2007 Chrysler Aspen, Salvage, Recovered Theft, Runs And Drives, Suv on 2040-cars

Louisville, Kentucky, United States

Body Type:SUV

Engine:4.7L 285Cu. In. V8 GAS SOHC Naturally Aspirated

Vehicle Title:Salvage

Interior Color: Gray

Make: Chrysler

Number of Cylinders: 8

Model: Aspen

Trim: Limited Sport Utility 4-Door

Drive Type: RWD

Options: CD Player

Mileage: 74,251

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Exterior Color: White

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

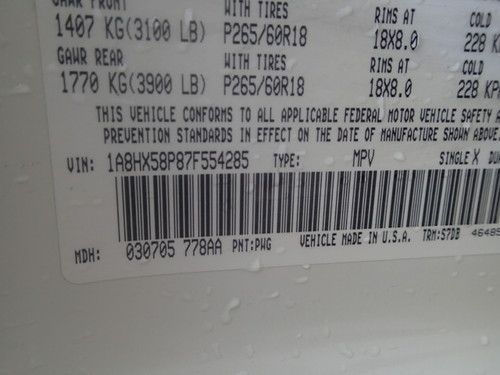

Hello you are bidding on a very nice recovered theft 2007 Chrysler Aspen. The vehicle runs and drives great. The vehicles exterior is very nice, the only flaw on the vehicle is a scuff on the front bumper cover. The engine bay is very nice. The vehicle shows no signs of any previous accidents, all the inner structure looks good, all the paint is on the mounting bolts on the vehicle, and the frame is in good condition. The was no damage done to the vehicles ignition switch or any broken glass on the vehicle. The vehicle does have third row seating. The vehicle is available for inspection,and please feel free to contact me with any questions you have. You can contact me at 502 817 2972. Vehicle is being sold as is. We do not accept paypal on vehicles.

Chrysler Aspen for Sale

2007 chrysler aspen limited sport utility 4-door 5.7l(US $14,500.00)

2007 chrysler aspen limited sport utility 4-door 5.7l(US $14,500.00) 2007 chrysler aspen 2wd 4dr limited

2007 chrysler aspen 2wd 4dr limited 2007 chrysler aspen limited navigation leather sunroof

2007 chrysler aspen limited navigation leather sunroof Arkansas 1owner, nonsmoker, limited, hemi, tv/dvd, heated seats, perfect carfax!(US $16,850.00)

Arkansas 1owner, nonsmoker, limited, hemi, tv/dvd, heated seats, perfect carfax!(US $16,850.00) 2009 chrysler aspen ltd hybrid 4x4 nav rear cam dvd 45k texas direct auto(US $26,480.00)

2009 chrysler aspen ltd hybrid 4x4 nav rear cam dvd 45k texas direct auto(US $26,480.00) 2008 black chrysler aspen hemi limited sport utility 4-door rear bucket seats(US $21,500.00)

2008 black chrysler aspen hemi limited sport utility 4-door rear bucket seats(US $21,500.00)

Auto Services in Kentucky

Triple T Auto Svc ★★★★★

Steve Price Auto Sales Inc ★★★★★

Simpsonville Automotive ★★★★★

Napa Auto Parts - Miller Auto Parts Inc ★★★★★

Napa Auto Parts - Madisonville Auto Parts ★★★★★

Lavalette Tire & Auto ★★★★★

Auto blog

Fiat Chrysler to open $30M autonomous driving test facility in Michigan

Thu, Sep 6 2018Fiat Chrysler said Wednesday it's invested more than $30 million in a new facility to develop and test autonomous vehicle and advanced safety technologies at its Chelsea Proving Grounds in southeast Michigan. The facility is the first of its kind for the automaker, which has mostly relied on partnerships with the likes of Uber and Google subsidiary Waymo to develop the hardware and software used in self-driving vehicles and avoided making large investments itself under former CEO Sergio Marchionne. The company this spring announced plans to deliver as many as 62,000 additional Chrysler Pacifica Hybrid minivans to Waymo and make Waymo's tech available in customer vehicles via a licensing deal. The new facility features a dedicated highway-speed track for testing self-driving cars with obstacles, tunnels and other features, a 35-acre safety feature testing area and a high-tech, 6,500-square-foot command center equipped with computers that can track GPS coordinates and test vehicle-to-infrastructure communications. It will allow FCA to test for different levels of automated driving, automatic electronic braking and automated parking simulations, and test protocols from third parties such as the Insurance Institute for Highway Safety, U.S. New Car Assessment Program and European New Car Assessment Program. Testing starts later this month. "The all-new facility at Chelsea Proving Grounds will help support and enable the successful rollout of the company's five-year plan laid out earlier this year," Mike Manley, FCA's new CEO and chief operating officer for the NAFTA region, said in a statement. "Our ability to test for autonomous and advanced safety technologies enables FCA to offer our customers the features they want across our brand portfolio." The Chelsea Proving Grounds, near Ann Arbor, opened in 1954 and now cover about 4,000 acres. About 900 people work there, the company says. Related Video: Image Credit: Getty Chrysler Fiat Technology Emerging Technologies Autonomous Vehicles Uber Waymo testing

FCA issuing software update for 1.4M vehicles to prevent hacking

Fri, Jul 24 2015In the wake of a Jeep Cherokee being hacked remotely while on the road through its Uconnect infotainment system, FCA US is now issuing a software update for 1.4 million vehicles in the United States. Affected customers will receive a USB stick in the mail with the improved version; owners can check this website to see if their cars are affected. A large variety of models with FCA's 8.4-inch touchscreen infotainment system are affected. They include the 2015 Chrysler 200, 2015 Chrysler 300, 2015 Dodge Charger, and 2015 Dodge Challenger; 2013-2015 Dodge Viper; 2013-2015 Ram 1500, 2500, and 3500; 2013-2015 Ram 3500, 4500, and 5500 chassis cab; 2014-2015 Jeep Grand Cherokee and Cherokee; and 2014-2015 Dodge Durango. According to FCA in its announcement, the new software "insulates connected vehicles from remote manipulation." As of July 23, the company also "fully tested and implemented within the cellular network" additional security to prevent access to many of a vehicle's systems. FCA US says that it's conducting this campaign out of an abundance of caution and disputes the notion that there's a defect with these vehicles. Beyond the demonstration of the hack in the Cherokee, the automaker says that it's unaware of any other reports of these attacks actually happening. Related Video: Statement: Software Update July 24, 2015 , Auburn Hills, Mich. - FCA US LLC is conducting a voluntary safety recall to update software in approximately 1,400,000 U.S. vehicles equipped with certain radios. The recall aligns with an ongoing software distribution that insulates connected vehicles from remote manipulation, which, if unauthorized, constitutes criminal action. Further, FCA US has applied network-level security measures to prevent the type of remote manipulation demonstrated in a recent media report. These measures – which required no customer or dealer actions – block remote access to certain vehicle systems and were fully tested and implemented within the cellular network on July 23, 2015. The Company is unaware of any injuries related to software exploitation, nor is it aware of any related complaints, warranty claims or accidents – independent of the media demonstration.

GM cites evidence of offshore accounts, wants FCA racketeering lawsuit revived

Tue, Aug 4 2020General Motors on Monday asked a U.S. federal judge to reinstate a racketeering lawsuit against Fiat Chrysler Automobiles NV (FCA), saying it has new information on foreign accounts used in an alleged bribery scheme involving its smaller rival and union leaders. In its filing to U.S. District Judge Paul Borman, GM says the scheme, which it alleges occurred between FCA executives and former United Auto Workers (UAW) leaders, "is much broader and deeper than previously suspected or revealed as it involved FCA Group apparently using various accounts in foreign countries ... to control corrupt individuals by compensating and corrupting those centrally involved in the scheme to harm GM." Last month, Borman threw out the racketeering lawsuit, saying the No. 1 U.S. automaker's alleged injuries were not caused by FCA's alleged violations. GM alleged FCA bribed UAW officials over many years to corrupt the bargaining process and gain advantages that cost GM billions of dollars. GM was seeking "substantial damages" that one analyst said could have totaled at least $6 billion. "These new facts warrant amending the court's prior judgment, so we are respectfully asking the court to reinstate the case," GM said in a statement. "FCA will continue to defend itself vigorously and pursue all available remedies in response to GM's attempts to resurrect this groundless lawsuit," FCA said in a statement. In affidavits accompanying GM's filing, attorneys for the automaker said "reliable information concerning the existence of foreign bank accounts" used in the alleged scheme had only come to light recently. "The UAW is unaware of any allegations regarding illicit off-shore accounts as claimed," by GM, the UAW said in a statement. "If GM actually has substantive information supporting its allegations, we ask that they provide it to us so we can take all appropriate actions." Earnings/Financials Government/Legal UAW/Unions Chrysler Fiat GM