish are now standard. Inside, the S Appearance brings black seats with gray accents and the "S" logo, light gray stitching and black accents on the wheel, and light gray stitching and the imaginatively named Anodized Ice Cave bezels on the instrument panel and door trim. Everything else in the interior is as blacked-out as your hard-as-nails, tree-hugging soul. You can order the S Appearance Package on the 2019 Pacifica Hybrid models with any exterior paint color, not just black, starting next month, for $595. It'll arrive in showrooms in the fall. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Featured Gallery 2019 Chrysler Pacifica Hybrid S Appearance Package Image Credit: Fiat Chrysler Design/Style Green Chrysler Minivan/Van Electric Hybrid chrysler pacifica hybrid options package trim

eBay Find of the Day: 1979 Chrysler ETV-1 electric car prototype

Mon, 27 Jan 2014Electric cars may be reaching their time in the sun with successes like the Tesla Model S, but the basic concept goes back to practically beginning of motoring. EVs also saw a brief renaissance in the 1970s when automakers were trying find a way around rising fuel prices. This 1979 Chrysler ETV-1 concept for sale on eBay Motors is a great example from that era.

Built in 1979, designers hoped the ETV-1 would preview what an electric car would look like in 1985. The base price was slated to start at $6,400, or the rough equivalent of $20,536, which seems like an optimistic price. General Electric created the ETV-1's powertrain, and Chrysler was in charge of styling. At the time, the Department of Energy called it "the first advanced four-passenger subcompact experimental electric car."

While it seems ancient compared to today's EVs, the ETV-1 featured regenerative braking and a computer-controlled electric motor. Chrysler reported a 100-mile range at 45 miles per hour with two passengers in the car. The range fell to 75 miles with four passengers. Acceleration was not brisk with Chrysler claiming the run to 30 mph in 9 seconds. Power was stored in 18 lead-acid batteries, and a full charge took 10 hours from a home outlet.

Chrysler 300C gets Sport Appearance Package option

Fri, Jun 14 2019In 2017, Chrysler added the option of a Sport Appearance Package to the sporty trim level of the 300 sedan, the 300S. The package added trim pieces from the hot-blooded 300 SRT sedan that we don't get in the U.S., namely the front fascia with LED foglights and SRT-style side skirts. Mopar Insiders reports that as of this month, the same upgrade is available on the top-level 300C trim as the Performance Appearance Package. Whereas the Sport Appearance Package on the V6-powered S model costs $1,795; the 300C's Performance Appearance Package is said to cost $695. We're sure Chrysler knows this isn't the performance upgrade that U.S. 300 buyers want. For reasons best known inside Chrysler, only Australia, New Zealand, and the Middle East get the 300 SRT and its 6.4-liter V8 with 469 horsepower and 469 pound-feet of torque, limited-slip differential, Bilstein dampers, and Brembo brakes. It's possible the absence of the 300 SRT here is because Chrysler wants North American audiences to see Dodge as the performance brand. At this point, however, anyone intending to buy a 300 should be happy the four-door is still on sale. The model is eight years old and hasn't been the subject of anything close to hard news since last September. That's when Automotive News Canada said the car would die in 2020 to make room for the six-passenger Portal concept. The last hard nugget before that was in 2016, when the late Sergio Marchionne told Reuters the 300 could go front-wheel drive on the Pacifica platform — a fate arguably worse than killing the car. Now all we have is rumor and speculation, such as when Road & Track writes a "major refresh [is] ... supposedly being planned already," and sees a possibility that the 300/Charger/Challenger trio live into the next decade. The moral of the story is: The 300's irons could be as hot as they're ever going to get right now. FCA hasn't announced the upgrade package, but Mopar Insider says dealers can get it right now, order code AJU.